Hawaii Correspondent Agreement - Self-Employed Independent Contractor

Description

How to fill out Correspondent Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a variety of legal form templates that you can download or create. Through the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms such as the Hawaii Correspondent Agreement - Self-Employed Independent Contractor in moments.

If you already possess a subscription, Log In and acquire the Hawaii Correspondent Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents section of your account.

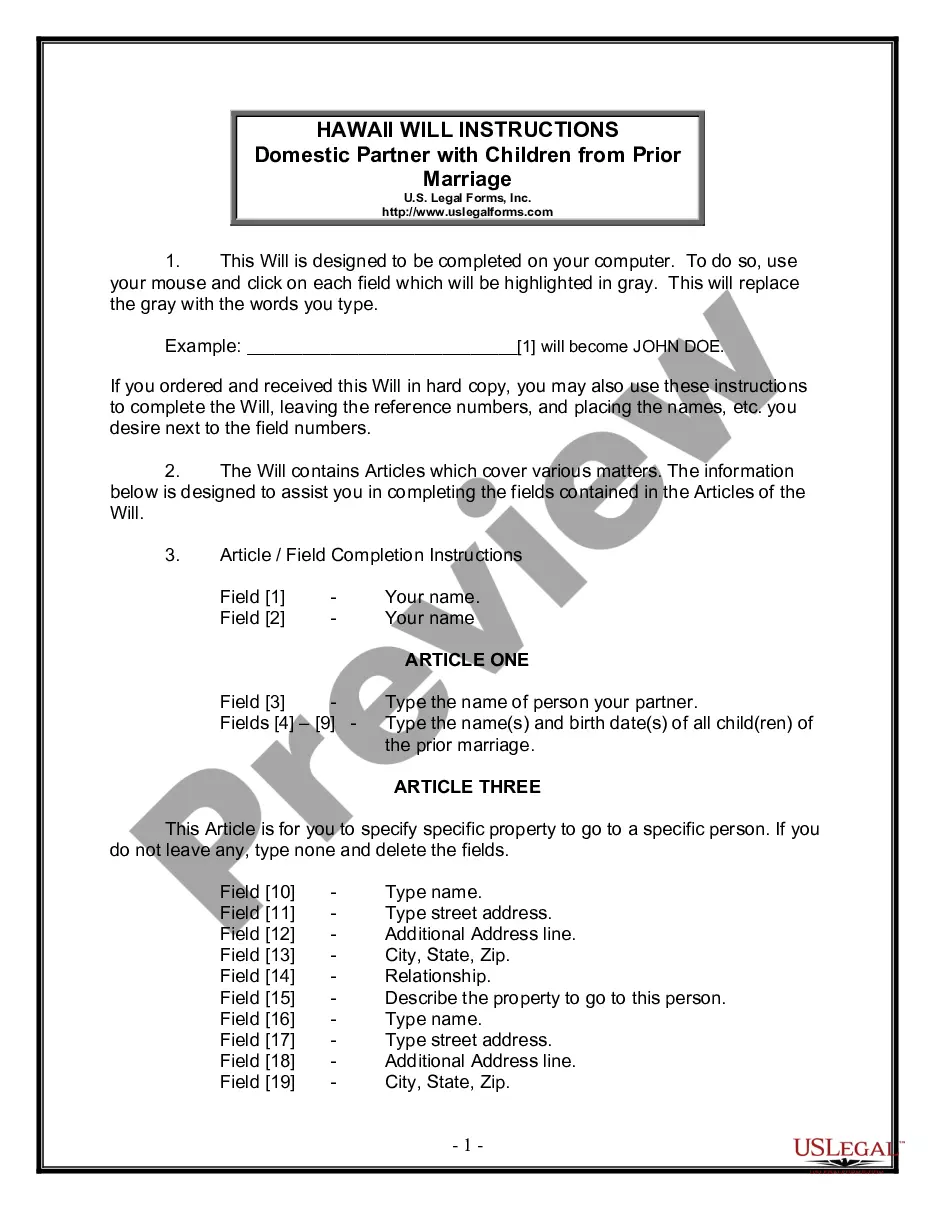

To utilize US Legal Forms for the first time, here are some simple instructions to get started: Ensure you have selected the correct form for your locale/state. Click the Preview button to review the form’s details. Read the form description to confirm that you have chosen the appropriate form. If the form does not meet your needs, use the Search bar at the top of the page to find one that does. If you are happy with the form, confirm your choice by clicking the Buy now button. Then, select your preferred pricing plan and provide your credentials to register for the account. Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make alterations. Fill out, modify, and print and sign the downloaded Hawaii Correspondent Agreement - Self-Employed Independent Contractor.

US Legal Forms ensures that all templates are readily available for your convenience and use.

Whether for personal or business purposes, you will find all necessary legal documents in one place.

- Each template you add to your account has no expiration date and belongs to you permanently.

- Thus, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Hawaii Correspondent Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the largest collections of legal form templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Explore the extensive library to find the forms that suit your circumstances.

- Download and customize the documents as necessary.

Form popularity

FAQ

The new federal rule regarding independent contractors aims to clarify their classification under labor laws. This rule establishes criteria that help determine whether a worker is truly an independent contractor or an employee. It's essential to stay informed about these changes, and using the Hawaii Correspondent Agreement - Self-Employed Independent Contractor can ensure you comply with current regulations.

To qualify as self-employed, you must work for yourself, control your workload, and manage your finances. This includes operating a business that generates income, either through contracts or freelance work. The Hawaii Correspondent Agreement - Self-Employed Independent Contractor can help formalize your self-employed status and clarify your business arrangements.

