Hawaii Visiting Professor Agreement - Self-Employed Independent Contractor

Description

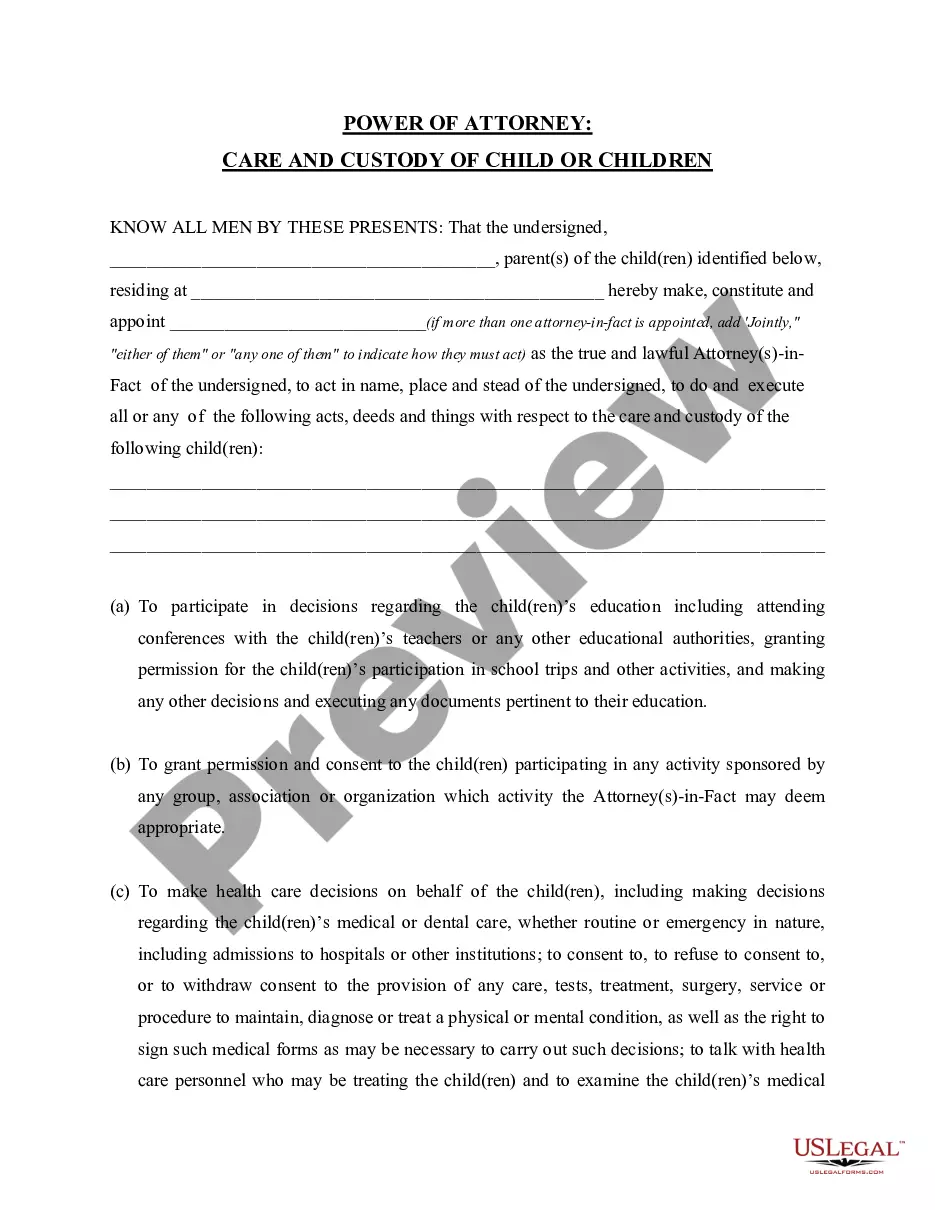

How to fill out Visiting Professor Agreement - Self-Employed Independent Contractor?

If you require to access, acquire, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's user-friendly and straightforward search to find the documents you need.

