Hawaii Quitclaim Deed for Mineral / Royalty Interest

Description

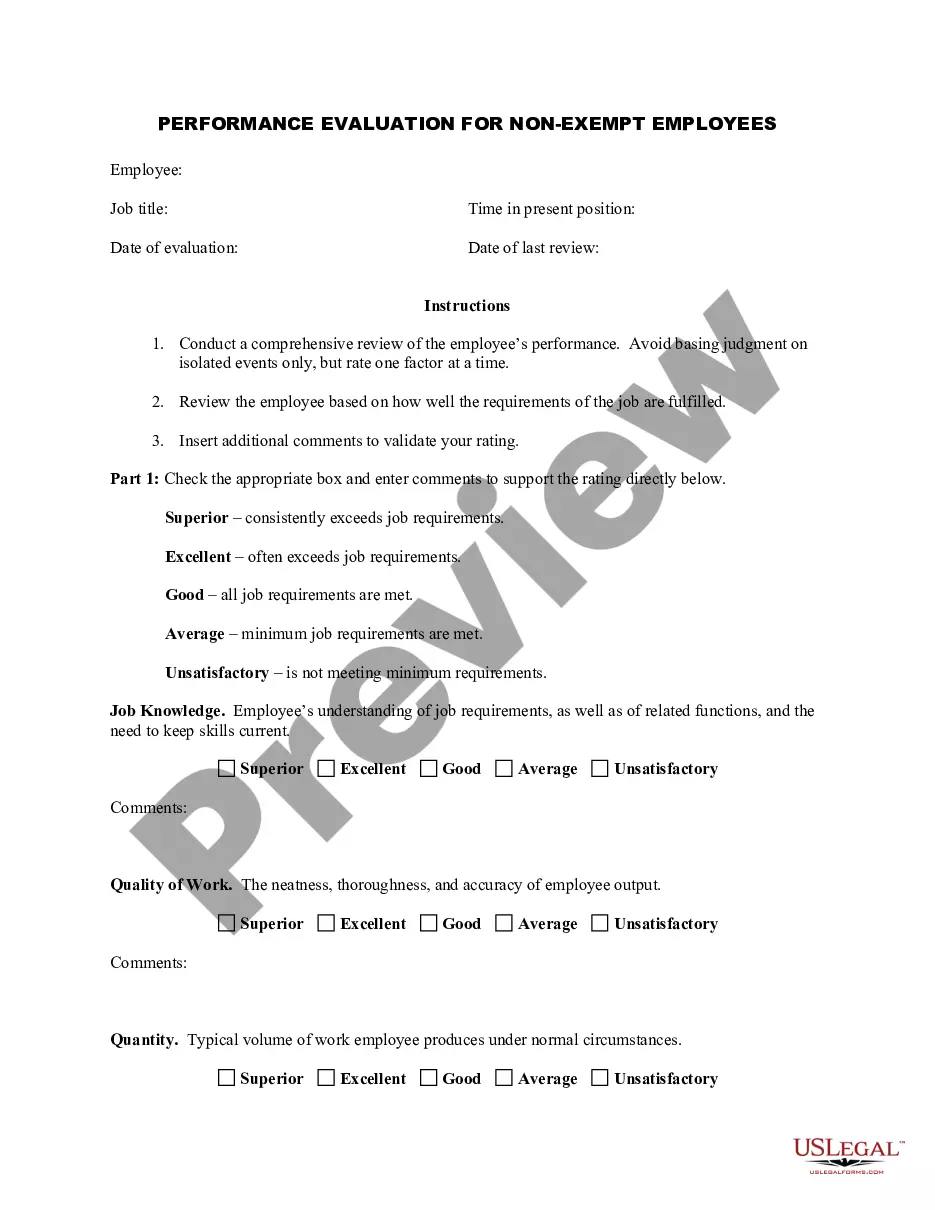

How to fill out Quitclaim Deed For Mineral / Royalty Interest?

