Iowa Creating a CJA20 Voucher is a program that allows for indigent defendants to be represented by appointed counsel. It is an initiative of the Iowa Supreme Court that is funded by the Iowa Legislature. The program provides access to attorneys for indigent defendants who cannot afford to hire one. The vouchers can be used to pay for attorney fees, expert witness fees, and other necessary costs associated with a criminal case. There are three types of Iowa Creating a CJA20 Voucher: Standard Voucher, Expanded Voucher, and Enhanced Voucher. The Standard Voucher covers attorney fees and court costs, the Expanded Voucher covers expert witness fees and additional attorney fees, and the Enhanced Voucher covers investigator fees and additional attorney fees. The program also provides reimbursement for the reasonable costs of travel, lodging, and other necessary expenses incurred by appointed counsel in the course of representing an indigent defendant.

Iowa Creating_a_CJA20_Voucher

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

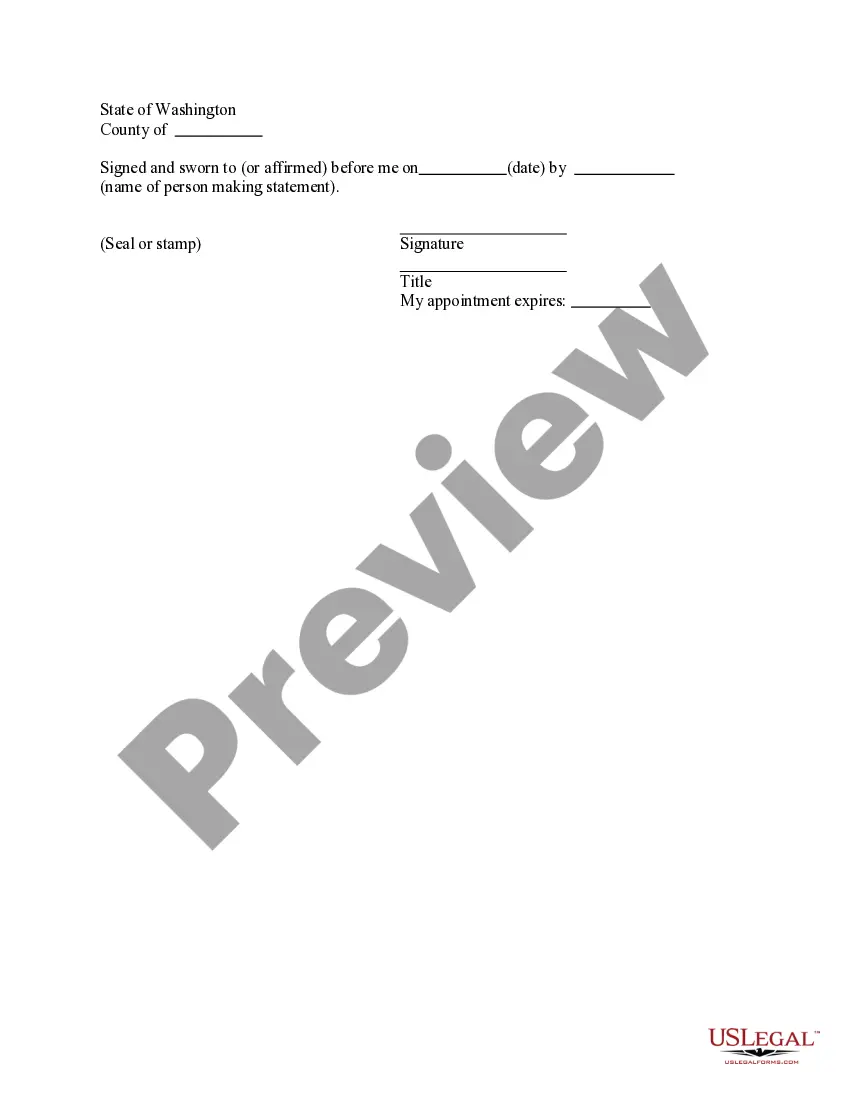

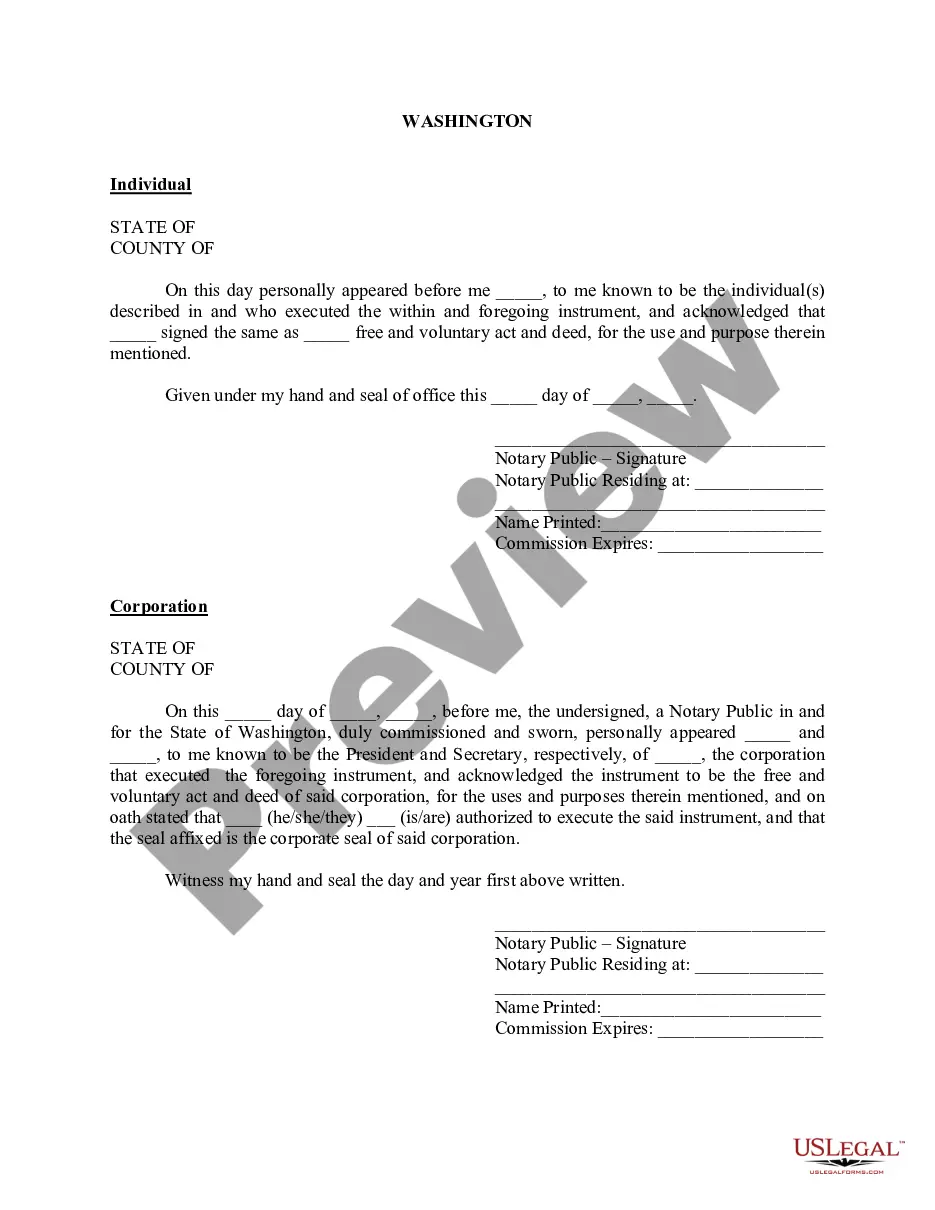

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Iowa Creating_a_CJA20_Voucher?

If you are searching for a method to adequately finalize the Iowa Creating_a_CJA20_Voucher without employing a legal expert, then you are in the ideal location.

US Legal Forms has established itself as the most comprehensive and trusted repository of official templates for every personal and business situation. Every document you find on our online service is crafted in compliance with federal and state laws, ensuring that your records are accurate.

Another benefit of US Legal Forms is that you never lose the documents you have purchased - you can access any of your downloaded templates in the My documents section of your profile whenever you need them.

