Hawaii Executor's Deed of Distribution

Description

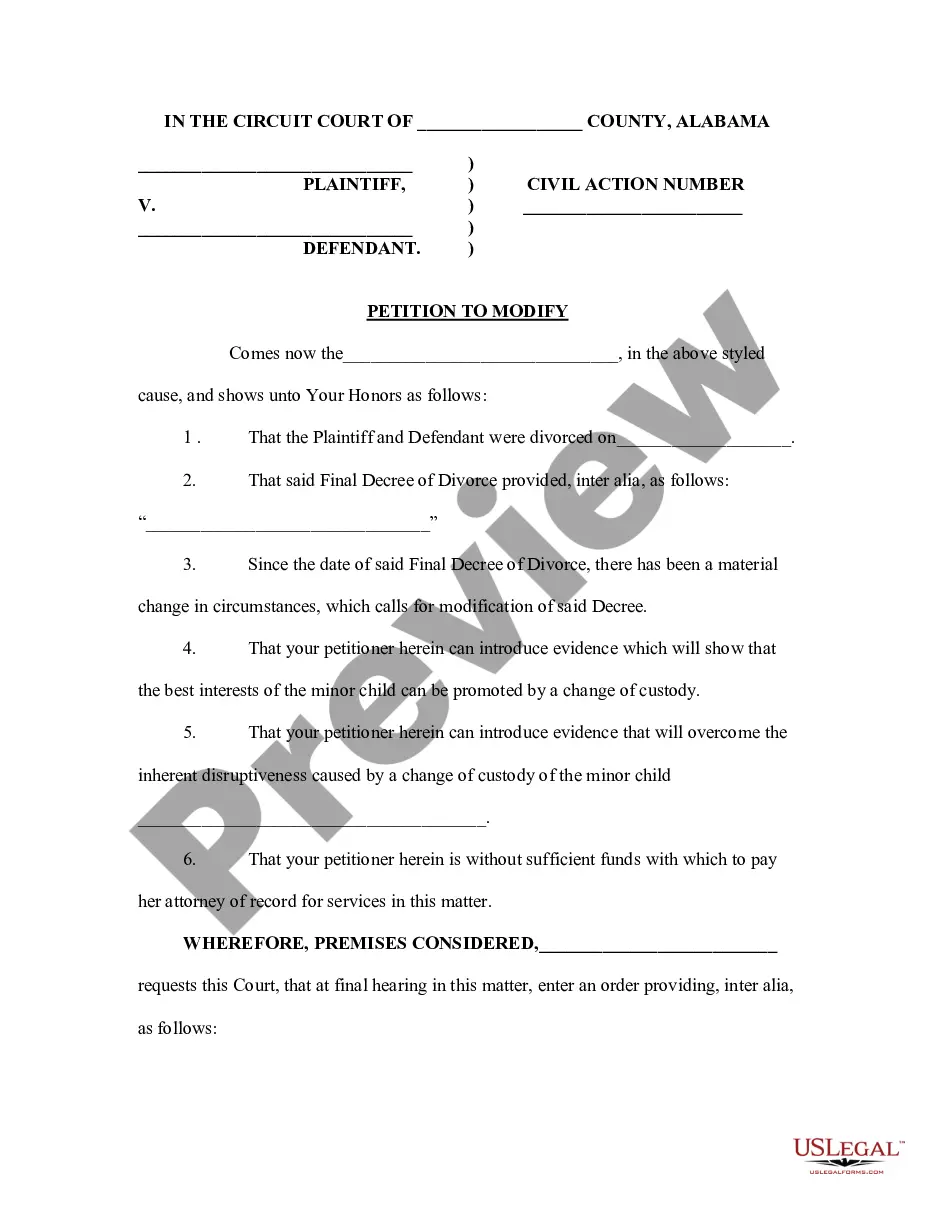

How to fill out Executor's Deed Of Distribution?

US Legal Forms - one of several greatest libraries of lawful varieties in the United States - gives a wide array of lawful file web templates you are able to download or printing. While using internet site, you can find thousands of varieties for business and specific purposes, categorized by types, says, or search phrases.You can get the most recent models of varieties much like the Hawaii Executor's Deed of Distribution within minutes.

If you already possess a subscription, log in and download Hawaii Executor's Deed of Distribution from your US Legal Forms catalogue. The Acquire switch can look on each kind you view. You have access to all previously acquired varieties inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms initially, listed here are basic instructions to help you get started out:

- Be sure to have picked out the proper kind to your area/region. Click on the Review switch to examine the form`s content material. Look at the kind outline to actually have chosen the correct kind.

- If the kind does not match your specifications, make use of the Research area at the top of the monitor to find the one who does.

- In case you are happy with the shape, verify your choice by clicking the Buy now switch. Then, select the rates strategy you like and give your credentials to register for the accounts.

- Method the purchase. Make use of charge card or PayPal accounts to complete the purchase.

- Find the file format and download the shape on your own gadget.

- Make alterations. Load, modify and printing and signal the acquired Hawaii Executor's Deed of Distribution.

Every web template you added to your bank account lacks an expiration time and it is yours forever. So, if you want to download or printing an additional copy, just visit the My Forms segment and click around the kind you will need.

Gain access to the Hawaii Executor's Deed of Distribution with US Legal Forms, by far the most substantial catalogue of lawful file web templates. Use thousands of skilled and express-specific web templates that meet up with your small business or specific needs and specifications.

Form popularity

FAQ

Hawaii is a lien theory state and uses mortgages instead of deeds of trust.

Yes. The Hawaii Uniform Real Property Transfer on Death Act allows a single TOD deed to be signed by joint owners. The law sees a property owner who owns property with another owner with right of survivorship as a joint owner.

The person responsible for the tax is generally the transferor, grantor, lessor, sublessor, conveyor, or other person conveying the real property interest (HRS §247-3). The ® standard purchase contract directs escrow to charge the conveyance tax to the seller.

A Hawaii quitclaim deed is a form of deed conveying interest in real property from a Seller (the ?Grantor?) to a Buyer (the ?Grantee?). Because it is a quit claim, the seller is transferring the property with no guarantee whatsoever that he or she has clean title to the property.

Revoking the deed. You have two options: (1) sign and record a revocation or (2) record another TOD deed, leaving the property to someone else. You cannot use your will to revoke or override a TOD deed.

The deed or assignment of lease must be signed (in black ink) by the current owner and the new owner before a notary public. The deed or assignment of lease must be recorded in the State of Hawaii Bureau of Conveyances or Land Court. A Conveyance Tax Certificate must be filed and any tax due must be paid.

Yes. The Hawaii Uniform Real Property Transfer on Death Act allows a single TOD deed to be signed by joint owners. The law sees a property owner who owns property with another owner with right of survivorship as a joint owner.