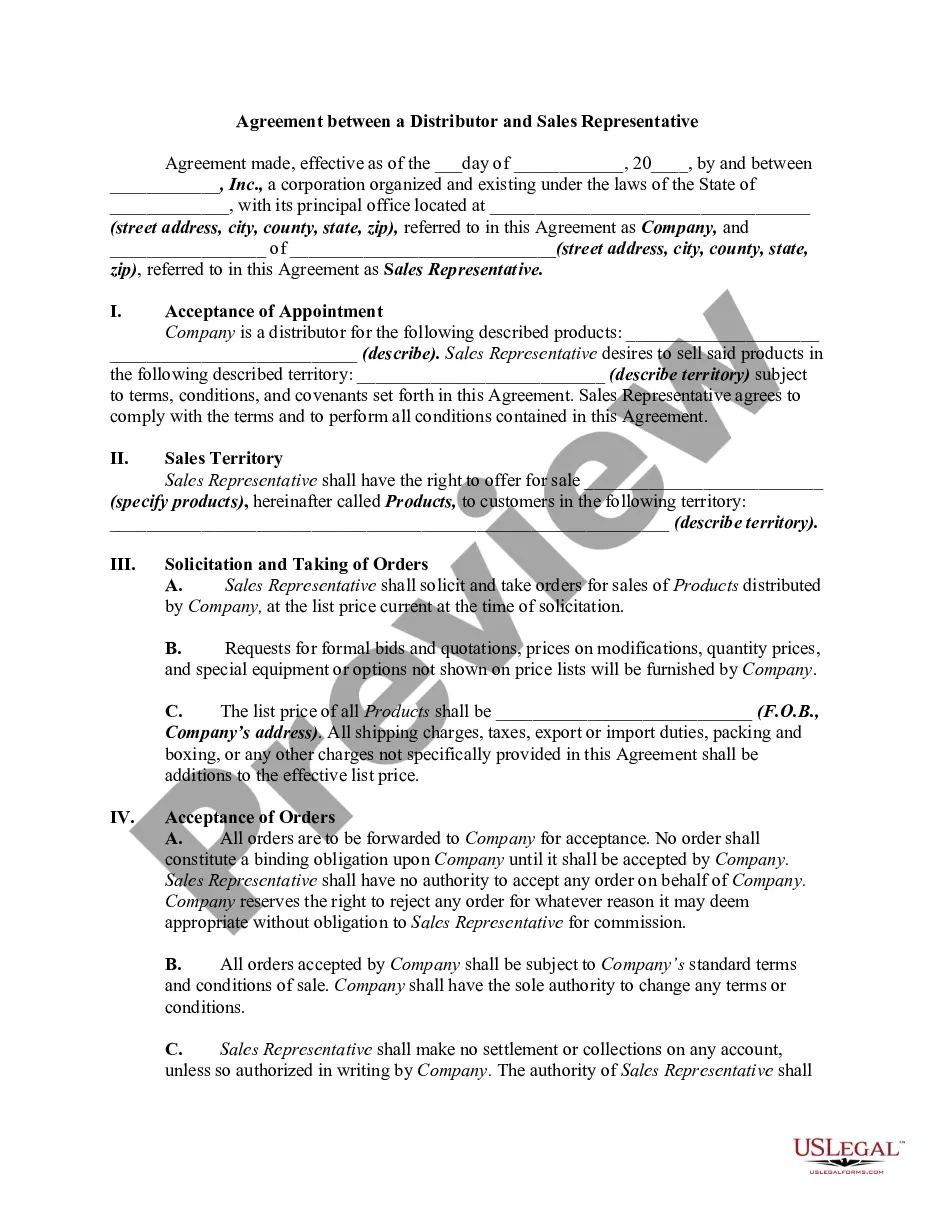

If you need to complete, down load, or produce authorized document layouts, use US Legal Forms, the most important collection of authorized varieties, that can be found on the Internet. Utilize the site`s easy and hassle-free search to find the papers you will need. Numerous layouts for business and individual functions are categorized by types and states, or search phrases. Use US Legal Forms to find the Hawaii Quitclaim Deed for Mineral / Royalty Interest within a number of clicks.

Should you be already a US Legal Forms buyer, log in to your profile and then click the Download switch to find the Hawaii Quitclaim Deed for Mineral / Royalty Interest. Also you can entry varieties you formerly delivered electronically from the My Forms tab of your profile.