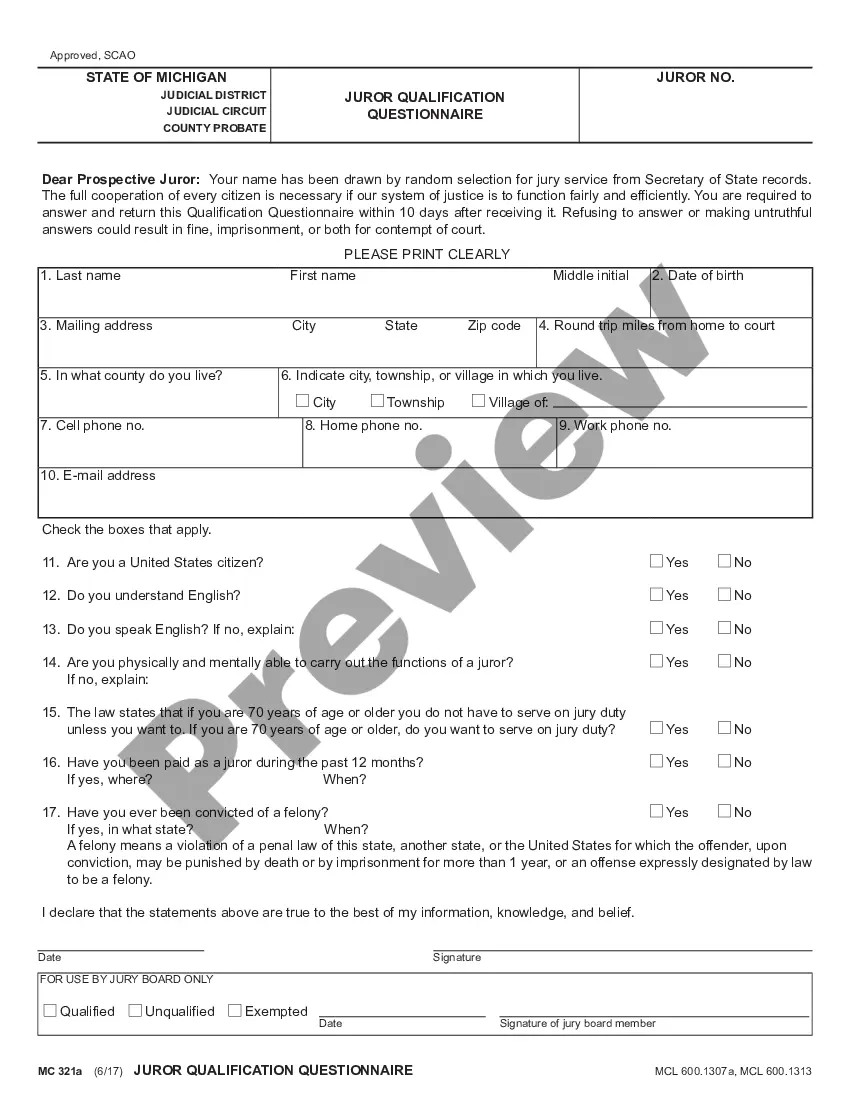

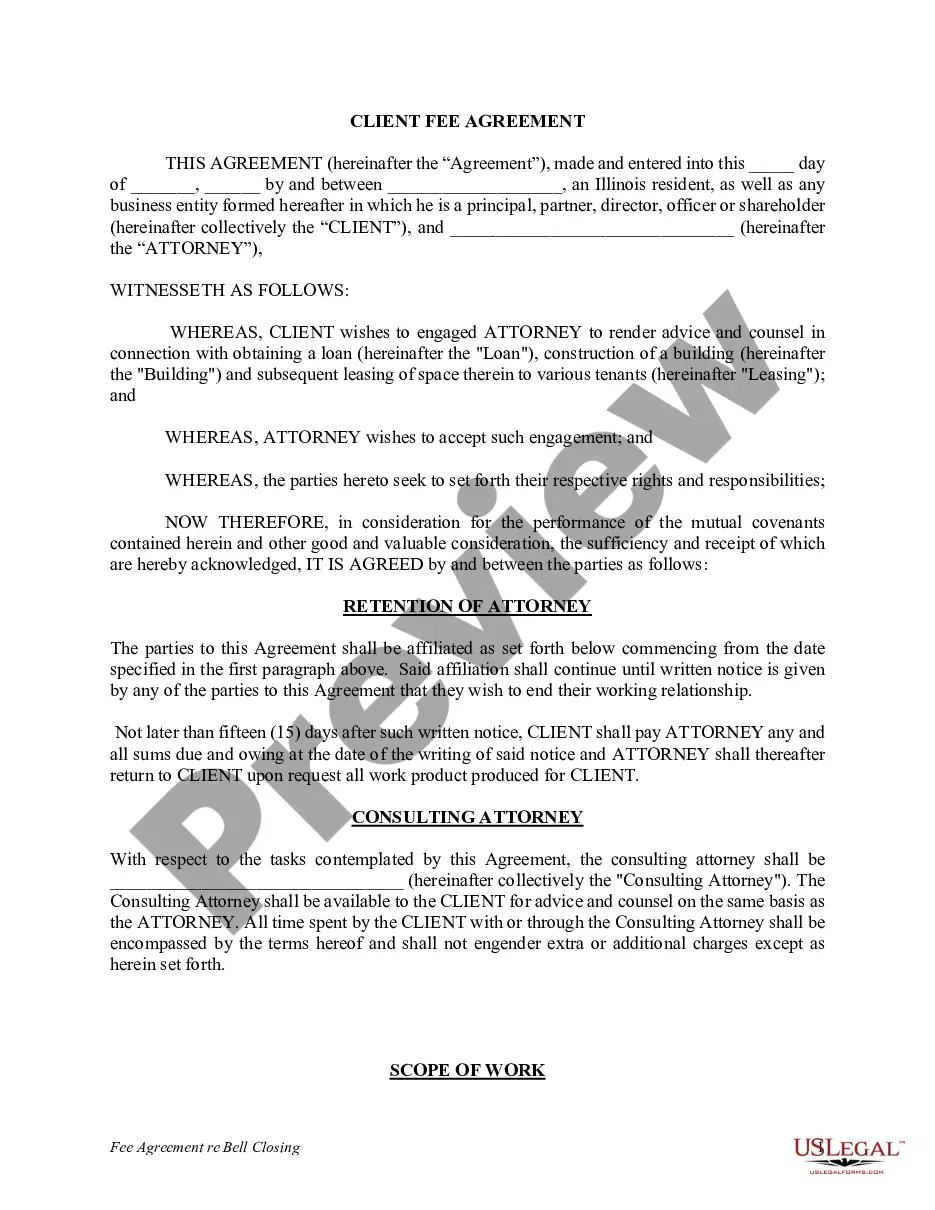

- Ensure the document displayed on the page aligns with your legal circumstances and state laws by reviewing its textual description or browsing through the Preview mode.

- Enter the document name in the Search tab at the top of the page and choose your state from the dropdown to locate an alternative template if there are any discrepancies.

- Perform the content verification and click Buy now when you are confident that the paperwork meets all necessary standards.

- Log in to your account and click Download. Create an account with the service and select a subscription plan if you do not already have one.

- Utilize your credit card or the PayPal method to pay for your US Legal Forms subscription. The template will be ready for download immediately after.

- Select the format in which you wish to save your Iowa Creating_a_CJA20_Voucher and download it by clicking the corresponding button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your physical copy manually.

Form popularity

FAQ

You may get these vouchers if you're self-employed or had an uncharacteristic spike in your income this year. For example, you sold stock or took a large distribution from your retirement plan. You're not required to make estimated tax payments; we're just suggesting it based on the info in your return.

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

This form is used by a representative who has the authority to act on behalf of a taxpayer due to their status as a legal guardian, conservator, receiver, executor, trustee, parent/guardian, government representative, officer/director, or as a holder of a non- IA-2848 general or durable power of attorney.

A corporation filing Form 1120 can pay its balance due using a variety of electronic methods, but it cannot pay the balance due by check. Thus, Form 1120 does not have a payment voucher. When marking the return for electronic filing, you'll have the option to enter bank information for payment by direct debit.

What Is Form 1040-V, Payment Voucher? Form 1040-V is a payment voucher that is used to accompany your check or money order when you have a balance due on your federal tax return. This form is typically used with the "Amount you owe" line on your 2022 Form 1040, 1040-SR, or 1040-NR.

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

What Is Form 1040-V? It's a statement you send with your check or money order for any balance due on the ?Amount you owe? line of your 2022 Form 1040, 1040-SR, or 1040-NR.

The IRS is modernizing its payment system. The Form 1040-V, Payment Voucher, is part of the modernization. If you have a balance due on your tax return, using the payment voucher will help the IRS process your payment more accurately and efficiently.