Yes, if you receive a 1099 form, you are considered self-employed. A 1099 is typically issued for services rendered as an independent contractor, indicating you are responsible for your taxes. Using the Hawaii Correspondent Agreement - Self-Employed Independent Contractor can further solidify this classification.

The terms self-employed and independent contractor can often be used interchangeably. However, 'self-employed' encompasses a broader category that includes various types of work arrangements. When discussing your status, using the phrase associated with the Hawaii Correspondent Agreement - Self-Employed Independent Contractor can highlight your specific business model.

Absolutely, an independent contractor counts as self-employed. This designation allows you to enjoy certain freedoms, such as setting your own hours and choosing your clients. It's essential to have proper agreements, like the Hawaii Correspondent Agreement - Self-Employed Independent Contractor, to confirm your status.

Having a contract as an independent contractor is highly recommended. A contract provides clarity about the terms of your work, payment details, and expectations. When you utilize the Hawaii Correspondent Agreement - Self-Employed Independent Contractor, it ensures both parties understand their roles and responsibilities.

Yes, an independent contractor is indeed considered self-employed. As an independent contractor, you operate your own business and have the freedom to accept or decline work. This classification can be beneficial, especially when using documents like the Hawaii Correspondent Agreement - Self-Employed Independent Contractor to clarify your status.

To provide proof of employment as an independent contractor, gather essential documents like your contracts, invoices, and bank statements showing payments. Additionally, keep records of communications with your clients, which can establish your working relationship. Utilizing the Hawaii Correspondent Agreement - Self-Employed Independent Contractor can help formalize this relationship and serve as proof when needed.

To fill out an independent contractor agreement, start by clearly outlining the project's specifics, such as deliverables and deadlines. Next, enter the agreed-upon payment terms and any special conditions pertinent to the work. By carefully detailing these aspects, you comply with the guidelines set forth in the Hawaii Correspondent Agreement - Self-Employed Independent Contractor.

An independent contractor typically needs to fill out a W-9 form, which provides their tax identification information. Depending on the nature of the work, additional forms might apply, such as a service contract or a declaration of independent contractor status. Utilizing platforms like uslegalforms can help streamline this process, especially in relation to the Hawaii Correspondent Agreement - Self-Employed Independent Contractor.