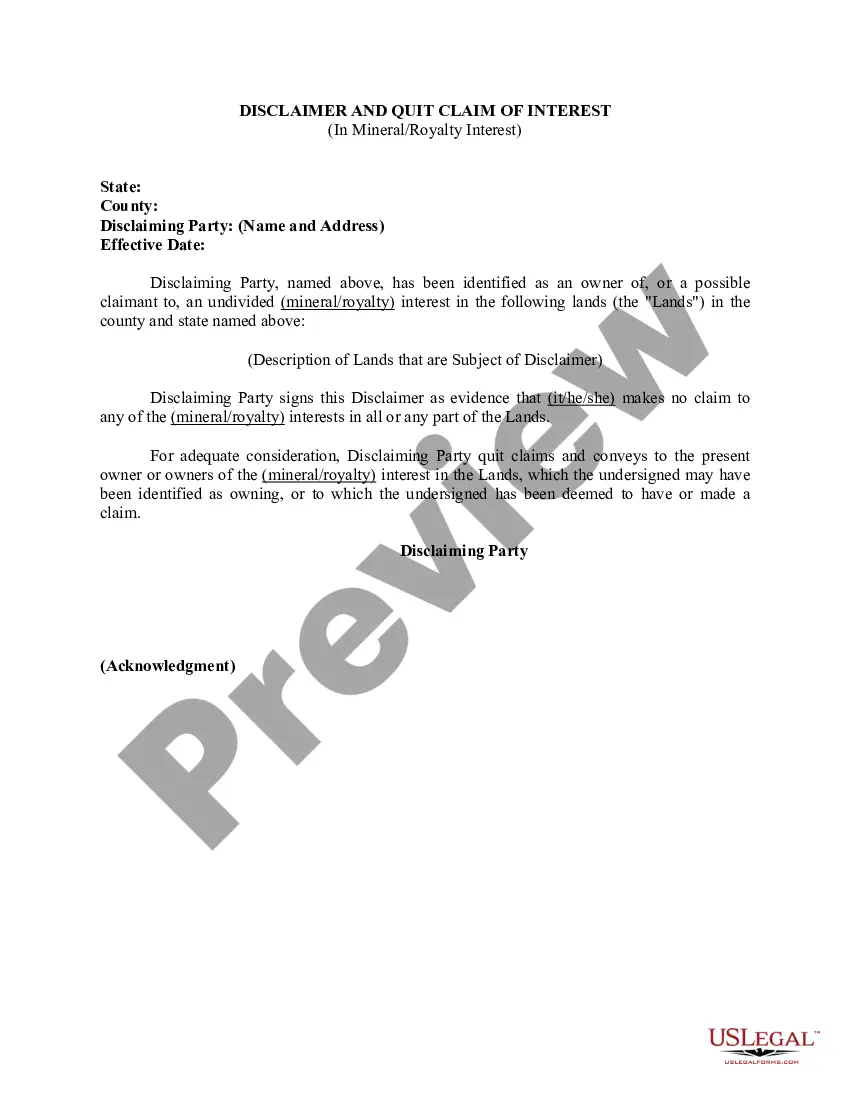

Hawaii Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest

Description

How to fill out Disclaimer And Quitclaim Of Interest In Mineral / Royalty Interest?

You can commit several hours on the Internet searching for the legitimate file design which fits the state and federal needs you will need. US Legal Forms provides 1000s of legitimate kinds that happen to be evaluated by professionals. You can easily down load or print the Hawaii Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest from the services.

If you currently have a US Legal Forms bank account, you can log in and click the Download key. Following that, you can comprehensive, change, print, or signal the Hawaii Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest. Every legitimate file design you acquire is your own eternally. To acquire an additional copy associated with a obtained kind, go to the My Forms tab and click the related key.

If you use the US Legal Forms website the first time, follow the simple directions below:

- Very first, ensure that you have chosen the right file design for your region/area of your liking. Browse the kind outline to make sure you have chosen the appropriate kind. If accessible, take advantage of the Review key to check throughout the file design as well.

- In order to get an additional version from the kind, take advantage of the Look for field to get the design that meets your needs and needs.

- After you have discovered the design you would like, click Purchase now to move forward.

- Find the rates plan you would like, type your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You should use your charge card or PayPal bank account to pay for the legitimate kind.

- Find the file format from the file and down load it for your gadget.

- Make changes for your file if possible. You can comprehensive, change and signal and print Hawaii Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest.

Download and print 1000s of file web templates while using US Legal Forms site, that offers the most important variety of legitimate kinds. Use professional and state-specific web templates to deal with your business or specific requires.

Form popularity

FAQ

Mineral interests are defined by the Texas Property Tax Code as real property and are subject to taxes the same as all other real property. When do mineral interests become taxable? Mineral interests become taxable on January 1 of the year following the first production of the unit.

The following are methods for establishing mineral rights ownership: Deed. A deed is used to transfer mineral rights ownership from one party to another. Lease. ... Severance. ... Adverse Possession. ... Surface Use Agreement. ... Royalties. ... Mineral Estate. ... Texas Railroad Commission.

Surface rights determine who owns the rights to the surface of the land, while mineral rights determine who has the right to mine the minerals below the surface of the property. Mineral rights include oil and natural gas resources. Mineral rights can be completely separate from land rights.

When buying land, it's important that the mineral rights being sold with the property are actually owned by the person selling the surface estate, the Watson Law Firm says. The seller must own those rights in order to transfer them with the sale of the surface estate.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Mineral rights are a form of real property, and they are governed by the same principles of marital property law as other real estate. If the mineral rights were owned before marriage, they are separate property.

The general rule of thumb for the value of mineral rights in Texas is 2x to 3x the lease bonus you received. For example, if you got $500/acre when you leased your property, you might expect to sell for somewhere between $1,000 to $1,500/acre if you were to sell mineral rights in Texas.

Royalty is a portion of the proceeds from the sale of production which is paid monthly to the mineral rights owner. The royalty is usually described in the lease as a fraction such as 1/8th, or 1/6th.