Hawaii Last Will and Testament for a Married Person with No Children

Description

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

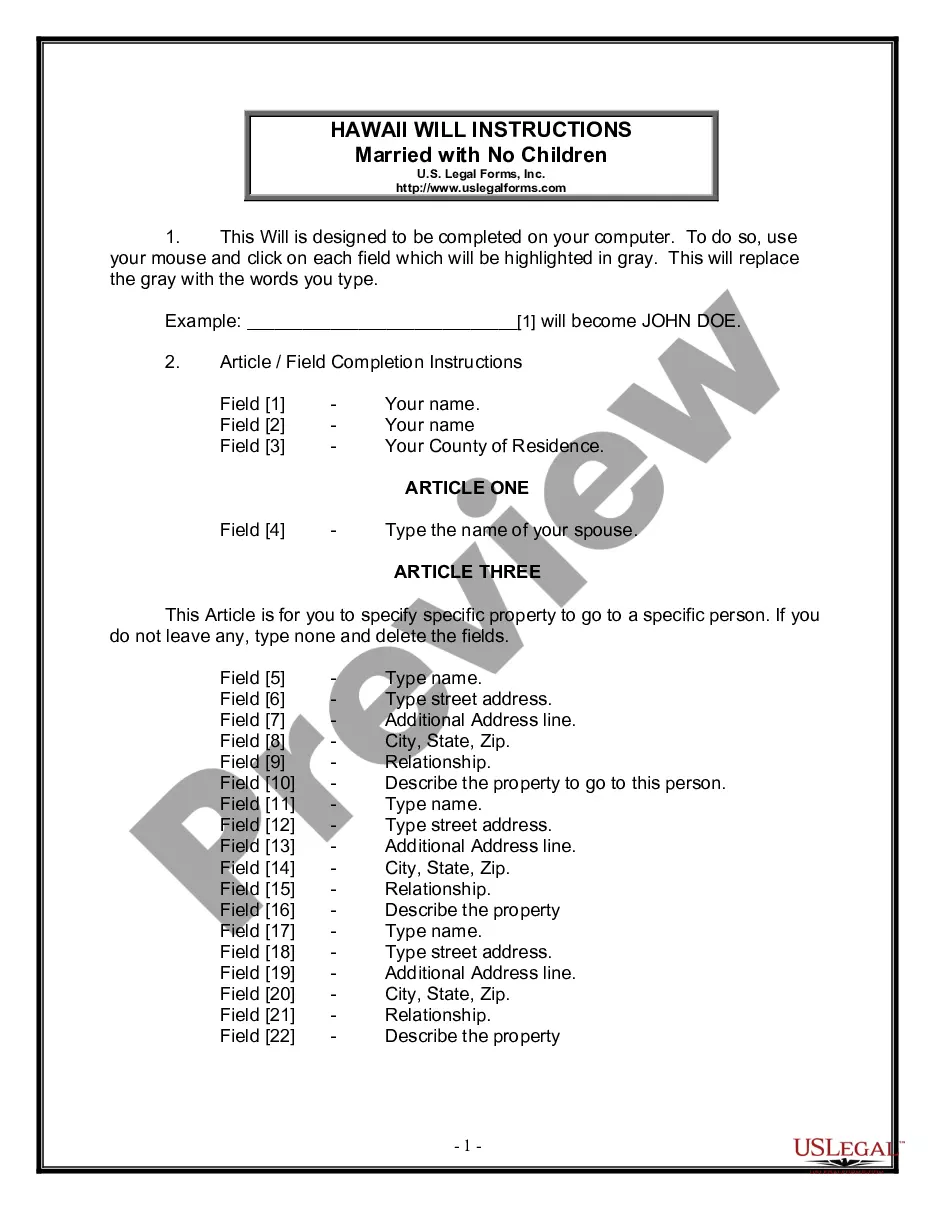