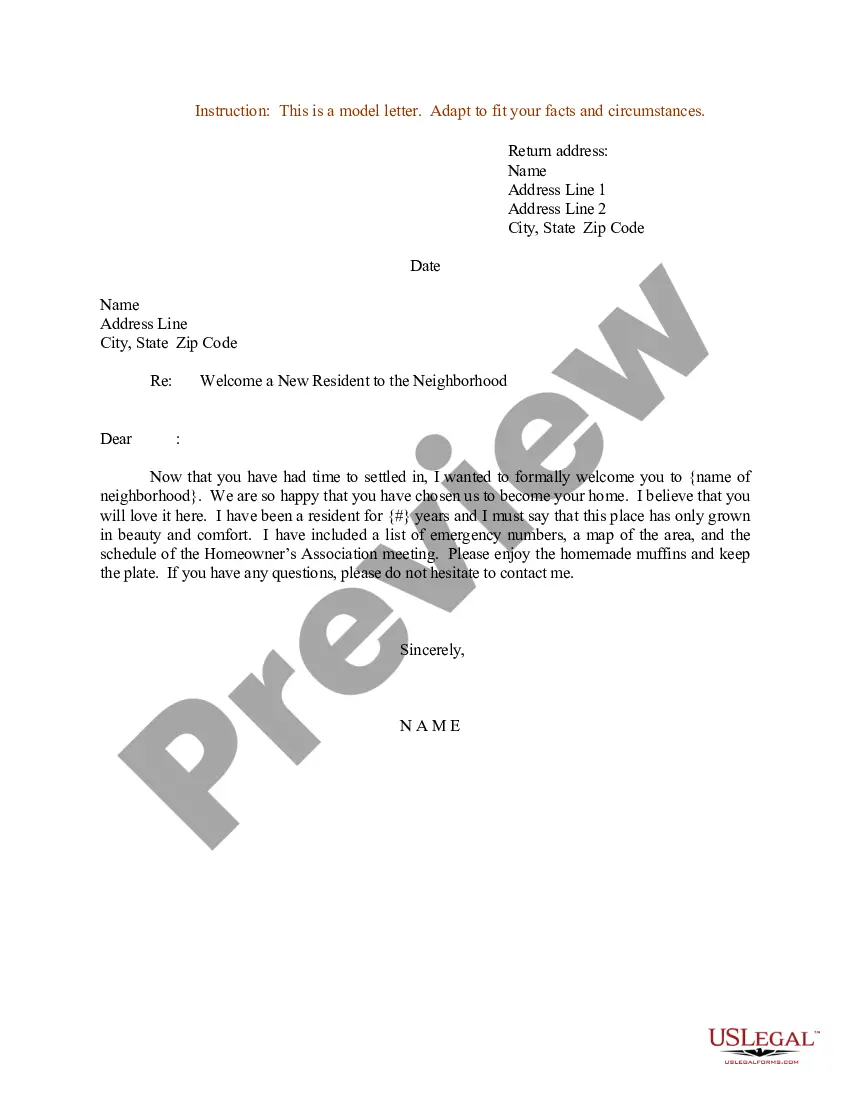

If you work with US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for your proper city/nation.

