Hawaii Employee Evaluation Form for Accountant

Description

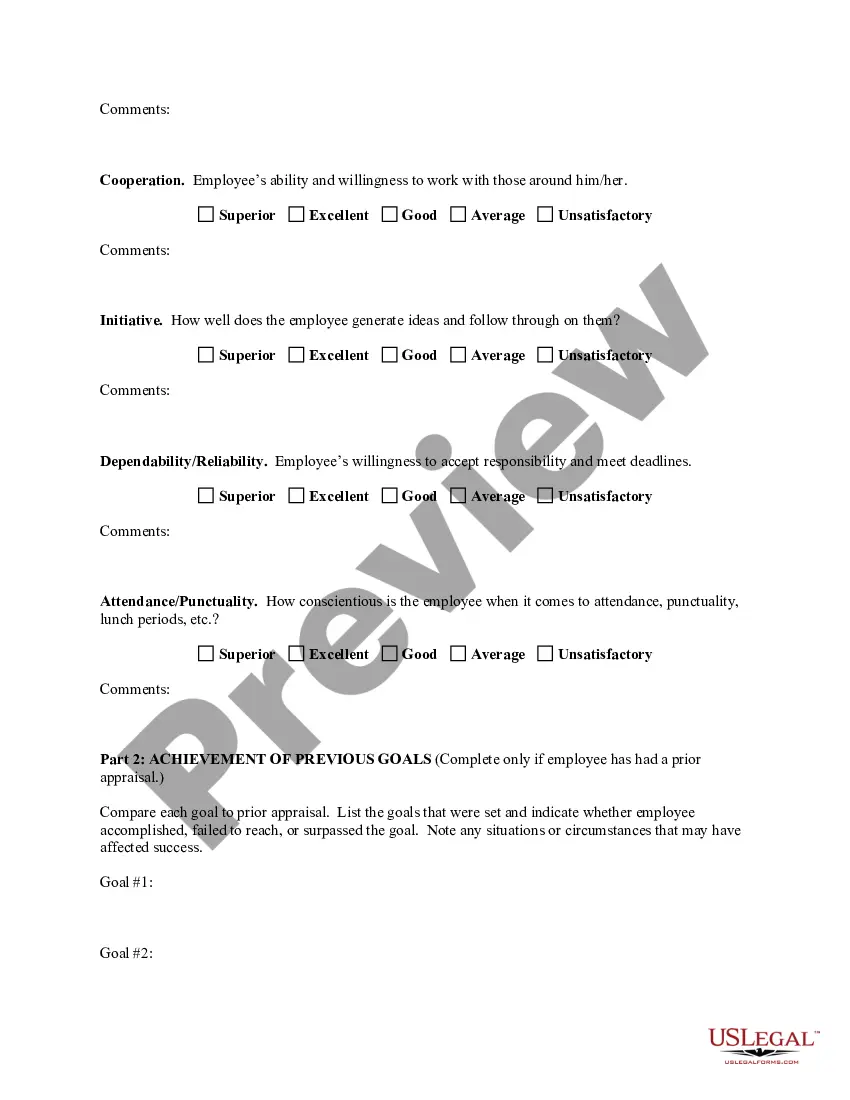

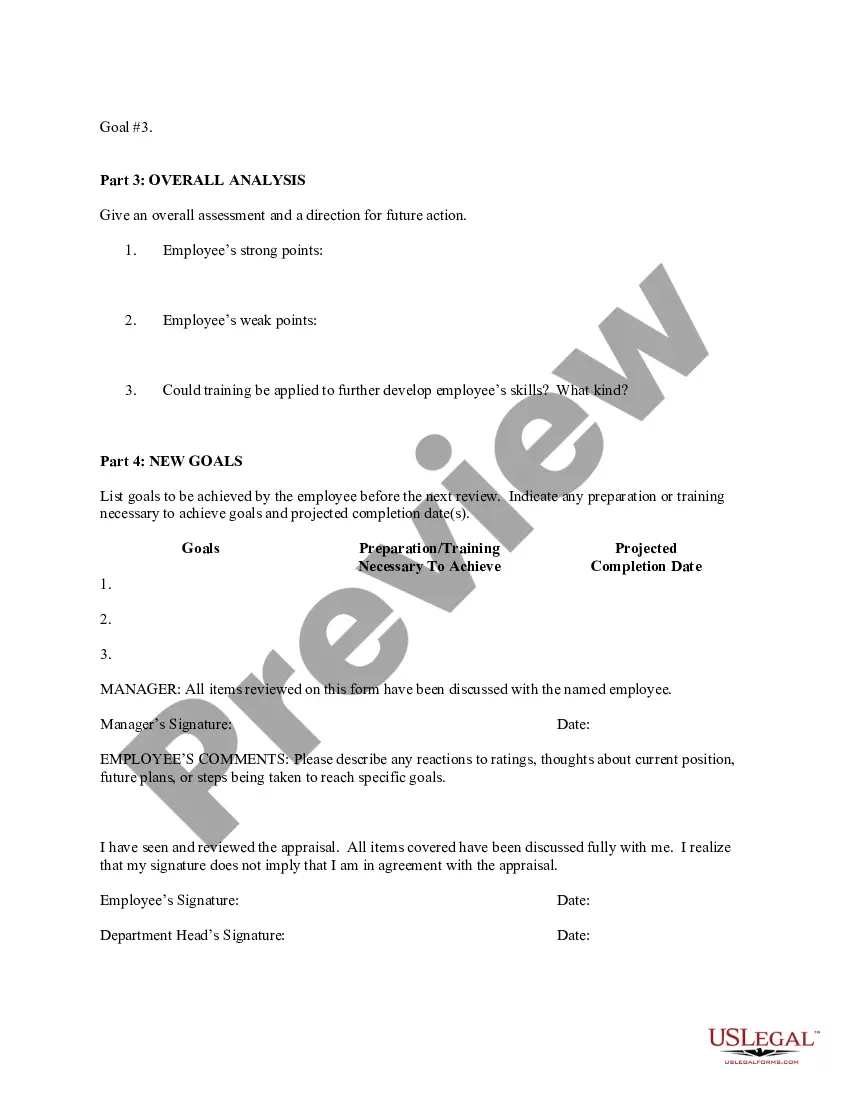

How to fill out Employee Evaluation Form For Accountant?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad assortment of legal template documents available for download or printing.

By utilizing the website, you can locate thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the most current versions of forms such as the Hawaii Employee Evaluation Form for Accountant within moments.

If you currently hold a subscription, Log In and download the Hawaii Employee Evaluation Form for Accountant from the US Legal Forms library. The Download button will appear on every form you view.

If you are happy with the form, confirm your selection by clicking the Acquire now button. Next, choose the payment plan you prefer and provide your details to register for an account.

Process the transaction. Use a credit card or PayPal account to complete the purchase. Select the file format and download the form to your device. Edit. Complete, adjust, print, and sign the downloaded Hawaii Employee Evaluation Form for Accountant. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply visit the My documents section and click on the form you need.

- Access to all previously downloaded forms is available in the My documents section of your account.

- If you intend to use US Legal Forms for the first time, here are simple guidelines to help you get started.

- Ensure that you have selected the correct form for your city/state.

- Click the Preview button to examine the content of the form.

- Review the form's description to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search area at the top of the screen to find the one that does.

Form popularity

FAQ

CPA profession stakeholders in Hawaii achieved a significant victory this year with the Hawaii House of Representatives' passage of a bill to adopt individual CPA mobility.

