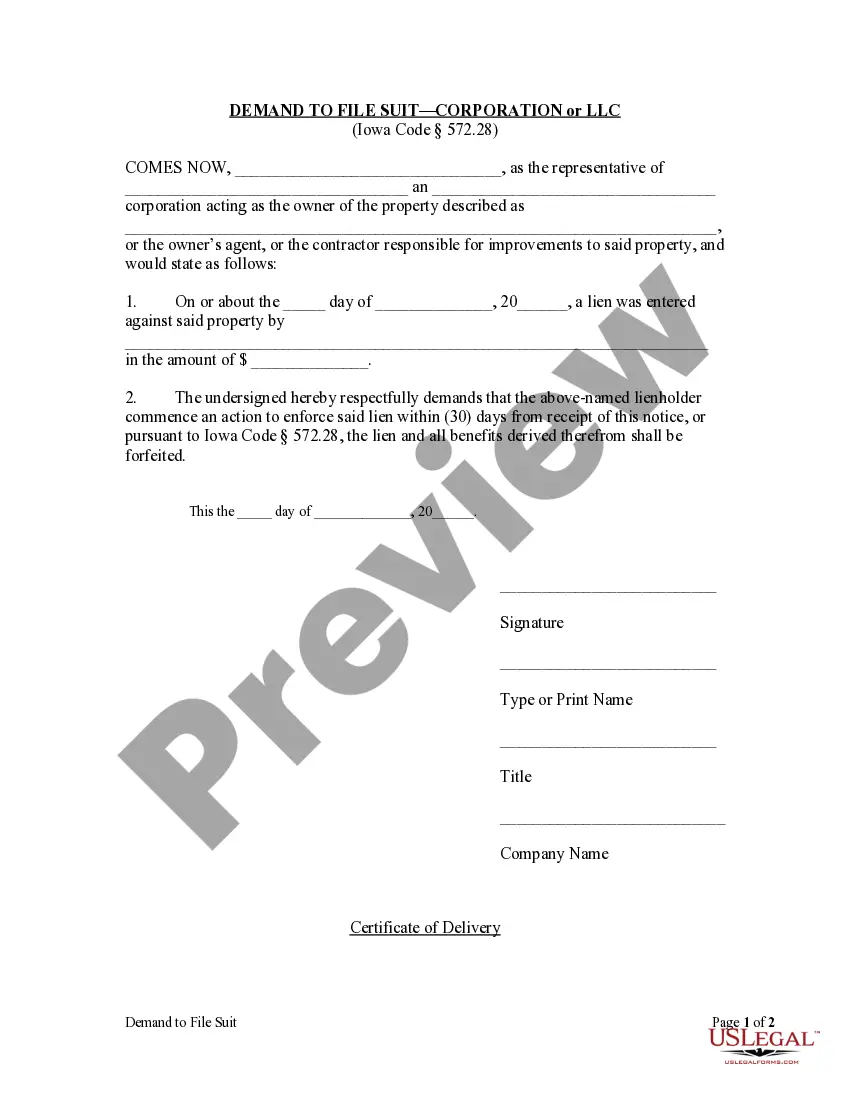

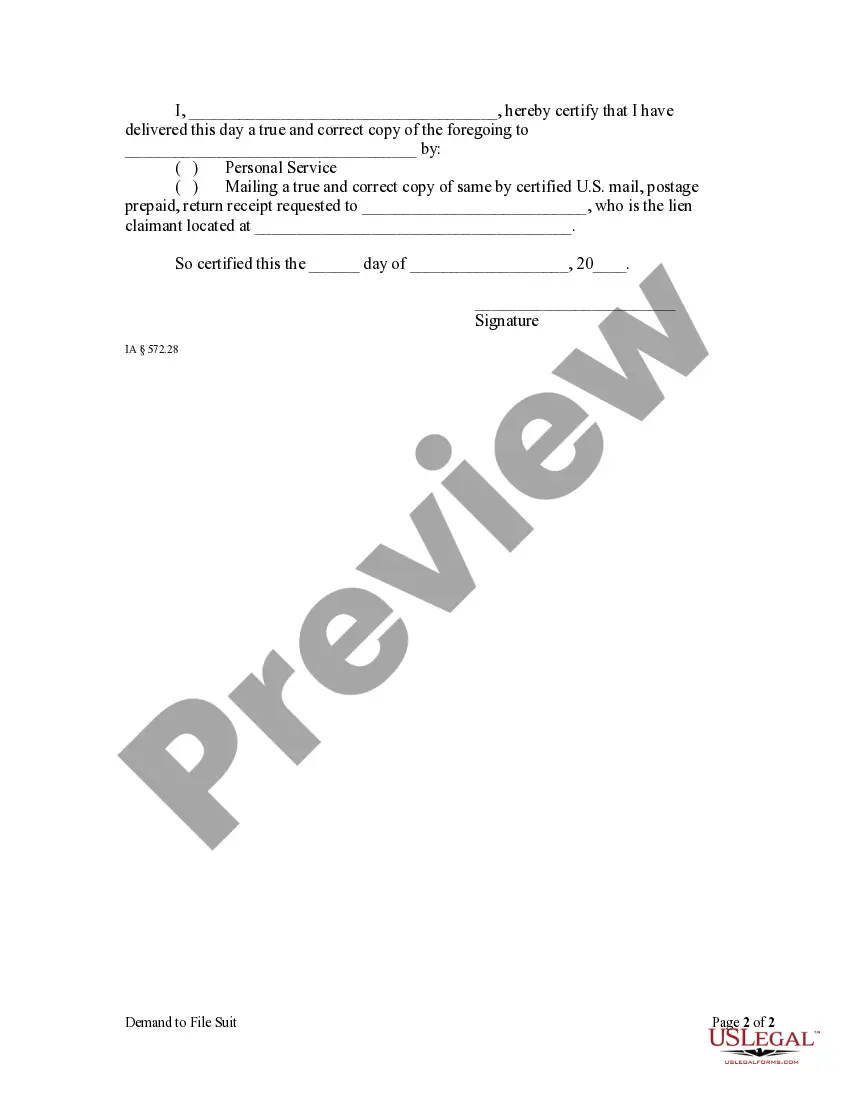

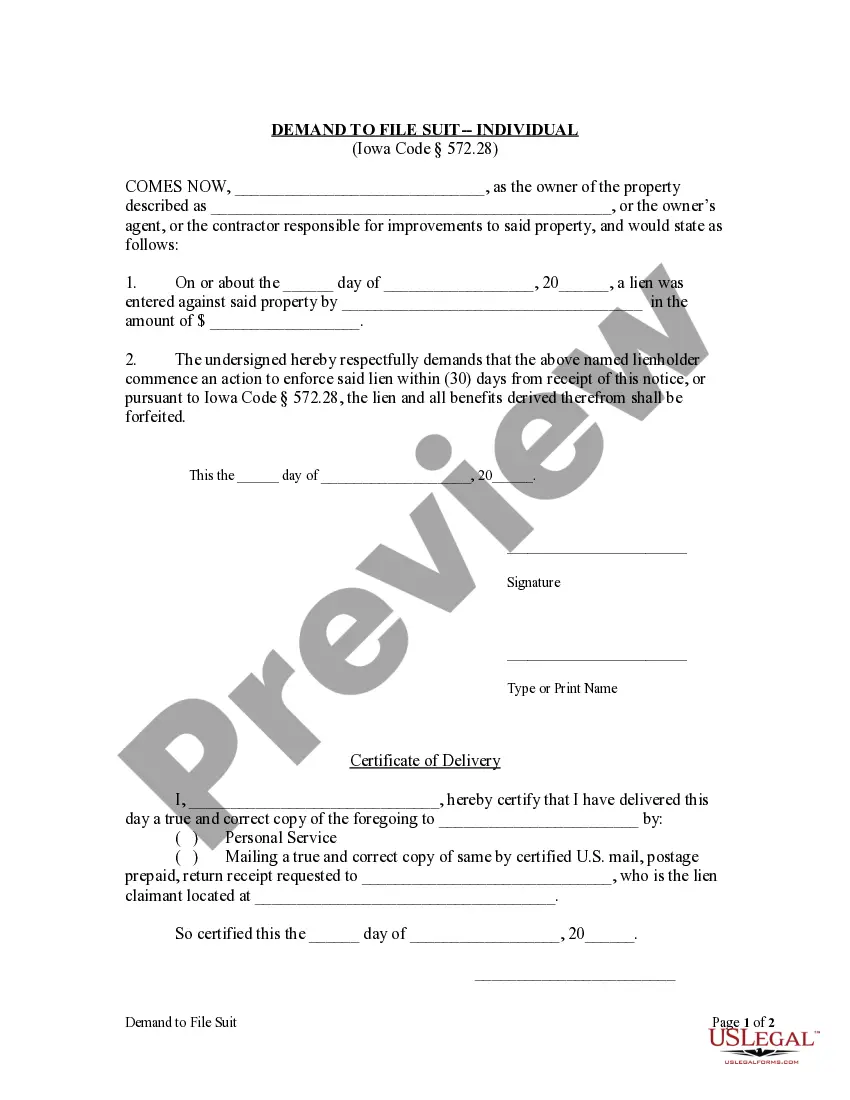

Iowa law permits a property owner, the owner's agent, or a contractor to make a written demand upon a lien holder to commence suit. If the lien holder does not file a lawsuit to enforce his lien within thirty (30) days of receipt of this demand, the lien and all benefits derived therefrom shall be forfeited.

