This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

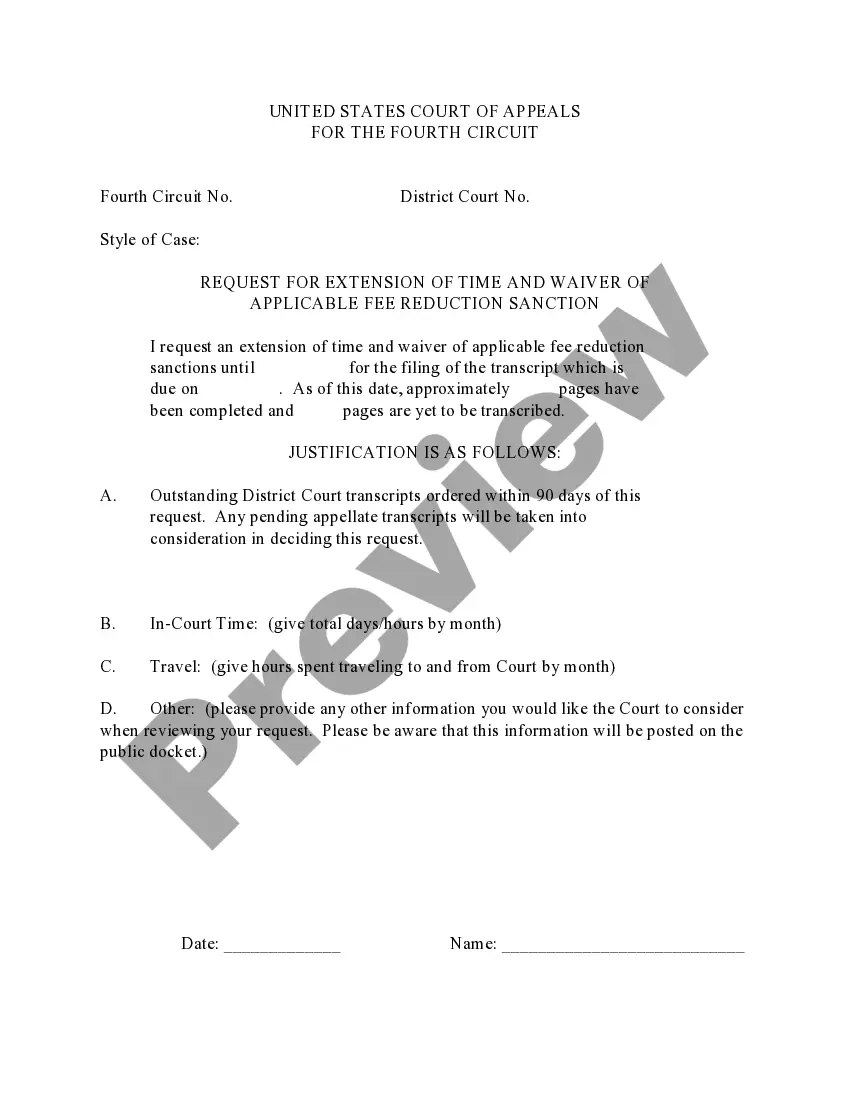

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

You might spend time online attempting to find the valid document format that meets the state and federal requirements you desire.

US Legal Forms offers a vast array of legal forms that are vetted by professionals.

You can easily download or print the Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure from the service.

If available, utilize the Review button to browse through the document format as well. If you wish to find another version of the form, use the Search field to locate the format that suits your needs and requirements. Once you have found the format you want, click Get now to proceed. Choose the payment plan you prefer, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Make adjustments to your document if necessary. You can fill out, modify, sign, and print the Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure. Download and print a vast number of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- After that, you can fill out, modify, print, or sign the Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure.

- Every legal document format you acquire is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents section and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document format for the region/city of your choice.

- Review the form outline to confirm you have chosen the right form.

Form popularity

FAQ

In Iowa, the redemption period typically lasts for one year after a foreclosure sale. During this time, property owners can reclaim their property by paying the full amount owed, including any associated costs. The Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure plays a crucial role in this process, ensuring your rights are protected. To navigate the complexities of the redemption period effectively, consider using US Legal Forms for comprehensive support and resources.

In Iowa, you typically have two years to redeem a tax sale after the sale occurs. This timeframe is critical for homeowners looking to regain their property. By submitting the Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure within this period, you can initiate the redemption process. It is important to be proactive and aware of the deadlines to protect your property and financial future.

The IRS right to redeem foreclosure means that taxpayers can reclaim their property after a tax sale by paying the IRS the amount owed. This right serves as a safeguard for taxpayers, ensuring they can protect their homes from being permanently lost. To navigate this process effectively, consider utilizing the Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure. Acting promptly is essential to take advantage of this right.

The right to redeem property after a foreclosure allows the former owner to reclaim their property by settling outstanding debts within a specified period. This right is crucial for homeowners facing financial hardship, as it provides an opportunity to regain ownership. The Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure is a key tool in this process. By understanding this right, you can take the necessary steps to protect your property and financial well-being.

The IRS right of redemption in a foreclosure allows property owners to reclaim their property after a tax sale by paying the owed amount. This right exists to protect taxpayers from losing their homes due to unpaid taxes. Utilizing the Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure can help streamline this process. It is important to act quickly to ensure you do not lose your right to redeem your property.

The IRS 7 year rule refers to the timeframe in which certain tax liens can impact your credit and financial standing. Typically, a tax lien stays on your credit report for up to seven years, affecting your ability to secure loans or mortgages. Understanding this rule is vital when considering the Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure. Knowing the implications can help you make informed decisions about your financial future.

Form 14135 is the application you submit to the IRS to request a certificate of discharge of property from a federal tax lien. This form is essential if you want to remove a lien from the property due to foreclosure or other financial issues. Completing the Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure may also involve submitting this form. It is important to ensure that you meet the criteria outlined by the IRS to successfully discharge the lien.

Foreclosure redeemed refers to the process where a property owner retrieves their property after it has been foreclosed upon. This redemption usually involves paying off the outstanding mortgage or the amount owed to the IRS. In the context of the Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure, it is crucial to understand the steps involved in redeeming your property. Successfully redeeming your property allows you to regain ownership and avoid further financial loss.

To get the IRS to release a lien, you must file the Iowa Application for Release of Right to Redeem Property from IRS After Foreclosure. This application helps you formally request the removal of the lien once you meet specific criteria. Ensuring all your tax obligations are current is essential, as this can expedite the process. Additionally, using platforms like US Legal Forms can simplify your application process.