A variety of templates for business and personal use are organized by categories and states, or keywords. Use US Legal Forms to locate the Hawaii Visiting Professor Agreement - Self-Employed Independent Contractor in just a few clicks.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of the legal document and download it to your device. Step 7. Fill out, modify, and print or sign the Hawaii Visiting Professor Agreement - Self-Employed Independent Contractor. Every legal document template you purchase is yours permanently. You will have access to every form you saved in your account. Click the My documents section and select a form to print or download again. Stay competitive and acquire, and print the Hawaii Visiting Professor Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms customer, Log In to your account and click on the Download option to obtain the Hawaii Visiting Professor Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Confirm you have selected the form for your appropriate city/state.

- Step 2. Use the Preview option to review the form's content. Be sure to read the summary.

- Step 3. If you are dissatisfied with the document, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, select the Get now option. Choose your preferred pricing plan and enter your credentials to register for an account.

Form popularity

FAQ

The classification of teachers as employees or independent contractors can depend on the specific arrangement they have with their educational institution. Regular teachers typically have employee status, while those working on a freelance basis or teaching adjunct courses may be independent contractors. Understanding this distinction is crucial, especially when entering a Hawaii Visiting Professor Agreement - Self-Employed Independent Contractor. Clarifying your employment status helps you navigate your rights and responsibilities.

Often, adjunct professors are classified as independent contractors, although this can vary by institution. They usually teach on a part-time basis and enjoy greater flexibility compared to full-time faculty. If you secure a position through a Hawaii Visiting Professor Agreement - Self-Employed Independent Contractor, you would likely operate as an independent contractor. This classification can impact how you plan your teaching workload and financial arrangements.

Determining your status between independent contractor and employee depends on various factors, such as the level of control an employer has over your work and how you manage your taxes. If you maintain significant control over your schedule and methods, you may be classified as an independent contractor. Using resources like the Hawaii Visiting Professor Agreement - Self-Employed Independent Contractor can clarify your status and obligations. Always consult legal or financial advice tailored to your situation for final determinations.

Yes, an independent contractor is typically considered self-employed. This means they operate their own business, manage their own taxes, and do not receive typical employee benefits. It is essential for professionals to understand this distinction, particularly in the context of a Hawaii Visiting Professor Agreement - Self-Employed Independent Contractor, as it affects financial planning and liability. If you work on a project basis, this self-employment status may suit you well.

Independent contractors can encompass a wide range of professions, from freelance writers to consultants and skilled tradespeople. In academia, positions like adjunct professors or visiting professors often fall into this category. These roles allow for flexibility and autonomy in how work is performed. With a Hawaii Visiting Professor Agreement - Self-Employed Independent Contractor, educators can choose to establish themselves as independent contractors while providing their expertise.

A professor may be an employee or an independent contractor, depending on the specific terms of their agreement. In the context of a Hawaii Visiting Professor Agreement - Self-Employed Independent Contractor, a professor typically works as a self-employed independent contractor rather than as a traditional employee. This distinction allows them greater flexibility in how they manage their teaching responsibilities. Thus, understanding your status is crucial for benefits and tax purposes.

To fill out an independent contractor agreement effectively, start by entering your personal details and the hiring party’s information. Both parties must agree on the terms, including payment rates and service expectations outlined in the Hawaii Visiting Professor Agreement. Utilizing resources from platforms like USLegalForms can provide guidance and streamline the process, ensuring that nothing is overlooked.

Filling out an independent contractor form involves providing accurate personal information, tax details, and specifics about the services you offer. When completing documents tied to the Hawaii Visiting Professor Agreement, make sure to include a clear description of your teaching role and the terms of payment. This clarity can help prevent misunderstandings and ensure smooth transactions.

Writing an independent contractor agreement involves outlining key elements such as the scope of work, payment terms, and duration of the contract. For those entering into a Hawaii Visiting Professor Agreement, clearly specify expectations relating to teaching responsibilities and deadlines. Consider using templates available on platforms like USLegalForms to ensure comprehensive coverage of essential components.

Professors can operate as either employees or independent contractors, depending on their contractual arrangements. Through the Hawaii Visiting Professor Agreement, many professors function as self-employed independent contractors, allowing for greater flexibility in their teaching engagements. This distinction impacts tax obligations and benefits, so it’s important to understand your role clearly.