Hawaii Delivery Driver Services Contract - Self-Employed

Description

How to fill out Delivery Driver Services Contract - Self-Employed?

If you wish to finalize, obtain, or print legal document templates, utilize US Legal Forms, the premier collection of legal documents, available online.

Take advantage of the site's straightforward and convenient search feature to find the forms you require.

A selection of templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other variations of the legal document template.

Step 4. Once you locate the form you need, click the Get now button. Choose your preferred pricing plan and provide your details to register for an account.

- Utilize US Legal Forms to get the Hawaii Delivery Driver Services Agreement - Self-Employed in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Hawaii Delivery Driver Services Agreement - Self-Employed.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Confirm that you have selected the form for the correct region/state.

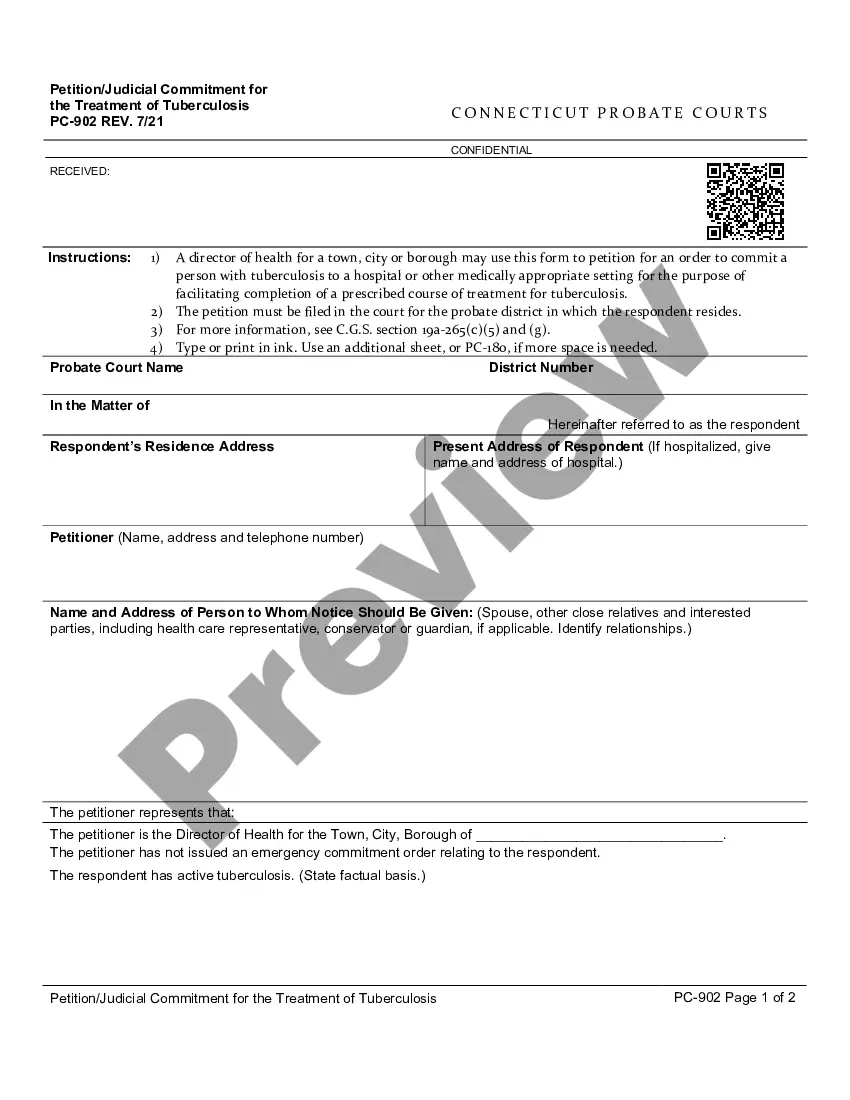

- Step 2. Use the Preview option to review the contents of the form. Don’t forget to read the details.

Form popularity

FAQ

The income potential of self-employed delivery services can vary widely, but many drivers report that services like Uber Eats and Grubhub offer lucrative opportunities. Earnings depend on factors such as location, time of day, and demand. If you seek consistency, a well-drafted Hawaii Delivery Driver Services Contract - Self-Employed can help you negotiate better terms.

To secure a delivery driver contract, you can start by researching platforms that facilitate such agreements, like uslegalforms. These platforms provide templates and resources for a Hawaii Delivery Driver Services Contract - Self-Employed. Familiarizing yourself with these resources will streamline the process of finding the right contract.

Yes, a delivery driver can indeed be an independent contractor. This arrangement includes advantages like flexible scheduling and the potential for higher income. When entering into a Hawaii Delivery Driver Services Contract - Self-Employed, drivers can better understand their rights and responsibilities.

Definitely, you can be a self-employed delivery driver. This allows you to operate under a Hawaii Delivery Driver Services Contract - Self-Employed, giving you control over your earnings and hours. Self-employment offers unique advantages, such as being your boss and choosing your own clients.

Yes, DoorDash drivers are typically classified as independent contractors. This means they do not receive employee benefits but have the freedom to choose their hours and delivery routes. If you're considering delivering for DoorDash, understanding the implications of a Hawaii Delivery Driver Services Contract - Self-Employed can be crucial for managing your business.

Yes, a delivery driver can be an independent contractor if they operate under a Hawaii Delivery Driver Services Contract - Self-Employed. As an independent contractor, you have the flexibility to set your schedule and manage your own business. This arrangement allows you to enjoy the benefits of self-employment while fulfilling delivery duties.

employed courier is a person responsible for delivering parcels on behalf of customers. But there's far more to the job than initially meets the eye. Couriers are tasked with managing the process of moving goods from A to B, from collecting goods from clients to executing the quickest and most efficient routes.

Contract Delivery means the date identified in the Contract by which the Contractor shall have completed the Contract to the satisfaction of the Authority.

Here are some common expenses you may be able to deduct:Mileage. It's essential to keep track of all of the miles you drove for business.Parking and tolls.Mobile phone.Supplies.Roadside assistance.Commissions and fees.Bike and accessories.

Many companies offer self-employment roles, notably delivery companies, where drivers often operate under self-employment terms. In most cases, this does not present problems, with many workers welcoming the independence associated with the role.