Hawaii Stone Contractor Agreement - Self-Employed

Description

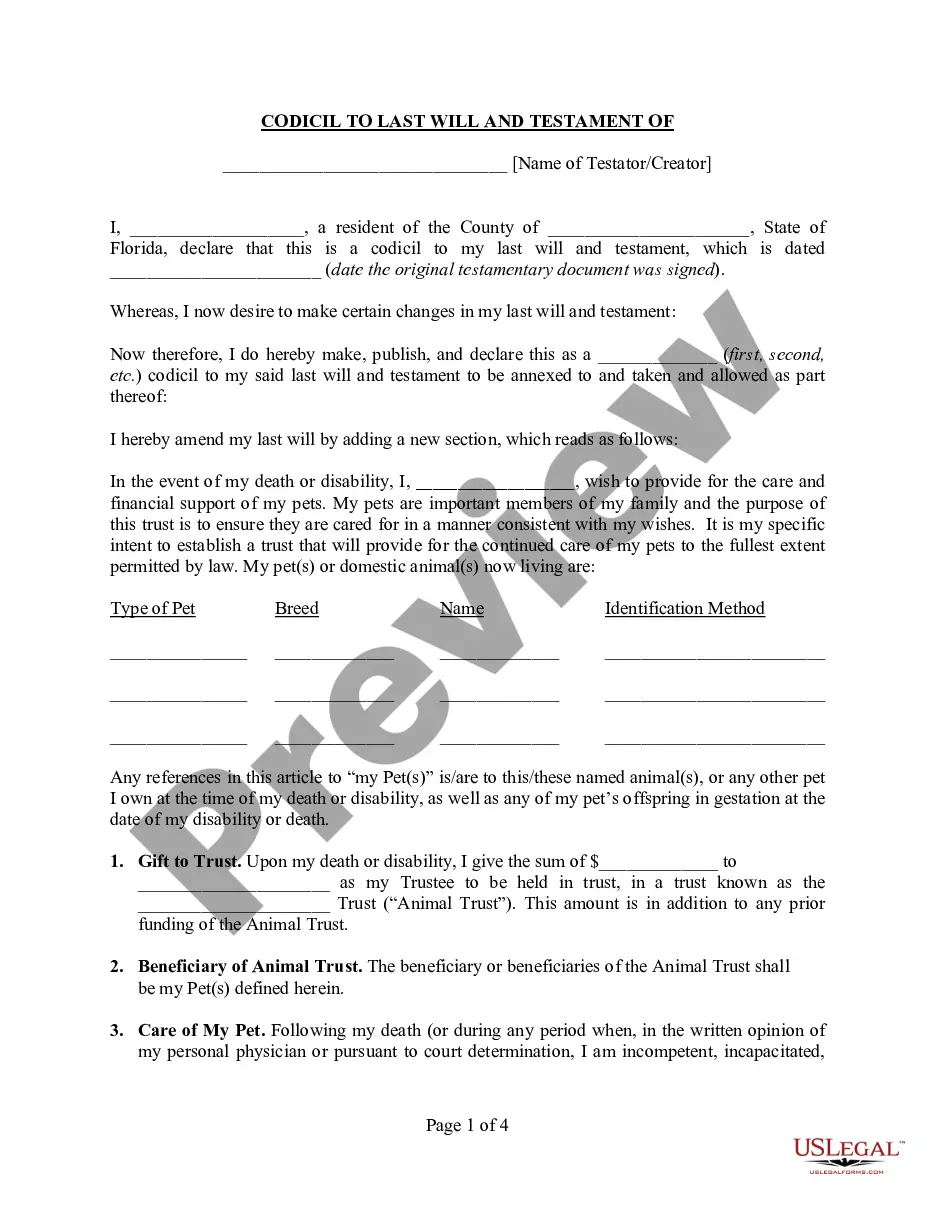

How to fill out Stone Contractor Agreement - Self-Employed?