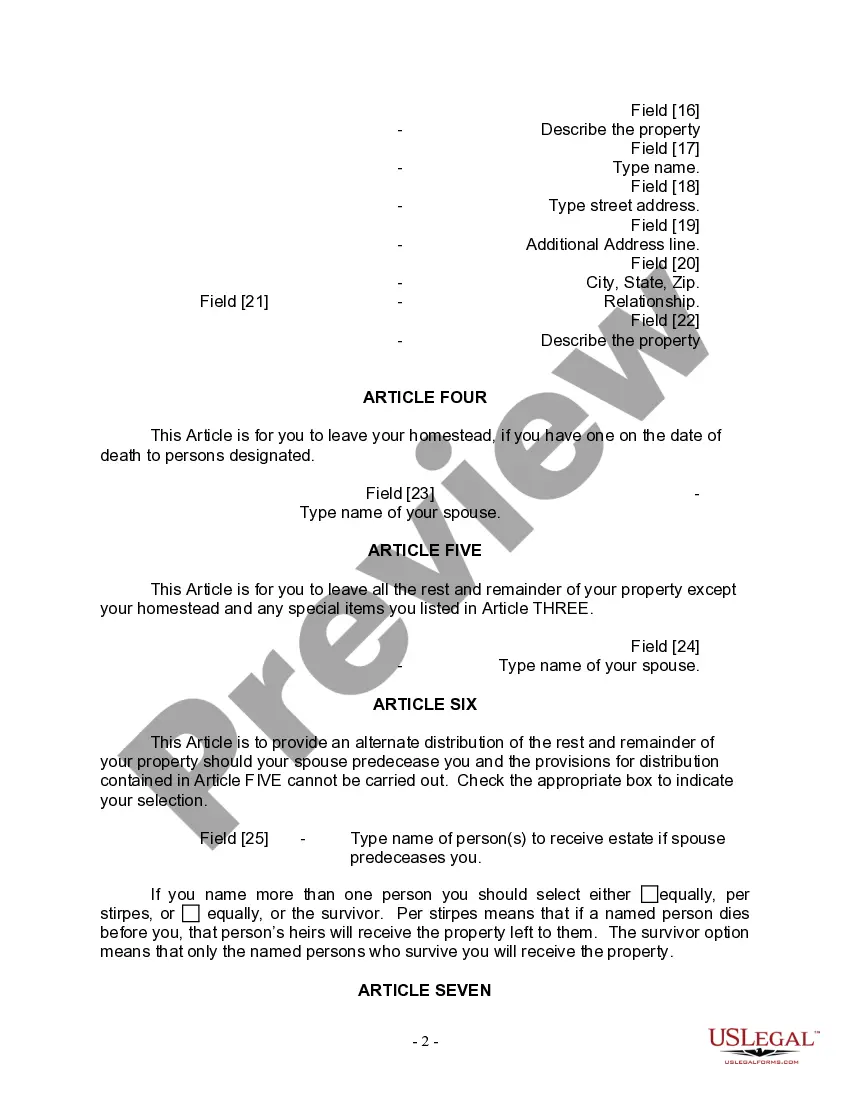

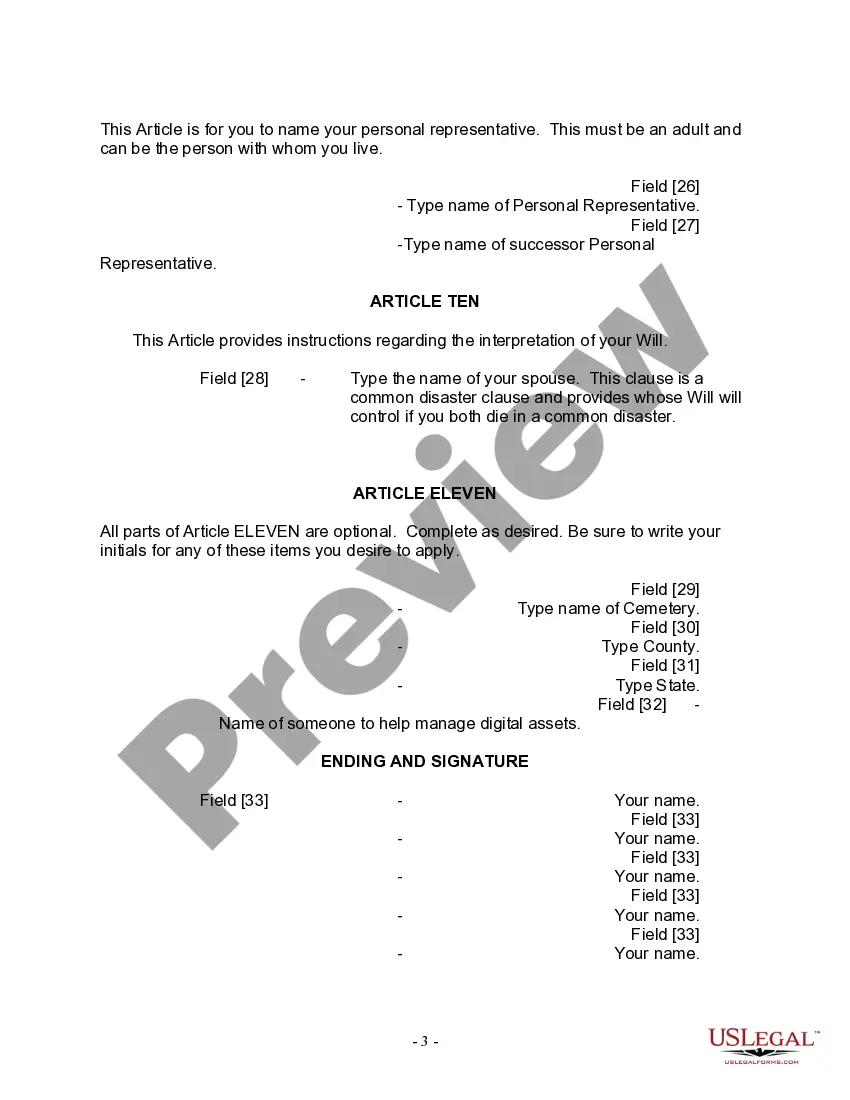

How to fill out Hawaii Last Will And Testament For A Married Person With No Children?