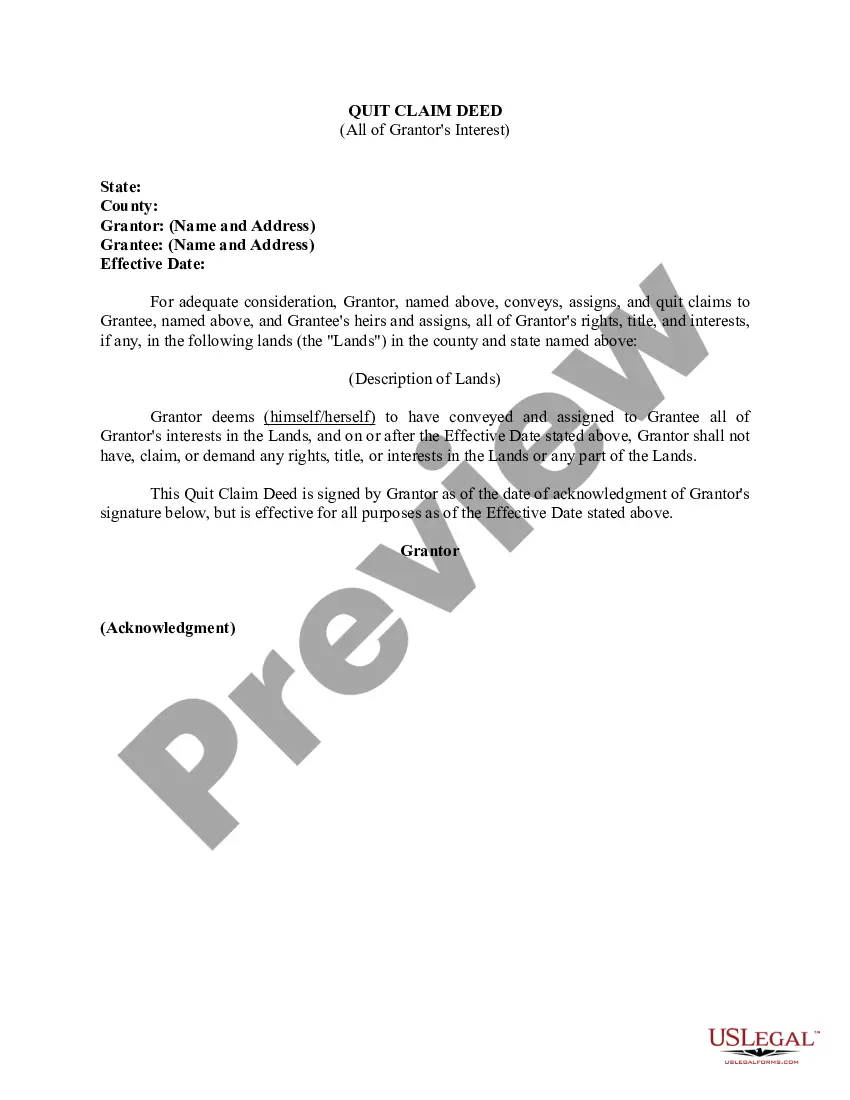

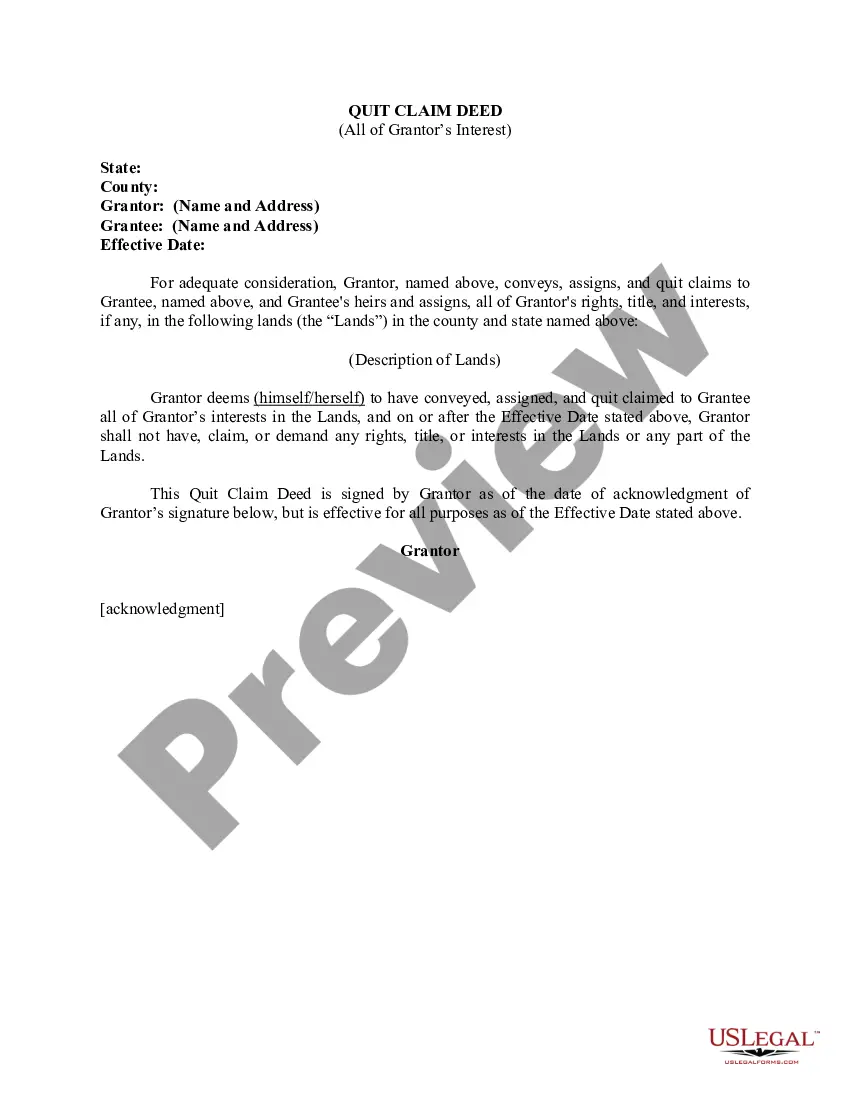

- Step 2. Utilize the Preview method to look through the form`s information. Never overlook to see the outline.