Iowa Demand to File Suit by Corporation or LLC

Description

How to fill out Iowa Demand To File Suit By Corporation Or LLC?

Obtain access to one of the most comprehensive collections of authorized documents.

US Legal Forms is indeed a platform where you can discover any state-specific document in just a few clicks, including Iowa Demand to File Suit by Corporation or LLC templates.

No need to waste hours searching for a court-acceptable template.

Utilize the Preview option if it's available to inspect the document's information. If everything is accurate, click Buy Now. After selecting a payment plan, create your account. Make payment via card or PayPal. Download the template to your device by clicking Download. That's it! You need to submit the Iowa Demand to File Suit by Corporation or LLC template and review it. To confirm that everything is correct, consult your local legal advisor for assistance. Sign up and effortlessly navigate through over 85,000 useful forms.

- Our experienced professionals guarantee you receive updated examples every time.

- To utilize the document library, choose a subscription and create an account.

- If you have already done this, simply Log In and then hit Download.

- The Iowa Demand to File Suit by Corporation or LLC template will automatically be saved in the My documents section (a section for all the forms you download on US Legal Forms).

- To create a new account, follow the simple instructions listed below.

- If you're required to use a state-specific template, ensure to specify the correct state.

- If feasible, review the description to understand all of the form's details.

Form popularity

FAQ

The primary difference between a sole proprietorship and an LLC in Iowa lies in liability protection and tax structure. A sole proprietorship does not provide personal liability protection for business debts, while an LLC limits personal liability, which can be crucial in situations involving an Iowa Demand to File Suit by Corporation or LLC. Additionally, LLCs offer more flexibility in tax treatment and can accommodate multiple members. To understand these differences better, consult UsLegalForms for tailored resources.

Forming an LLC in Iowa offers several advantages, including limited liability protection, taxation flexibility, and less administrative paperwork compared to corporations. This structure is especially beneficial when addressing issues related to the Iowa Demand to File Suit by Corporation or LLC, as it helps shield personal assets from business liabilities. Additionally, LLCs have the ability to choose how they want to be taxed, which can lead to potential savings. Opting for resources like UsLegalForms can guide you through the formation process seamlessly.

Phone codes in Iowa primarily consist of North American Area Codes that help identify the regions of the state. These codes can be important for businesses, including corporations and LLCs, especially when establishing communication. If your organization faces legal matters, such as an Iowa Demand to File Suit by Corporation or LLC, knowing these codes can facilitate faster and clearer connections with legal representatives. For more information, consider exploring directories that provide area code listings.

Iowa code 489.116 discusses the filing requirements for limited liability companies (LLCs). This code is vital for those involved in the Iowa Demand to File Suit by Corporation or LLC because it dictates how LLCs must operate legally. Understanding this code helps protect your business interests and ensures compliance with state laws. If you need assistance, UsLegalForms offers resources to help you understand these filing requirements.

Iowa code 364.16 outlines the legal procedures for city governance in civil cases, including those involving corporations and LLCs. It is particularly relevant when dealing with Iowa Demand to File Suit by Corporation or LLC, as it provides guidance on how cities can enforce their ordinances. For corporations and LLCs, understanding this code can help navigate local legal challenges effectively. Utilizing resources like UsLegalForms can provide clarity on the legal obligations under this code.

The failure to appear code in Iowa refers to the legal implications when a party does not show up for a court date. In cases related to Iowa Demand to File Suit by Corporation or LLC, this code can affect the outcome of the case. It is essential for both corporations and LLCs to understand this code to avoid penalties or unfavorable judgments. Consulting with legal professionals ensures you are well-prepared for any court appearance.

Yes, you can close your LLC yourself in Iowa by following the correct procedures outlined by the Iowa Secretary of State. This includes filing the Certificate of Dissolution and addressing any remaining obligations. While it's possible to manage this independently, using the USLegalForms platform can make the process smoother and help you avoid potential pitfalls.

Filing a biennial report in Iowa requires you to submit the report online or by mail through the Iowa Secretary of State's office. This report includes your LLC's updated information, such as the business address and registered agent. An accurate report is crucial for maintaining your good standing as an LLC in Iowa. Using the USLegalForms platform can simplify the filing process and ensure that your information is always up to date.

Iowa Code 489.903 pertains to the filing requirements for LLCs, specifically regarding the documentation needed for a certified copy of a demand to file suit by a corporation or LLC. This code outlines the legalities associated with civil actions involving an LLC. Understanding this code is vital if you're taking legal actions or need to file a suit. For more insights, consider the resources available on the USLegalForms platform.

There are several reasons you might choose to terminate an LLC, including the completion of its purpose, lack of profitability, or changes in personal circumstances. Termination protects you from potential future liabilities and unwanted obligations. By ending your LLC properly, you also maintain compliance with Iowa regulations. The USLegalForms platform can help guide you through this decision and the necessary steps.