Hawaii Expense Limitation Agreement

Description

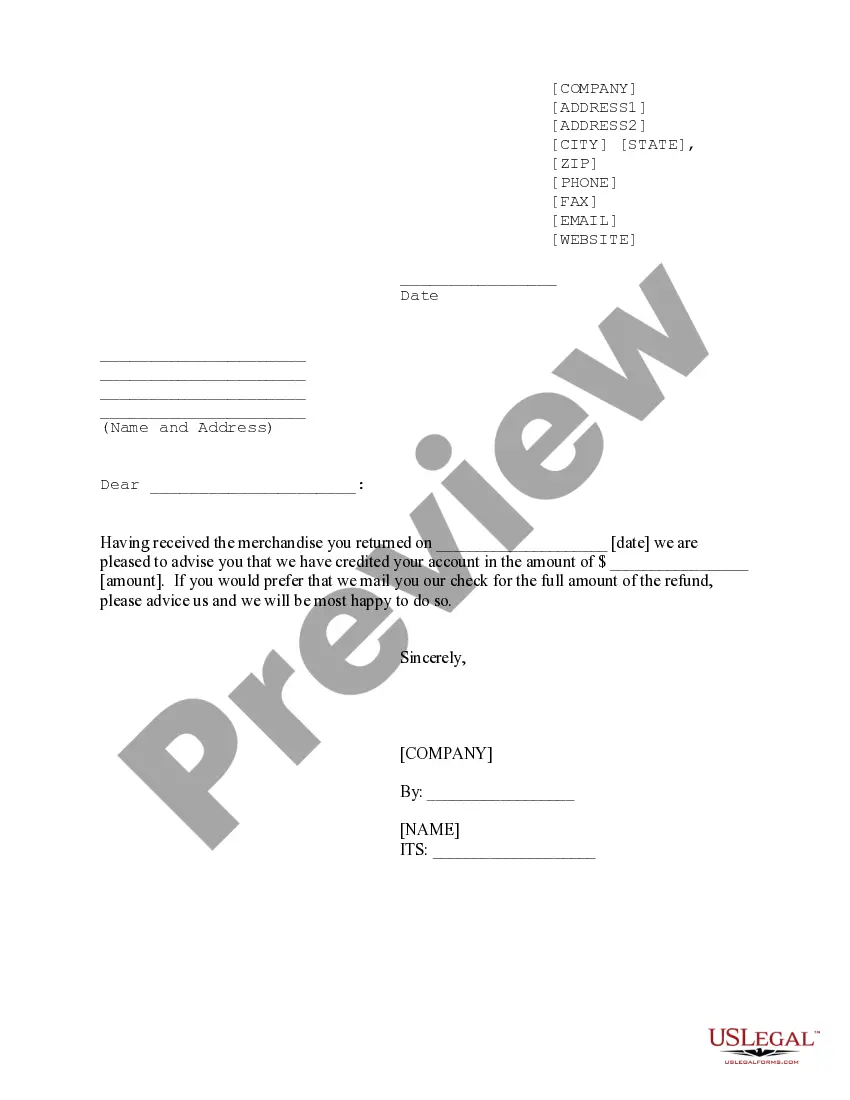

How to fill out Expense Limitation Agreement?

Are you currently inside a situation in which you need documents for possibly organization or person functions just about every time? There are a variety of lawful document web templates accessible on the Internet, but locating kinds you can rely is not easy. US Legal Forms gives 1000s of develop web templates, much like the Hawaii Expense Limitation Agreement, that happen to be published in order to meet state and federal needs.

Should you be previously informed about US Legal Forms internet site and get your account, simply log in. Afterward, you can acquire the Hawaii Expense Limitation Agreement template.

Should you not provide an accounts and would like to start using US Legal Forms, adopt these measures:

- Find the develop you need and make sure it is for the appropriate area/region.

- Utilize the Review switch to examine the shape.

- Read the information to ensure that you have selected the appropriate develop.

- In case the develop is not what you are seeking, use the Search discipline to obtain the develop that meets your needs and needs.

- When you find the appropriate develop, just click Purchase now.

- Opt for the pricing plan you would like, submit the specified information and facts to produce your account, and pay money for the transaction with your PayPal or credit card.

- Select a practical paper structure and acquire your copy.

Get all of the document web templates you have purchased in the My Forms food list. You can obtain a more copy of Hawaii Expense Limitation Agreement whenever, if possible. Just click the required develop to acquire or print out the document template.

Use US Legal Forms, by far the most considerable assortment of lawful varieties, in order to save time and steer clear of errors. The support gives professionally made lawful document web templates which can be used for an array of functions. Generate your account on US Legal Forms and start producing your way of life easier.

Form popularity

FAQ

Use Form N-139 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). If the new workplace is outside the United States or its possessions, you must be a U.S. citizen or resident alien to deduct your expenses.

15.3% In Honolulu, Hawaii, self-employed business owners pay a self-employment tax rate of 15.3%. This is, of course, separate from, and additional to, whatever they pay in income tax. Self Employment Tax in Honolulu, Hawaii - Tax Lawyers - LegalMatch legalmatch.com ? Honolulu ? self-em... legalmatch.com ? Honolulu ? self-em...

11, Rev. 2022, Individual Income Tax Return (Resident)

Taxpayers whose annual estimated tax liability is greater than $4,000 MUST file returns on Hawaii Tax Online (HTO) at . Mandatory Electronic Filing - Hawaii Department of Taxation hawaii.gov ? geninfo ? efile-mandate hawaii.gov ? geninfo ? efile-mandate

There is a 15-year statute of limitations on tax collection in Hawaii. That means that once the tax is assessed, the state only has 15 years to collect it. However, in practice, the state can take longer to collect some tax debts.

Form N-15 (nonresident or part-year resident) requires attachment of completed federal return. Nonresident is taxed on Hawaii source income only and may exclude most intangible income. Hawaii source deductions are allowed in full; other deductions are prorated. Personal exemption(s) is/are prorated.

Several forms are on NCR paper and must be obtained from the tax office. If you need any forms which are not on this list, please call our Taxpayer Services Forms Request Line at 808-587-4242 or 1-800-222-3229. Viewing and printing forms and instructions, requires Adobe Reader. Hawaii Tax Forms by Category | Department of Taxation hawaii.gov ? forms ? a1_2taxforms hawaii.gov ? forms ? a1_2taxforms

Form 1040 Schedule 1 is used to report certain types of income that aren't listed on the main 1040 form. It's also used to claim some tax deductions. What is IRS Form 1040 Schedule 1? - TurboTax Tax Tips & Videos - Intuit intuit.com ? tax-tips ? what-is-irs-form-1... intuit.com ? tax-tips ? what-is-irs-form-1...