- Step 3. Should you be not satisfied together with the develop, utilize the Lookup field on top of the display to locate other types of the authorized develop web template.

- Step 4. When you have identified the form you will need, select the Get now switch. Select the costs plan you choose and add your accreditations to register to have an profile.

- Step 5. Approach the purchase. You should use your charge card or PayPal profile to finish the purchase.

- Step 6. Pick the structure of the authorized develop and down load it in your product.

- Step 7. Full, revise and produce or signal the Hawaii Quitclaim Deed for Mineral / Royalty Interest.

Every authorized document web template you get is yours eternally. You may have acces to each develop you delivered electronically in your acccount. Click the My Forms portion and pick a develop to produce or down load once again.

Remain competitive and down load, and produce the Hawaii Quitclaim Deed for Mineral / Royalty Interest with US Legal Forms. There are thousands of specialist and state-particular varieties you may use to your business or individual needs.

Form popularity

FAQ

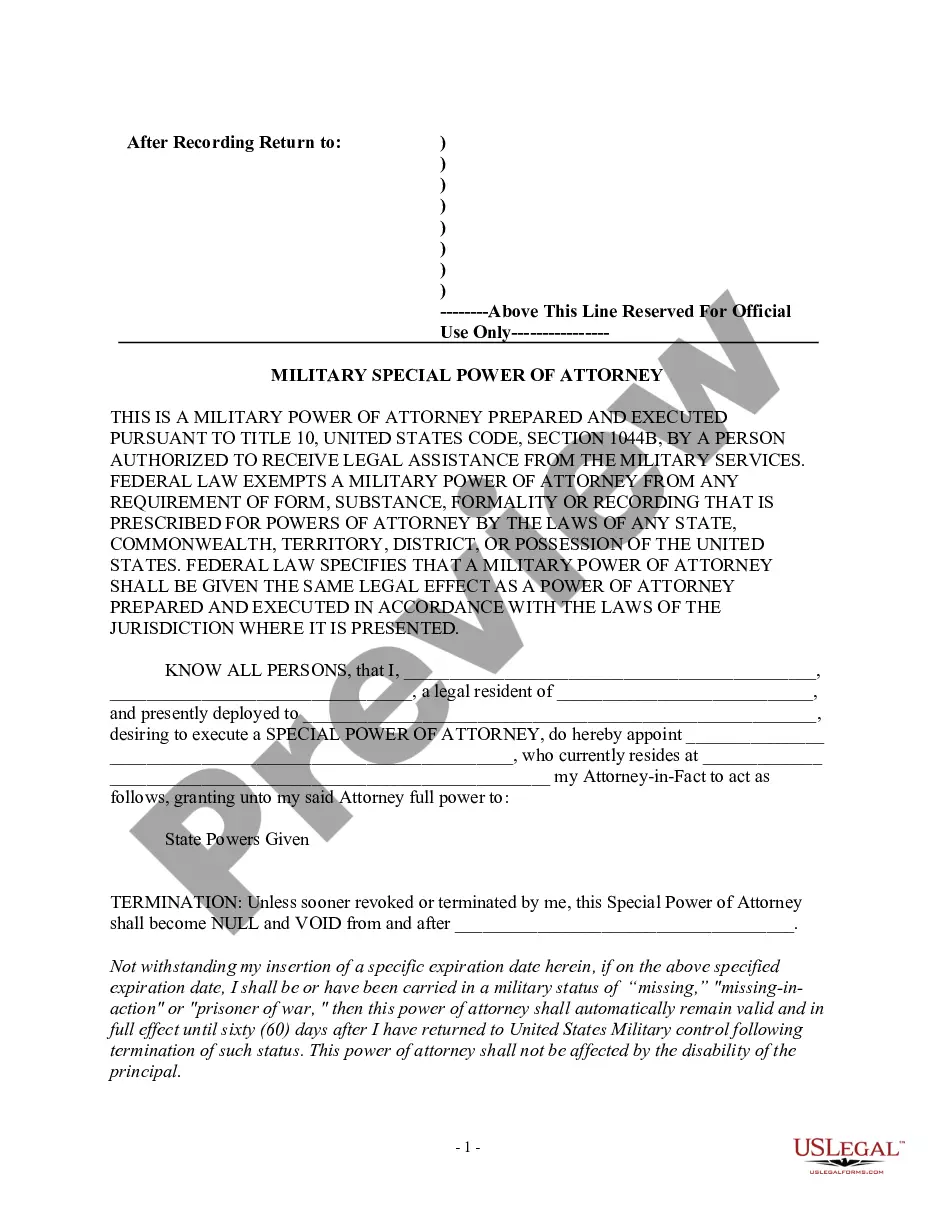

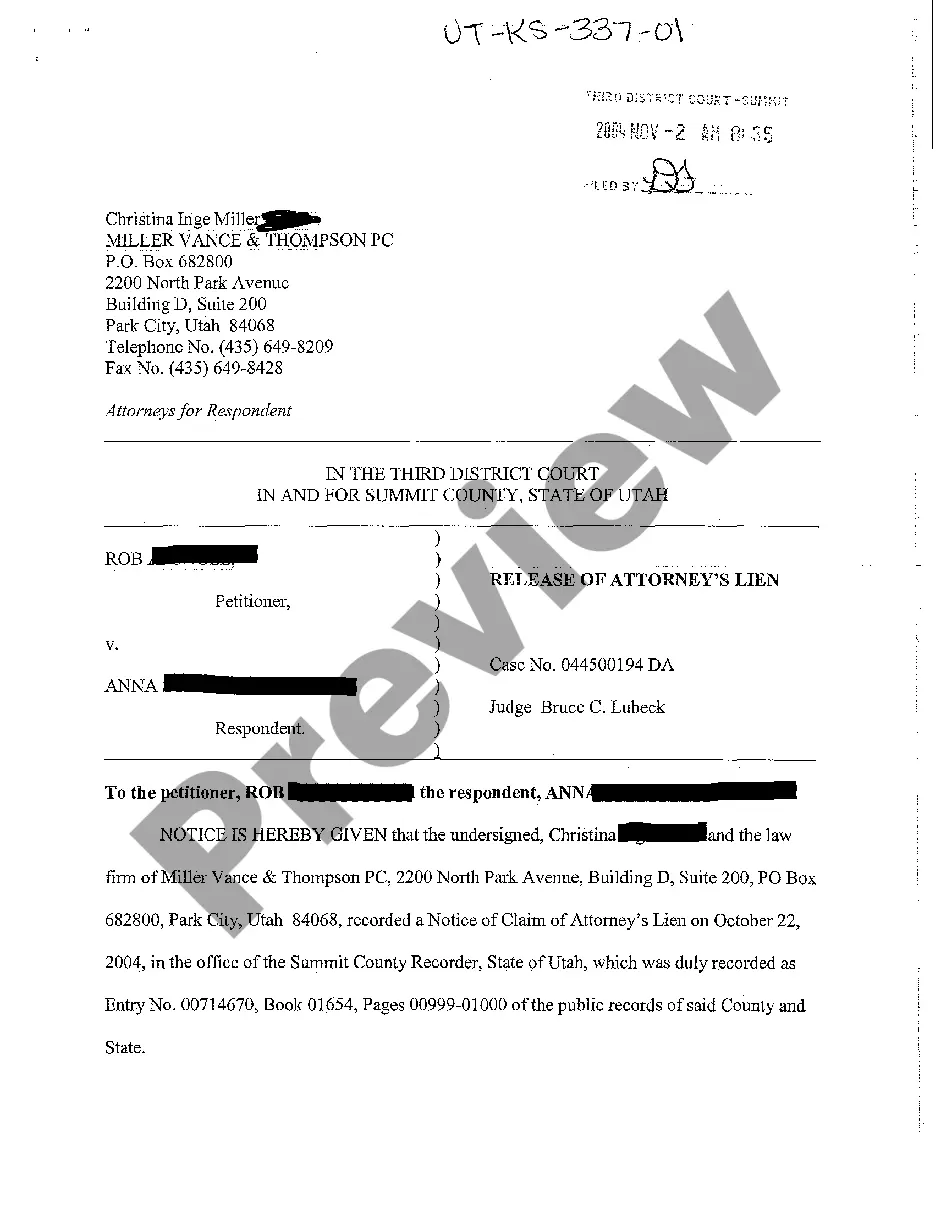

The deed or assignment of lease must be signed (in black ink) by the current owner and the new owner before a notary public. The deed or assignment of lease must be recorded in the State of Hawaii Bureau of Conveyances or Land Court. A Conveyance Tax Certificate must be filed and any tax due must be paid.

