Hawaii Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock

Description

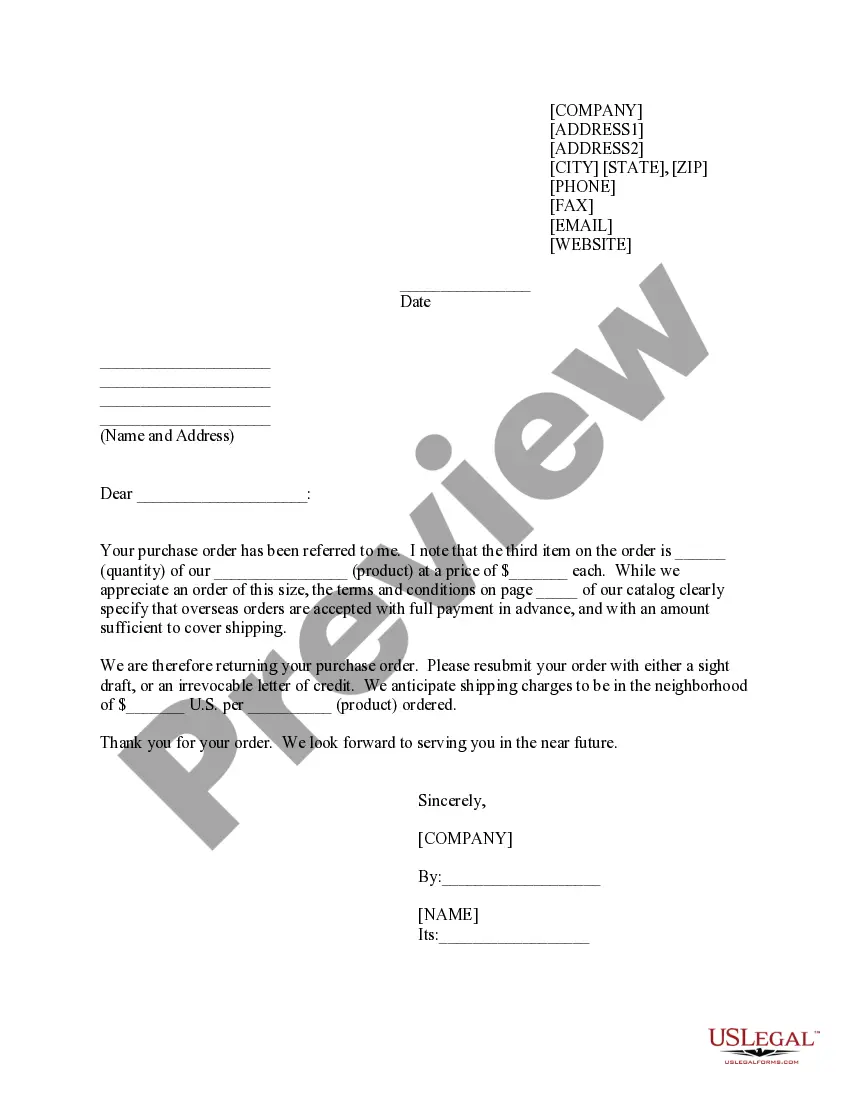

How to fill out Notice And Proxy Statement To Effect A 2-for-1 Split Of Outstanding Common Stock?

You are able to commit time on-line searching for the legal file template that fits the federal and state needs you will need. US Legal Forms supplies thousands of legal forms that are reviewed by experts. It is possible to obtain or printing the Hawaii Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock from your service.

If you already possess a US Legal Forms bank account, you can log in and click on the Download key. Afterward, you can complete, edit, printing, or sign the Hawaii Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock. Each legal file template you purchase is the one you have permanently. To have an additional duplicate associated with a purchased type, go to the My Forms tab and click on the related key.

If you are using the US Legal Forms web site the very first time, keep to the easy instructions listed below:

- Very first, ensure that you have chosen the correct file template for the state/town of your liking. See the type outline to make sure you have chosen the proper type. If available, make use of the Preview key to search from the file template at the same time.

- In order to locate an additional variation in the type, make use of the Lookup field to obtain the template that suits you and needs.

- Once you have identified the template you need, click Acquire now to continue.

- Select the rates prepare you need, enter your qualifications, and sign up for your account on US Legal Forms.

- Total the deal. You should use your Visa or Mastercard or PayPal bank account to cover the legal type.

- Select the formatting in the file and obtain it to the gadget.

- Make alterations to the file if required. You are able to complete, edit and sign and printing Hawaii Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock.

Download and printing thousands of file layouts using the US Legal Forms Internet site, which offers the most important collection of legal forms. Use specialist and express-distinct layouts to tackle your company or person demands.

Form popularity

FAQ

Proxy statements must disclose the company's voting procedure, nominated candidates for its board of directors, and compensation of directors and executives.

Proxy statements are documents that the Securities and Exchange Commission requires companies to give to shareholders so they can weigh in on important company issues. Proxy statements offer shareholders information about changes on the board and other important decisions the board needs to make.

A proxy statement generally includes the names and short biographies of individuals on a company's board of directors, including those who are running for reelection and new candidates chosen by the board's nominating committee.

In business, a proxy allows shareholders to participate in corporate governance even if they cannot be physically present at the general meeting. Proxies are essential in the global economy, where an individual investor might own shares in many companies around the world. U.S. Securities and Exchange Commission.

Proxy statements describe matters up for shareholder vote, and include management and executive compensation information if the shareholders are voting for the election of directors.

The information required in the proxy statement must include: (1) the identity of the late filer; (2) the number of late filings; (3) the number of transactions not reported on time; and (4) any known failure to file a required form. The solicitation of proxies section is required by Item 4 of Schedule 14A.

The proxy statement is a formal direct communication from a company to its stockholders which: Provides information about the upcoming meeting, including the specific matters to be discussed.

A proxy statement is a document that public companies must provide their shareholders prior to a shareholder meeting. The Securities and Exchange Commission (SEC) requires companies to file their proxy statement in compliance with Schedule 14A. Companies file proxy statements on a Form DEF 14A.