Hawaii Results of voting for directors at three previous stockholders meetings

Description

How to fill out Results Of Voting For Directors At Three Previous Stockholders Meetings?

Have you been in the place in which you will need papers for possibly company or specific purposes nearly every working day? There are tons of lawful papers web templates available on the net, but getting ones you can rely is not straightforward. US Legal Forms delivers 1000s of form web templates, such as the Hawaii Results of voting for directors at three previous stockholders meetings, that happen to be published in order to meet federal and state demands.

If you are previously informed about US Legal Forms website and possess your account, simply log in. Following that, you are able to acquire the Hawaii Results of voting for directors at three previous stockholders meetings design.

Unless you offer an account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the form you need and make sure it is for the proper city/area.

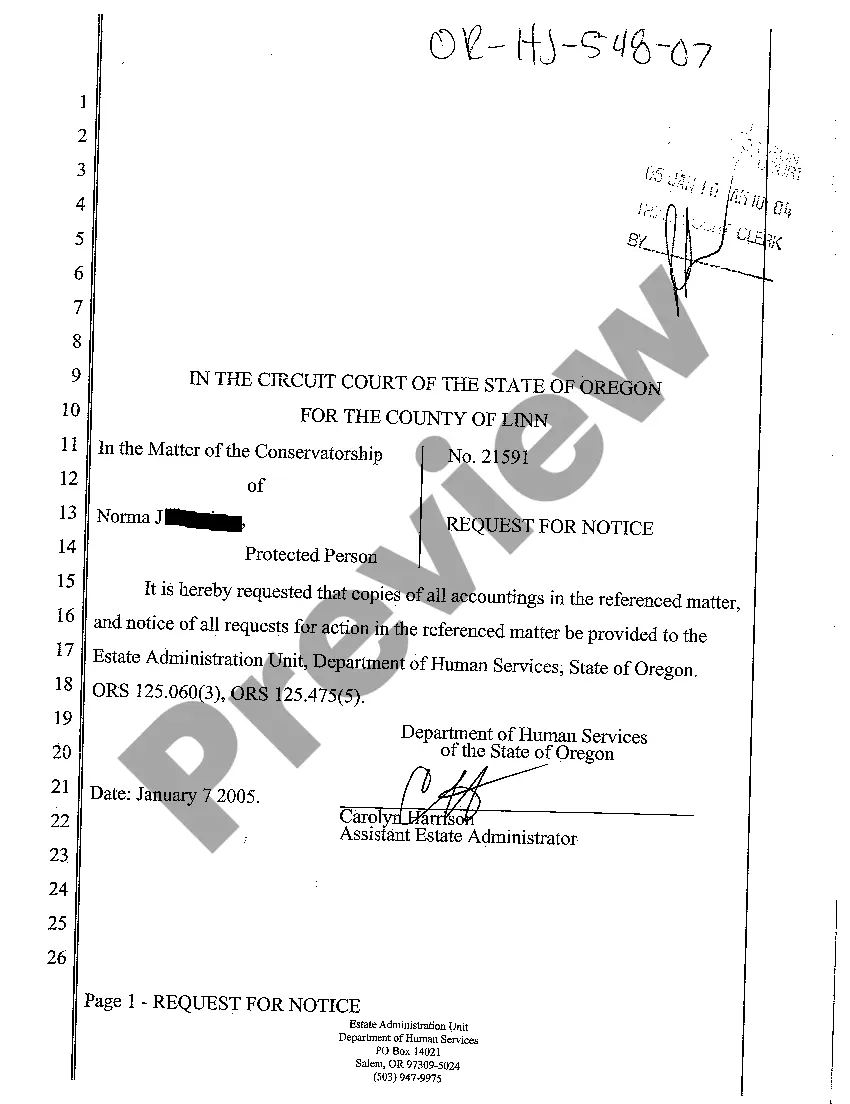

- Utilize the Review button to check the shape.

- See the explanation to ensure that you have chosen the appropriate form.

- When the form is not what you`re trying to find, utilize the Search discipline to find the form that suits you and demands.

- When you find the proper form, click on Purchase now.

- Opt for the costs prepare you desire, fill in the specified information to make your bank account, and pay for an order making use of your PayPal or charge card.

- Select a handy file structure and acquire your copy.

Locate all of the papers web templates you might have purchased in the My Forms food selection. You may get a further copy of Hawaii Results of voting for directors at three previous stockholders meetings any time, if necessary. Just select the necessary form to acquire or print the papers design.

Use US Legal Forms, by far the most considerable variety of lawful varieties, to save lots of efforts and stay away from mistakes. The service delivers expertly produced lawful papers web templates that you can use for a selection of purposes. Generate your account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

In the context of electing a director, each share is usually entitled to one vote per director seat. For example, if a shareholder owned 100 shares and three directors were up for election, the shareholder can cast up to 100 votes per director for a total of 300 votes.

Shareholders typically vote for the board of directors at the annual meeting of shareholders. In most cases, shareholders can vote in person at the meeting or by proxy, which allows them to appoint someone else to vote on their behalf. Some companies may also allow shareholders to vote by mail or online.

Stockholder voting right allow shareholders of record in a company to vote on certain corporate actions, elect members to the board of directors, and approve issuing new securities or payment of dividends. Shareholders cast votes at a company's annual meeting.

The right to cast another shareholder's vote is called: - cumulative voting.

Common stock shareholders in a publicly-traded company have certain rights pertaining to their equity investment, and among the more important of these is the right to vote on certain corporate matters.

Cumulative voting is a type of voting system that helps strengthen the ability of minority shareholders to elect a director. This method allows shareholders to cast all of their votes for a single nominee for the board of directors when the company has multiple openings on its board.