A Hawaii quitclaim deed is a form of deed conveying interest in real property from a Seller (the ?Grantor?) to a Buyer (the ?Grantee?). Because it is a quit claim, the seller is transferring the property with no guarantee whatsoever that he or she has clean title to the property.

A Quitclaim Deed transfers whatever interest the Grantor may have in the property. It makes no guarantees, whatsoever. For example, anyone could Quitclaim their interest in any property whether they owned it or not.

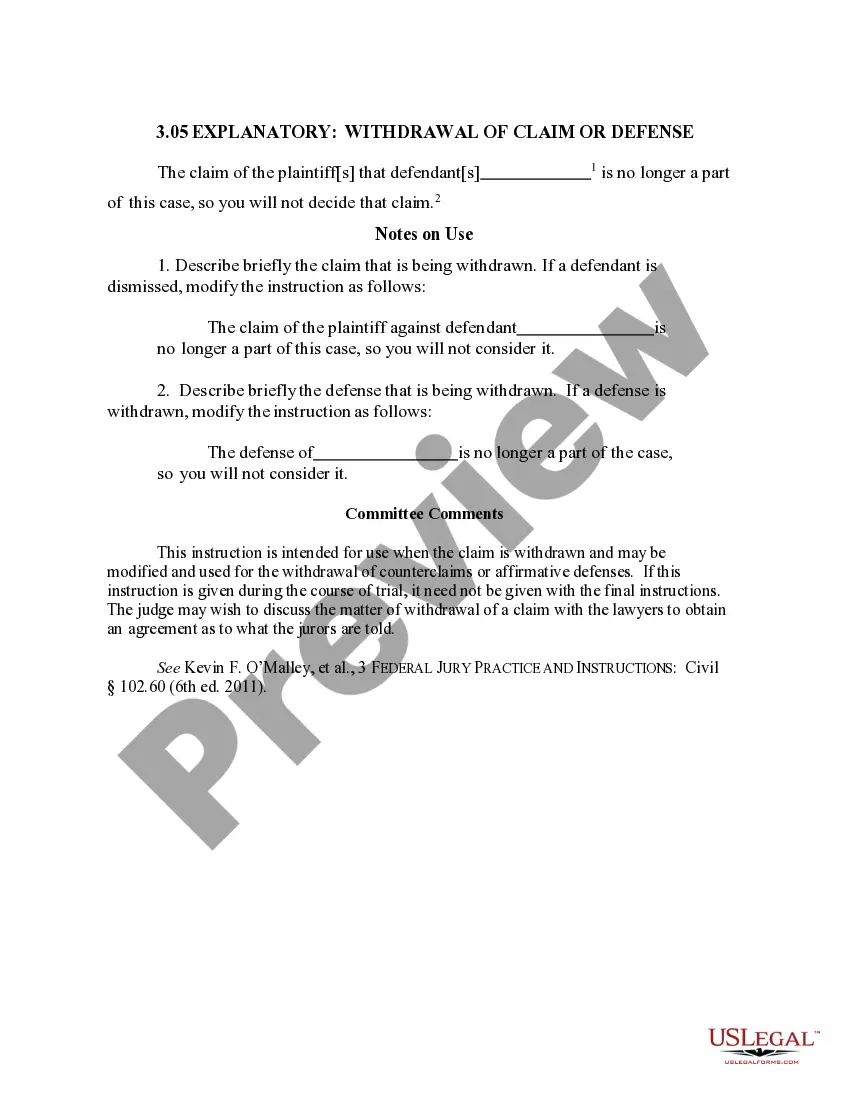

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

The parties involved in the property transfer must affix their signature, including the date signed, on the quitclaim deed in the presence of a notary public. After the quitclaim deed has been notarized, it can be filed in the Register of Deeds Office within the County to make the property transfer legal and effective.

Hawaii is a lien theory state and uses mortgages instead of deeds of trust.

Yes. The Hawaii Uniform Real Property Transfer on Death Act allows a single TOD deed to be signed by joint owners. The law sees a property owner who owns property with another owner with right of survivorship as a joint owner.

The person responsible for the tax is generally the transferor, grantor, lessor, sublessor, conveyor, or other person conveying the real property interest (HRS §247-3). The ® standard purchase contract directs escrow to charge the conveyance tax to the seller.