Hawaii FCRA Disclosure and Authorization Statement

Description

How to fill out FCRA Disclosure And Authorization Statement?

Are you presently in a position where you require documents for either the organization or specific roles almost every business day.

There are countless legal document templates accessible online, but finding reliable versions isn't straightforward.

US Legal Forms offers thousands of form templates, including the Hawaii FCRA Disclosure and Authorization Statement, which can be completed to meet both federal and state regulations.

You can view all the document templates you have purchased in the My documents section.

You can obtain an additional copy of the Hawaii FCRA Disclosure and Authorization Statement at any time if needed. Just click the appropriate form to download or print the template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Hawaii FCRA Disclosure and Authorization Statement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

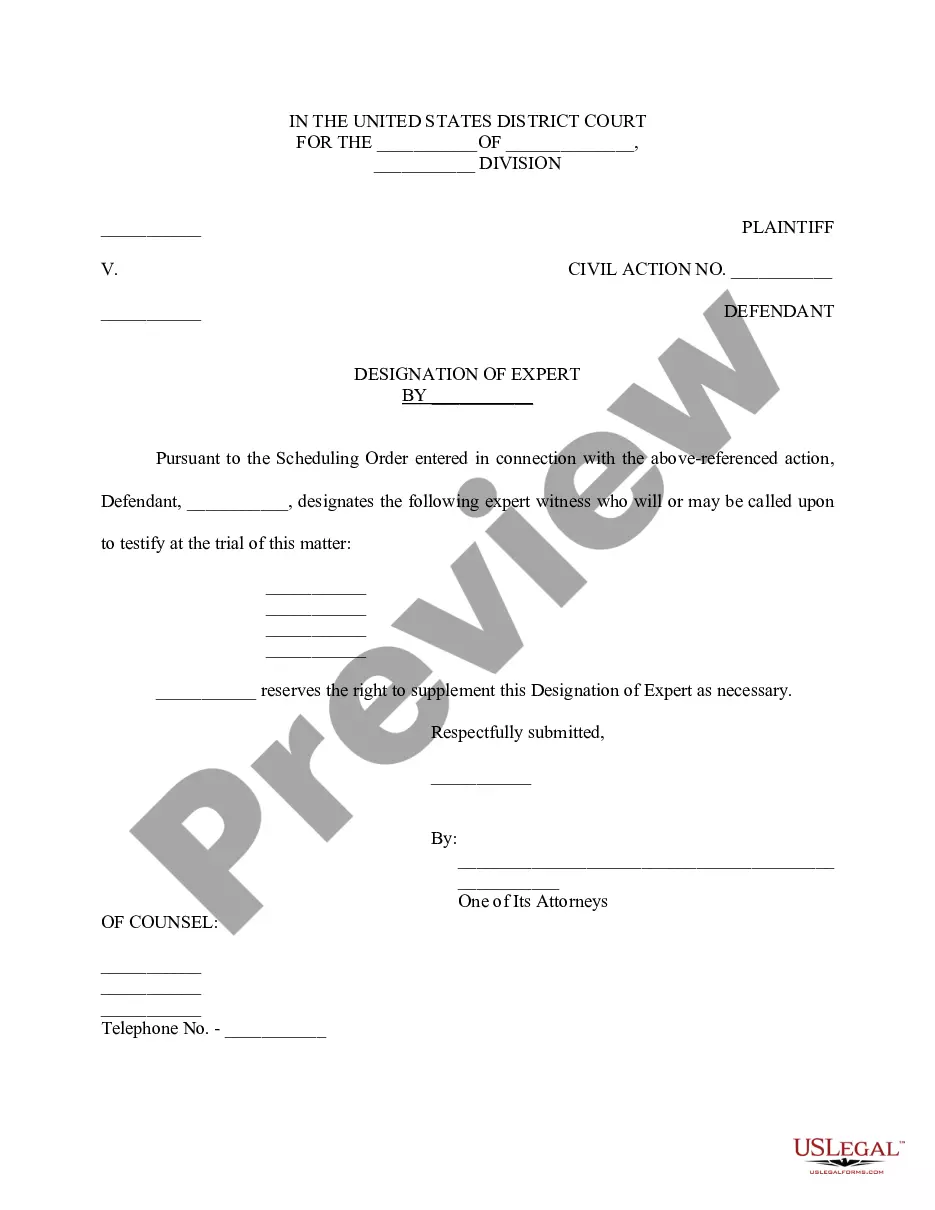

- Use the Preview feature to review the document.

- Check the description to confirm you have selected the right form.

- If the form isn’t what you’re looking for, use the Search box to find the form that suits your needs and specifications.

- Once you find the right form, click Buy now.

- Choose the payment plan you prefer, complete the necessary information to create your account, and process the payment with your PayPal or credit card.

- Pick a convenient document format and download your copy.

Form popularity

FAQ

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies.

Specifically, the FCRA requires that you must provide a clear and conspicuous written notice that consists solely of the disclosure. In other words, the disclosure must be (1) clear and conspicuous; and (2) exist as a standalone document.

S. (a) Every consumer reporting agency shall, upon request and proper identification of any consumer, clearly and accurately disclose to the consumer: (1) The nature and substance of all information (except medical information) in its files on the consumer at the time of the request.

What is FCRA Compliance? FCRA compliance is designed to protect consumers. The FCRA regulates employers that use background reports and the Consumer Reporting Agencies (CRAs) (aka background screening companies) that provide the information.

FCRA Authorization: Obtain Permission for a Background Check A compliant FCRA authorization form is an acknowledgement that a pre-employment background check will be conducted. It can be presented as a self-contained document or jointly with an FCRA disclosure form.

The FCRA requires agencies to remove most negative credit information after seven years and bankruptcies after seven to 10 years, depending on the kind of bankruptcy. Restrictions around who can access your reports.

On July 21, 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Section 1100F of the Dodd-Frank Act amended the FCRA to require disclosure of credit scores and information relating to credit scores for both risk-based pricing and FCRA adverse action notices.

While the Fair Credit Reporting Act (FCRA) requires that a disclosure of rights be provided in a separate document, it may include lines for signature and date, and be part of an application packet, the 9th U.S. Circuit Court of Appeals ruled.

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes. The form of the disclosure must meet very specific criteria set forth in the statute.