Hawaii Shareholders Agreement

Description

How to fill out Shareholders Agreement?

You may commit several hours on the web trying to find the legal document format that meets the federal and state specifications you want. US Legal Forms offers 1000s of legal kinds that are examined by experts. You can actually obtain or produce the Hawaii Shareholders Agreement from the services.

If you have a US Legal Forms bank account, you may log in and then click the Download option. Next, you may full, revise, produce, or indication the Hawaii Shareholders Agreement. Each legal document format you acquire is your own for a long time. To have another duplicate for any obtained type, go to the My Forms tab and then click the related option.

If you work with the US Legal Forms website for the first time, keep to the simple recommendations below:

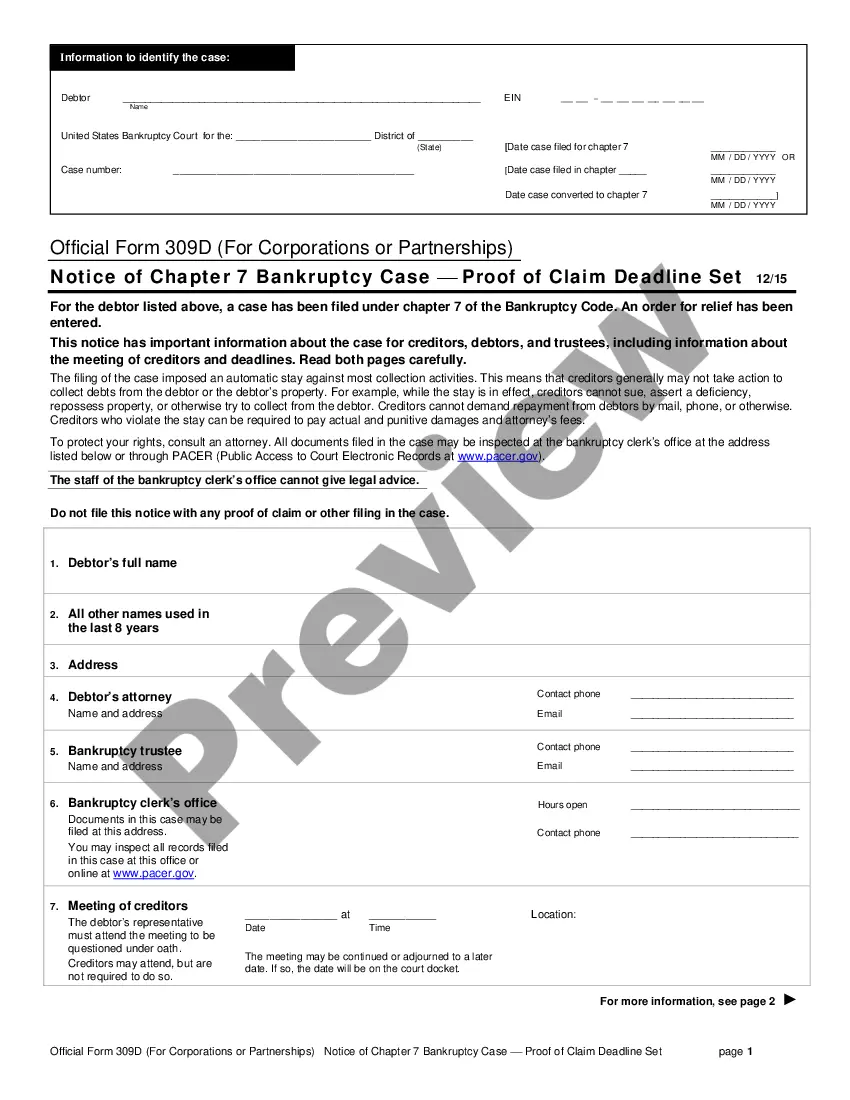

- Initial, ensure that you have selected the best document format to the region/city of your choosing. Browse the type description to ensure you have picked the right type. If accessible, take advantage of the Review option to check through the document format at the same time.

- If you want to find another version from the type, take advantage of the Research discipline to discover the format that fits your needs and specifications.

- Once you have discovered the format you need, click Get now to continue.

- Choose the rates prepare you need, type in your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the financial transaction. You may use your Visa or Mastercard or PayPal bank account to purchase the legal type.

- Choose the file format from the document and obtain it to your product.

- Make modifications to your document if needed. You may full, revise and indication and produce Hawaii Shareholders Agreement.

Download and produce 1000s of document web templates while using US Legal Forms Internet site, which offers the largest selection of legal kinds. Use professional and status-specific web templates to tackle your organization or person requires.

Form popularity

FAQ

How do I set up an S corp in Hawaii? Choose a distinct business name. Appoint a registered agent. File Articles of Organization with the Hawaii Department of Commerce and Consumer Affairs Business Registration Division. Draft an operating agreement. Get an Employer Identification Number (EIN).

The GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person en- gaging in the business activity. The GET applies to nearly every form of business activity.

To form a Hawaii S corp, you'll need to ensure your company has a Hawaii formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status. How to Start an S Corp in Hawaii - Startup Savant Startup Savant ? ... ? How to Start an S Corp Startup Savant ? ... ? How to Start an S Corp

To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors. How to Establish an S Corp in California ? Formations formationscorp.com ? blog ? establish-an-s-corp-i... formationscorp.com ? blog ? establish-an-s-corp-i...

A partnership return shall be filed in the first year the partners formally agree to engage in joint operation, or in the absence of a formal agreement, the first taxable year in which the organization receives income or makes or incurs any expenditures treated as deductions for Hawaii income tax purposes.

Any person who is in Hawai?i for a temporary or transient purpose and whose permanent residence is not Hawai?i is considered a Hawai?i nonresident. Each year, a nonresident who earns income from Hawai?i sources must file a State of Hawai?i tax return and will be taxed only on income from Hawai?i sources.

If an individual has been in Hawaii more than 200 days of the taxable year in the aggregate (not consecutive), the individual is presumed to have been a resident of Hawaii from the time of the individual's arrival.

To qualify for S corporation status, the corporation must meet the following requirements: Be a domestic corporation. Have only allowable shareholders. ... Have no more than 100 shareholders. Have only one class of stock. S Corporations | Internal Revenue Service irs.gov ? small-businesses-self-employed ? s... irs.gov ? small-businesses-self-employed ? s...

Form N-35 is used to report the income, de- ductions, gains, losses, etc., of an S corporation doing business in Hawaii.