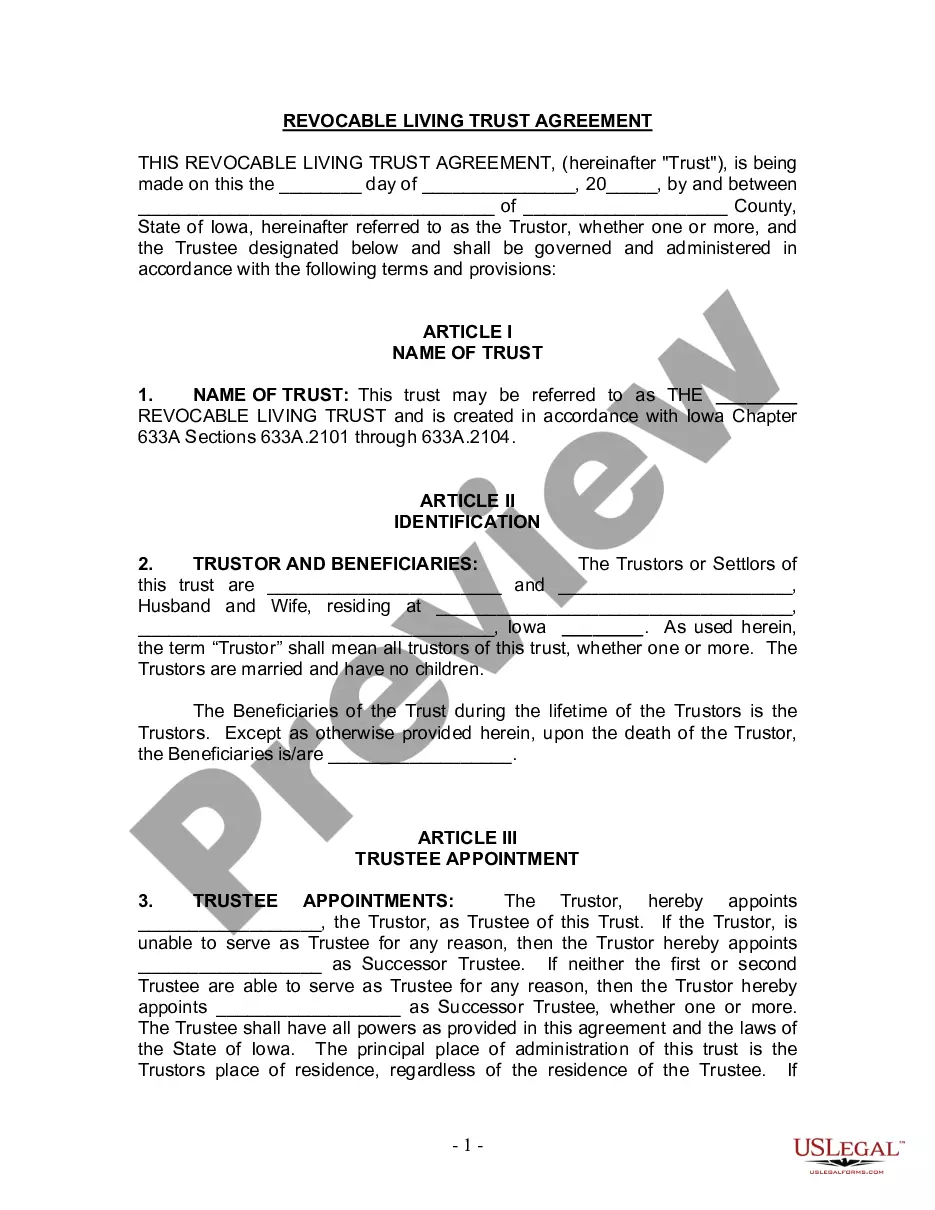

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Iowa Living Trust for Husband and Wife with No Children

Description

How to fill out Iowa Living Trust For Husband And Wife With No Children?

Obtain entry to the most extensive collection of legal documents. US Legal Forms is fundamentally a platform where you can locate any state-specific form in just a few clicks, including Iowa Living Trust for Husband and Wife with No Children templates.

No need to invest hours of your time searching for an admissible court form. Our certified professionals guarantee that you receive current examples each time.

To utilize the document library, select a subscription and create an account. If you are already registered, simply Log In and click Download. The Iowa Living Trust for Husband and Wife with No Children file will be immediately stored in the My documents section (a section for every document you download from US Legal Forms).

Download the document to your computer by clicking on the Download button. That's all! You should complete the Iowa Living Trust for Husband and Wife with No Children template and check out. To ensure that everything is accurate, consult your local legal advisor for assistance. Register and easily discover over 85,000 valuable samples.

- To create a new account, follow the straightforward instructions below.

- If you need to use a state-specific document, ensure you select the correct state.

- If possible, read the description to understand all details of the form.

- Use the Preview feature if it’s available to review the document's content.

- If everything is correct, click on the Buy Now button.

- After selecting a pricing plan, create an account.

- Make payment using a credit card or PayPal.

Form popularity

FAQ

The ideal trust for a single person often depends on their specific needs and financial circumstances. An Iowa Living Trust for Husband and Wife with No Children may not directly apply, but a revocable living trust can be an excellent option. This type of trust allows you to retain control over your assets during your lifetime while providing a clear plan for distribution when the time comes. Evaluating all trust options with a financial advisor can lead to the best decision for your situation.

Whether a couple should create separate living trusts often depends on their unique financial situation and goals. Separate trusts can provide clarity and allow for more tailored asset management, particularly if there are children from previous relationships. However, a joint Iowa Living Trust for Husband and Wife with No Children may simplify the process and ensure both partners are on the same page regarding asset distribution. Always consider consulting an estate planning attorney for personalized advice.

One of the biggest mistakes parents make when setting up a trust fund is not clearly communicating their intentions to their beneficiaries. Failing to specify how funds should be managed or distributed can lead to confusion and conflicts later on. Additionally, parents might overlook the importance of regularly reviewing and updating the trust to reflect changes in their financial situation or family dynamics. Leveraging Uslegalforms can ensure you create a well-structured Iowa Living Trust for Husband and Wife with No Children that meets your specific goals.

In many cases, an Iowa Living Trust for Husband and Wife with No Children may offer advantages over a will. Trusts can bypass probate, allowing for quicker distribution of assets to beneficiaries. Moreover, trusts provide greater privacy since they don’t go through public probate proceedings. If you're considering the best option for your situation, Uslegalforms can help clarify the distinctions and benefits of both.

Yes, you can write your own trust in Iowa, especially if you choose the Iowa Living Trust for Husband and Wife with No Children. This option allows you flexibility and control over how your assets are managed and distributed. However, it is essential to ensure that your trust meets all legal requirements to be valid, which Uslegalforms can assist you with through their resources and templates.

Even if you are a single person with no children, establishing an Iowa Living Trust for Husband and Wife with No Children can be beneficial. A trust allows you to manage your assets in a way that aligns with your wishes and can simplify the distribution process upon your passing. Additionally, having a trust can help avoid probate, saving time and resources. Uslegalforms offers templates and guidance to help you easily create the right trust.

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

Iowa does not have an estate tax. The inheritance tax is based on the value of property that a beneficiary receives from a person who died. The relationship between the person receiving the property and the decedent determines whether the tax will be owed.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

Surviving spouse. parents, grandparents, and other lineal ancestors, and. children (biological or legally adopted), stepchildren, grandchildren, and other lineal descendants. charitable organization as defined in sections 170(c) and 2055 of the Internal Revenue Code.