Hawaii Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement

Description

How to fill out Approval Of Transfer Of Outstanding Stock With Copy Of Liquidating Trust Agreement?

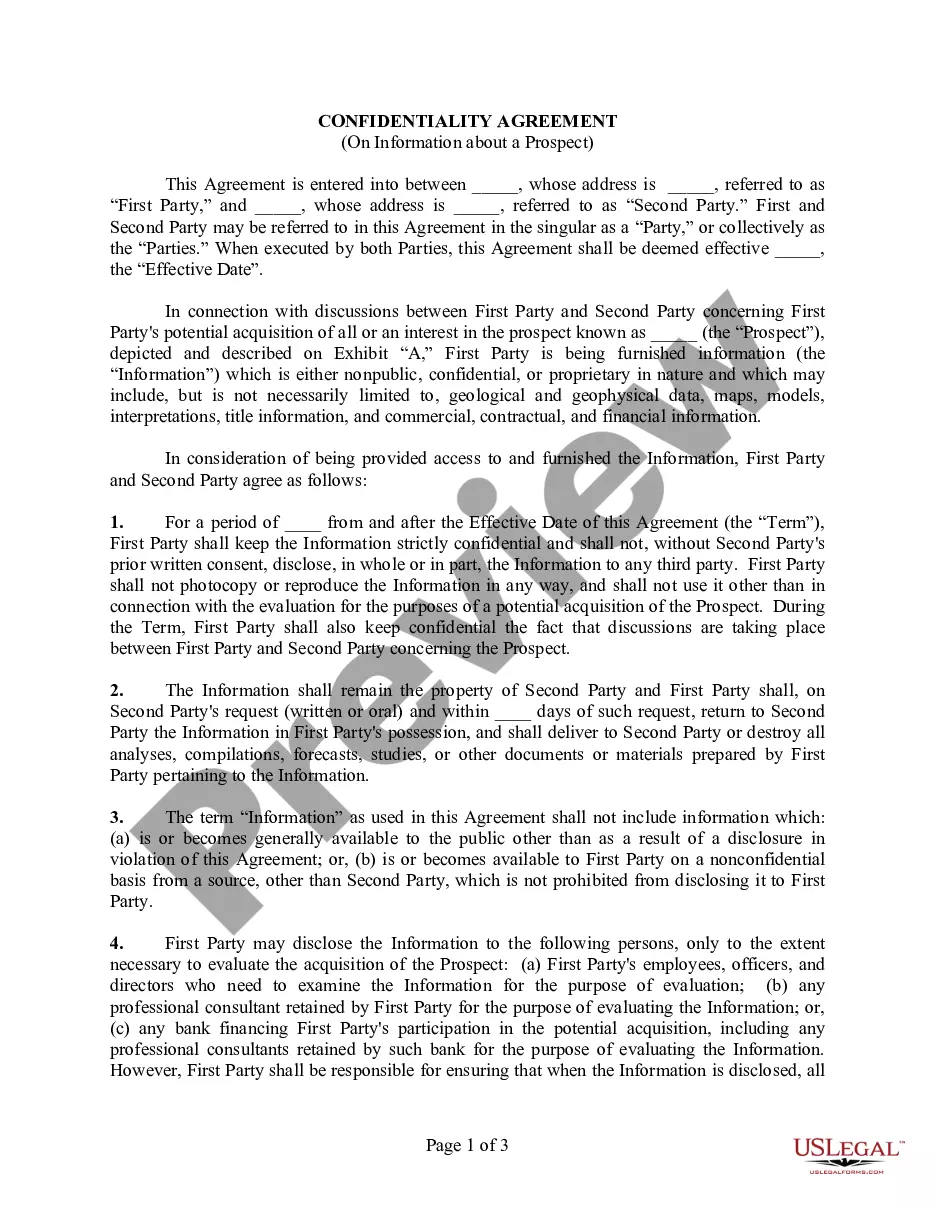

Have you been inside a placement where you need paperwork for both enterprise or person uses almost every time? There are a lot of lawful document templates accessible on the Internet, but discovering versions you can trust isn`t simple. US Legal Forms provides thousands of form templates, much like the Hawaii Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement, which can be composed to meet state and federal specifications.

If you are presently familiar with US Legal Forms internet site and have a free account, basically log in. After that, you are able to acquire the Hawaii Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement format.

If you do not provide an accounts and want to begin using US Legal Forms, follow these steps:

- Get the form you will need and ensure it is to the appropriate city/region.

- Make use of the Review key to analyze the shape.

- Look at the outline to ensure that you have selected the correct form.

- In the event the form isn`t what you are searching for, make use of the Lookup industry to obtain the form that suits you and specifications.

- If you obtain the appropriate form, simply click Purchase now.

- Opt for the rates strategy you desire, fill out the specified information and facts to make your money, and pay for your order with your PayPal or charge card.

- Pick a handy paper file format and acquire your copy.

Find all the document templates you have bought in the My Forms menu. You may get a extra copy of Hawaii Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement anytime, if possible. Just click on the necessary form to acquire or print out the document format.

Use US Legal Forms, by far the most extensive assortment of lawful kinds, to save time as well as stay away from faults. The support provides expertly created lawful document templates that can be used for an array of uses. Create a free account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

Yes, as a trustee, you can transfer stock from a trust to a beneficiary without selling it if the terms of the trust allow you to do so. If the trust instrument allows for the transfer of stock to a beneficiary, the trustee can transfer the stock as directed by the trust agreement. Can You Sell Stock In a Trust After Death? - RMO LLP rmolawyers.com ? can-you-sell-stock-in-a-trust-af... rmolawyers.com ? can-you-sell-stock-in-a-trust-af...

Liquidating trusts are commonly used to help shorten and conclude Chapter 11 cases by saving litigation for after plan confirmation. This can help save time and resources so the debtor can focus on conducting a sale or reorganization rather than being mired in creditor disputes while trying to do so.

An organization will be considered a liquidating trust if it is organized for the primary purpose of liquidating and distributing the assets transferred to it, and if its activities are all reasonably necessary to, and consistent with, the accomplishment of that purpose. Liquidating Trusts as Grantor Trusts cobar.org ? Sections ? Tax ? Newsletter ? Li... cobar.org ? Sections ? Tax ? Newsletter ? Li...

Liquidating trusts are funded with assets held for the benefit of creditors who may have a claim against the debtor. These trusts can exist from several months to several years, depending on how long it takes to liquidate the assets and work through various claims and settlements.