Hawaii Agreement for Sales of Data Processing Equipment

Description

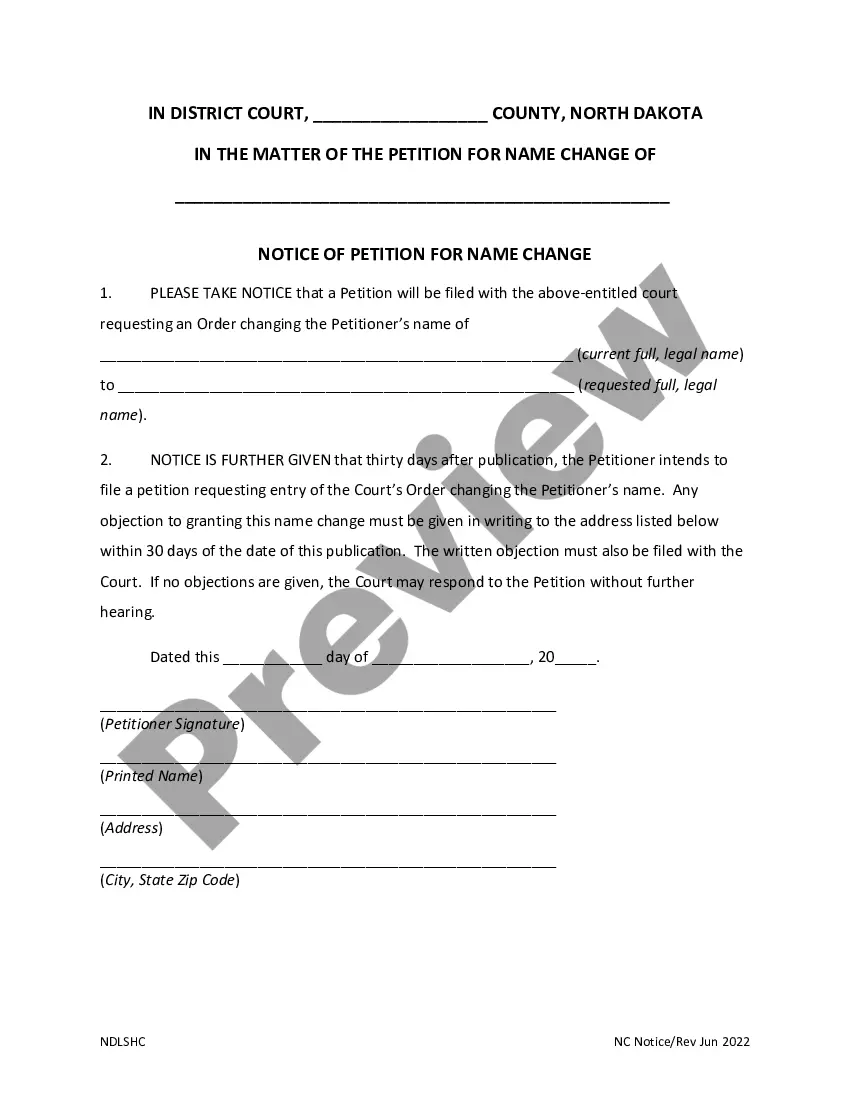

How to fill out Agreement For Sales Of Data Processing Equipment?

Are you in a situation where you need paperwork for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Hawaii Agreement for Sale of Data Processing Equipment, which are designed to meet state and federal regulations.

Once you find the right form, click on Get now.

Select the pricing plan you desire, fill out the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Hawaii Agreement for Sale of Data Processing Equipment template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct region/state.

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, use the Search section to find the form that meets your needs and requirements.

Form popularity

FAQ

To obtain Hawaii sales tax forms, you can visit the official Hawaii Department of Taxation website. They provide all necessary forms and detailed instructions to help you complete your sales tax obligations. If you are involved in transactions covered by the Hawaii Agreement for Sales of Data Processing Equipment, it’s crucial to ensure you have the correct forms for compliance. Additionally, platforms like US Legal Forms offer easy access to these forms and templates, streamlining the process for you.

To fill out a bill of sale in Hawaii, start with the date of the transaction and include both parties' information. Clearly describe the data processing equipment being sold, indicating any serial numbers or unique identifiers. For a thorough and reliable document, consider utilizing the resources available through USLegalForms, which can provide a streamlined Hawaii Agreement for Sales of Data Processing Equipment.

A bill of sale does not need to be notarized in Hawaii for the transfer of personal property, including data processing equipment. However, if you want added security or if the transaction involves significant value, notarization can help establish authenticity. Keep in mind that for a Hawaii Agreement for Sales of Data Processing Equipment, you may want to consider having your documents notarized for clarity and peace of mind.

Section 237 6 of Hawaii's tax code pertains to the regulations surrounding the sale of products and services in the state, including the Hawaii Agreement for Sales of Data Processing Equipment. This section provides vital insights into tax exemptions for certain sales transactions, which can be beneficial for businesses engaged in selling data processing equipment. Understanding this section helps you comply with local tax laws and optimize your operations. For a comprehensive understanding and the necessary documentation, US Legal Forms offers valuable resources tailored to your needs.

In Hawaii, there is no specific age at which individuals automatically stop paying property taxes. However, certain exemptions exist for seniors over 65 who meet specific income criteria. If you're concerned about property tax implications in relation to a Hawaii Agreement for Sales of Data Processing Equipment, consulting with professionals on available exemptions can provide clarity.

States that do not impose sales tax on electronics generally include Delaware, Montana, New Hampshire, and Oregon. For businesses dealing with electronics, such as those governed by a Hawaii Agreement for Sales of Data Processing Equipment, understanding state tax policies is crucial for informed purchasing decisions. Always check regional tax regulations to confirm current rules.

Products that are commonly exempt from sales tax include prescription drugs, certain food items, and selected agricultural supplies. Furthermore, when utilizing a Hawaii Agreement for Sales of Data Processing Equipment, you may find that certain purchases align with exemption criteria. Always ensure compliance by reviewing local laws related to exemptions.

In Hawaii, sales tax exemptions apply to specific categories such as agricultural products and certain educational materials. Additionally, transactions that involve a Hawaii Agreement for Sales of Data Processing Equipment may also qualify for exemptions. It’s important to review the guidelines to determine eligibility for such exemptions.

Yes, Hawaii is a mandatory withholding state, meaning that employers must withhold state income taxes from employee paychecks. This requirement helps ensure that workers contribute to state tax revenue consistently throughout the year. If you are engaging in sales or services under a Hawaii Agreement for Sales of Data Processing Equipment, it's essential to factor in these withholding requirements.

Certain items are exempt from sales tax in Hawaii, including food, prescription medications, and some medical devices. Moreover, when it comes to data processing equipment transactions, exemptions may apply under specific agreements, like the Hawaii Agreement for Sales of Data Processing Equipment. Always check the latest regulations to ensure compliance.