Obtain one of the most comprehensive collections of legal documents.

US Legal Forms is a platform where you can locate any state-specific document within a few clicks, such as the Hawaii Legal Last Will and Testament Form for a Married Individual without Children examples.

No need to waste hours of your time hunting for a court-approved template. Our certified experts guarantee you receive current samples every time.

After choosing a pricing plan, create your account. Make payment via credit card or PayPal. Download the document to your device by clicking the Download button. That's it! You should submit the Hawaii Legal Last Will and Testament Form for a Married Person without Children form and review it. To ensure everything is correct, consult your local legal advisor for help. Register and easily access around 85,000 valuable samples.

- To take advantage of the documents library, select a subscription and create your account.

- If you've already done this, simply Log In and hit the Download button.

- The Hawaii Legal Last Will and Testament Form for a Married Individual without Children document will be promptly saved in the My documents section (the section for all documents you download from US Legal Forms).

- To set up a new account, adhere to the straightforward instructions provided below.

- If you intend to use a state-specific document, be sure to select the correct state.

- If feasible, review the description to understand all of the details of the form.

- Utilize the Preview option if it's available to inspect the content of the document.

- If everything appears suitable, click the Buy Now button.

Form popularity

FAQ

To be legal in Hawaii, a will must fulfill specific criteria, including being written, signed by the testator, and witnessed by at least two people. It's also essential that the testator is of sound mind and not under duress when creating the document. For peace of mind, consider using US Legal Forms to draft your Hawaii Last Will and Testament for a Married Person with No Children to ensure compliance with state laws.

A valid will in Hawaii must meet three basic requirements: it must be in writing, signed by the testator, and witnessed by at least two individuals. These witnesses should not be beneficiaries, as this may invalidate certain bequests. By following these criteria, you can create a Hawaii Last Will and Testament for a Married Person with No Children that holds up in court.

You can write your own Hawaii Last Will and Testament for a Married Person with No Children and have it notarized. Notarization adds an extra layer of authenticity and can help validate your intentions. However, ensure that the will contains all necessary elements to comply with state laws, possibly by using templates from US Legal Forms.

In Hawaii, it is not necessary to register a will for it to be valid. However, probate court requires the will to be submitted after your death to initiate the distribution of your estate. It may be beneficial to keep your Hawaii Last Will and Testament for a Married Person with No Children in a safe place and inform your loved ones about its location.

Yes, you can write your Hawaii Last Will and Testament for a Married Person with No Children on a piece of paper. However, it is crucial to follow specific guidelines to ensure its validity. Your document should be clearly labeled as a will, signed by you, and ideally witnessed by two individuals who are not beneficiaries of the will.

To write a Hawaii Last Will and Testament for a Married Person with No Children, start by outlining your assets and how you want them distributed. Ensure you include your full name, address, and a declaration that this is your last will. Consider consulting an attorney or using an online service like US Legal Forms to guide you through the process and make sure your will meets all state requirements.

No, a will does not take precedence over the legal rights afforded by marriage. Spouses are entitled to inherit under state laws, which can affect how your assets are distributed after your passing. A Hawaii Last Will and Testament for a Married Person with No Children should be crafted with an understanding of these legal rights to achieve harmony between your wishes and marital obligations. Consulting a legal professional can provide clarity on these matters.

No, a will does not generally override a spouse's rights to inherit. In Hawaii, spouses hold certain rights to a portion of each other's estate, even if a will states otherwise. A Hawaii Last Will and Testament for a Married Person with No Children should consider these rights to ensure your spouse receives their fair share, while still following your wishes regarding other assets. Discussing your intentions with your spouse can foster understanding and communication.

Typically, a last will and testament does not override named beneficiaries on accounts or insurance policies. If you designate a beneficiary, they generally receive the asset directly, regardless of the provisions in your will. However, a Hawaii Last Will and Testament for a Married Person with No Children can clarify your wishes and is essential for any assets without designated beneficiaries. It's wise to review both documents and consult a legal professional for comprehensive estate planning.

Yes, a married couple with no children should consider having a will. A Hawaii Last Will and Testament for a Married Person with No Children ensures that your assets are distributed according to your wishes, even in the absence of children. Creating a will prevents confusion and potential disputes among family members after your passing. It also allows you to name guardians for pets or designate specific beneficiaries.