If you wish to acquire, download, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site's straightforward and user-friendly search feature to find the documents you require. A selection of templates for business and personal purposes are categorized by type and state, or keywords. Use US Legal Forms to obtain the Hawaii Stone Contractor Agreement - Self-Employed with just a few clicks.

If you are already a US Legal Forms member, Log In to your account and click on the Download button to acquire the Hawaii Stone Contractor Agreement - Self-Employed. You can also access forms you previously saved in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form's content. Don't forget to check the summary. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template. Step 4. Once you have located the form you need, select the Get Now button. Choose the pricing plan you prefer and provide your information to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Hawaii Stone Contractor Agreement - Self-Employed.

- Every legal document template you obtain is yours forever.

- You have access to each form you saved in your account.

- Select the My documents section and choose a form to print or download again.

- Acquire and download, and print the Hawaii Stone Contractor Agreement - Self-Employed with US Legal Forms.

- There are thousands of professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

Writing an independent contractor agreement involves outlining the responsibilities and expectations of both parties. Clearly describe the project, the payment terms, deadlines, and any specific conditions relating to the Hawaii Stone Contractor Agreement - Self-Employed. Make sure to include signatures from both parties to solidify the terms. Consider using platforms like uslegalforms for templates that simplify the process.

An independent contractor should prepare several essential documents, including a valid Hawaii Stone Contractor Agreement - Self-Employed. Necessary paperwork typically includes forms for tax identification, invoices for work completed, and any permits required for job completion. Additionally, it is wise to keep documentation of communication and agreements to avoid misunderstandings.

Filling out an independent contractor form involves several important steps to ensure clarity. Begin by entering your personal information and the contractor's details. Clearly state the nature of the work and the compensation structure, then include key points like timelines and obligations as per the Hawaii Stone Contractor Agreement - Self-Employed. Remember to read through the form thoroughly before submitting it.

To write a self-employed contract, start by clearly identifying the parties involved in the agreement, including their roles. The contract should define the work to be performed under the Hawaii Stone Contractor Agreement - Self-Employed and detail payment terms, deadlines, and confidentiality clauses, if necessary. Also, consider including provisions for dispute resolution. Always ensure both parties review and sign the document.

Filling out a Hawaii Stone Contractor Agreement - Self-Employed requires several key steps. First, include your contact information and the contractor's details. Next, outline the scope of work, payment terms, and any specific terms related to performance and deadlines. Finally, make sure both parties sign and date the agreement for it to be legally binding.

Contract work is generally classified differently than traditional employment. While you are performing work for a client or business, you are considered self-employed, not an employee. This classification can impact your taxes and obligations, so understanding it is vital as you create your Hawaii Stone Contractor Agreement - Self-Employed.

Receiving a 1099 form usually indicates that you are considered self-employed. This form is used to report income earned from a business or contract work, rather than as an employee. Therefore, if you receive a 1099, your status likely aligns with that of a self-employed individual. This is an important detail to keep in mind when creating your Hawaii Stone Contractor Agreement - Self-Employed.

To write an independent contractor agreement, start by clearly defining the scope of work, payment terms, and responsibilities of both parties. Moreover, it is crucial to include clauses that cover confidentiality and dispute resolution. If you are unsure about drafting this document, consider using the uslegalforms platform to simplify the process for your Hawaii Stone Contractor Agreement - Self-Employed.

Yes, a contractor is indeed considered self-employed. This means they are not classified as an employee of an organization but rather as a working individual running their own business. Understanding this distinction is essential, especially when drafting a Hawaii Stone Contractor Agreement - Self-Employed that outlines responsibilities and compensation.

The terms self-employed and independent contractor can often be used interchangeably, but there are subtle differences. Self-employed generally refers to anyone running their own business, while independent contractor specifies a working relationship defined by contractual agreements. For your Hawaii Stone Contractor Agreement - Self-Employed, using the more specific term can add clarity about the nature of the relationship.