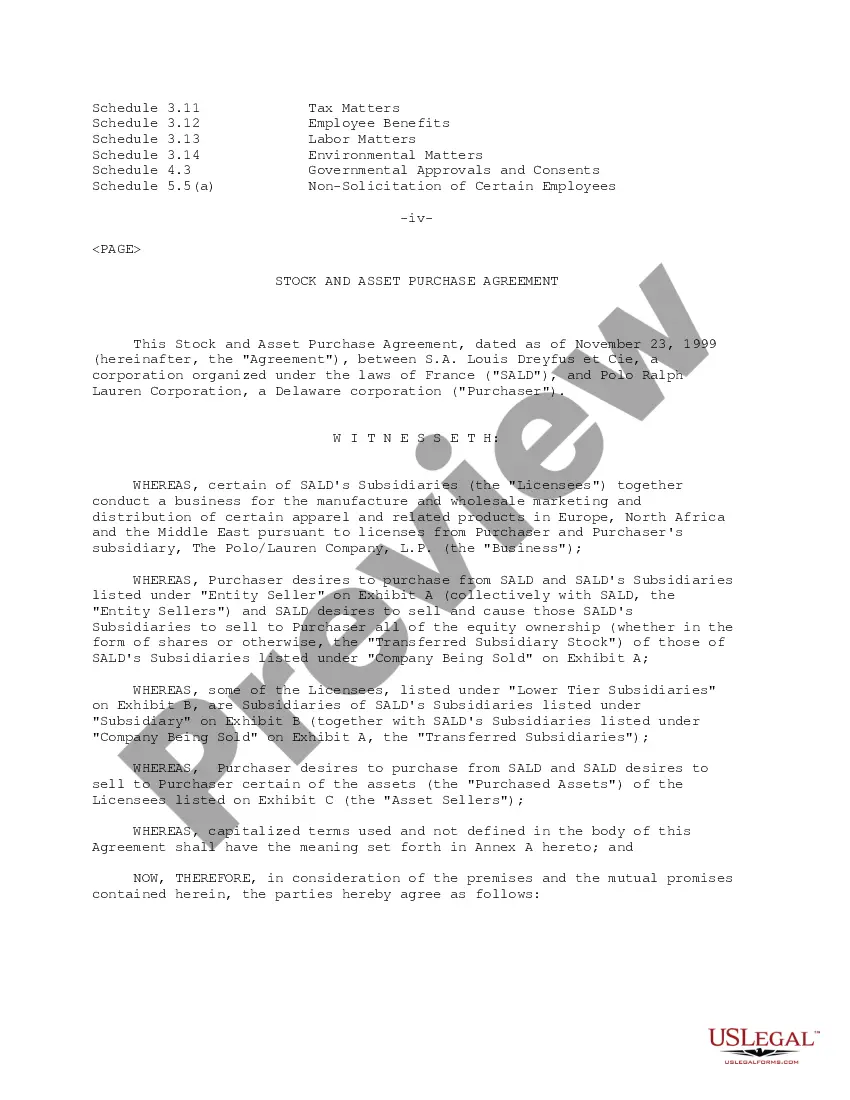

Hawaii Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation

Description

How to fill out Sample Stock Purchase Agreement Between S.A. Louis Dreyfus Et CIE And Polo Ralph Lauren Corporation?

You are able to spend time on the Internet attempting to find the legitimate papers design that meets the federal and state demands you want. US Legal Forms supplies 1000s of legitimate forms that happen to be evaluated by specialists. You can actually acquire or print the Hawaii Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation from the support.

If you have a US Legal Forms bank account, you may log in and then click the Obtain switch. Afterward, you may full, edit, print, or signal the Hawaii Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation. Each and every legitimate papers design you acquire is your own eternally. To acquire another copy of any purchased kind, visit the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms web site initially, keep to the straightforward recommendations listed below:

- Initial, make certain you have chosen the proper papers design for your region/town of your choice. Read the kind explanation to make sure you have picked the correct kind. If readily available, make use of the Preview switch to appear from the papers design as well.

- In order to discover another version of your kind, make use of the Search industry to find the design that meets your needs and demands.

- Once you have located the design you want, just click Purchase now to move forward.

- Find the prices prepare you want, enter your qualifications, and register for a free account on US Legal Forms.

- Complete the deal. You can utilize your charge card or PayPal bank account to purchase the legitimate kind.

- Find the file format of your papers and acquire it for your device.

- Make alterations for your papers if possible. You are able to full, edit and signal and print Hawaii Sample Stock Purchase Agreement between S.A. Louis Dreyfus Et CIE and Polo Ralph Lauren Corporation.

Obtain and print 1000s of papers themes utilizing the US Legal Forms site, which provides the most important variety of legitimate forms. Use specialist and express-particular themes to deal with your organization or person requirements.

Form popularity

FAQ

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

Some of the key items that are listed in a stock purchase agreement are: Name of the company whose shares are being bought and sold; Name of the buyer and seller of shares; The number of shares being sold and the par value of those shares; The date and place of the transaction;

How to draft a purchase agreement Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

This might include provisions for price and payment, conditions precedent to sale, completion arrangements, warranties, restraints and miscellaneous provisions (such as indemnity clauses, tax provisions or confidentiality agreements).

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.