The answer was simpler in the days when many CPAs mostly just served local clients. Today, technological advances and the ease of travel allow accountants to work at firms operating in multiple states, accept new jobs across the country, and serve clients virtually anywhere.

The CPA would theoretically submit a simple one-page notice form and automatically qualify for practice privileges in another state. A CPA with practice privileges in another state is not considered a licensee and is not required to comply with the CPE requirements of that state.

General RequirementsHawaii requires that all applicants for CPA licensure be citizens of the United States, U.S. nationals, or certified to work in the country. You must also have a Social Security number and be at least 18 years old.

NASBA, the state boards of accountancy and the AICPA have developed a valuable tool to help CPAs and accounting firms understand the implications of Mobility as they enter engagements across state lines.

Check with the CA State Board of Accountancy to ensure your CPA doesn't have outstanding complaints against them (do this when looking for a new CPA firm, as well). Assess Your Situation. Think about whether you need an Enrolled Agent (EA), a CPA or a tax lawyer.

First of all, most state boards allow a CPA license transfer. And, the process is not difficult as long as the person holds a license from a substantially equivalent state. Nowadays, all states that issue a full license following the 3E requirement recommendation are considered substantially equivalent.

The states that currently have firm mobility laws are Alabama, Arizona, Colorado, Delaware, Florida, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Missouri, Montana, New Hampshire, New Jersey, New Mexico, North Dakota, Ohio, Pennsylvania, Rhode Island, Tennessee, Texas, Utah,

According to the US Bureau of Labor Statistics, the state of Hawaii has 4,700 accounting professionals that make an average salary of $66,000. Also, according to the BLS, the need for more accountants is expected to increase by 6% between now and 2029.