Hawaii Sample FCRA Letter to Applicant

Description

How to fill out Sample FCRA Letter To Applicant?

Are you currently in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones isn't simple.

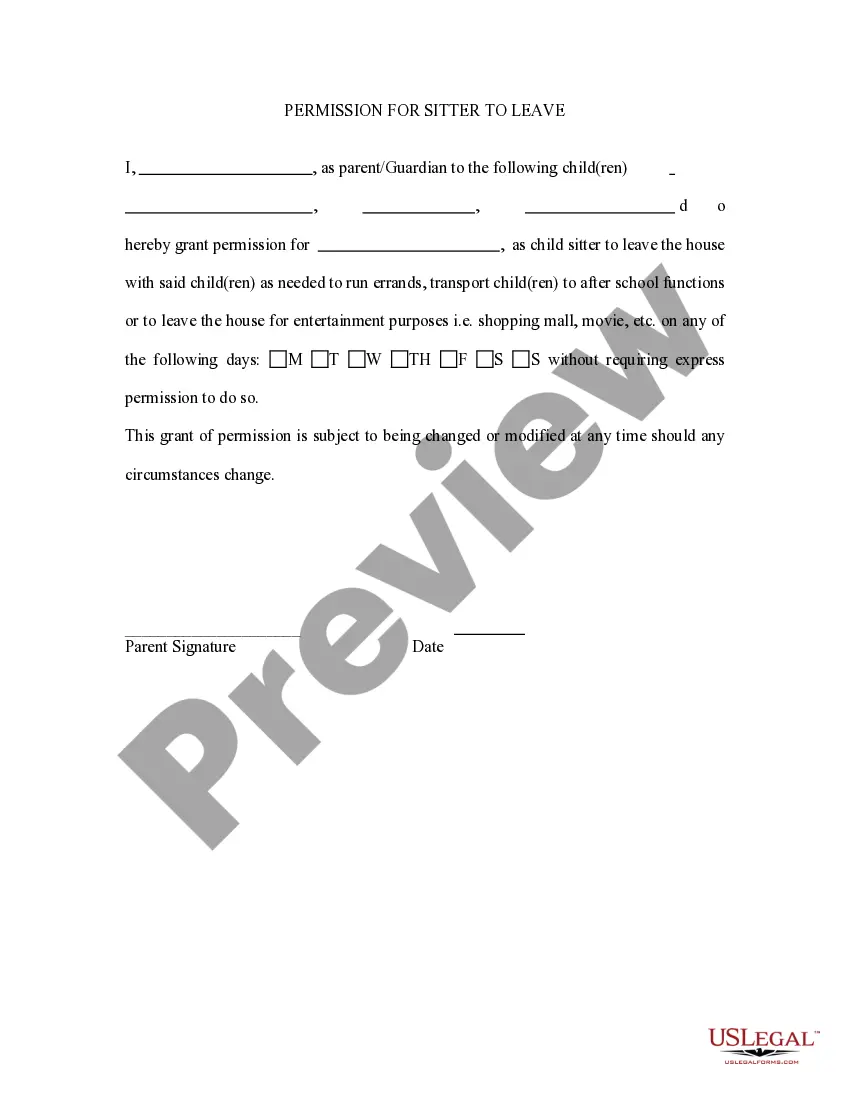

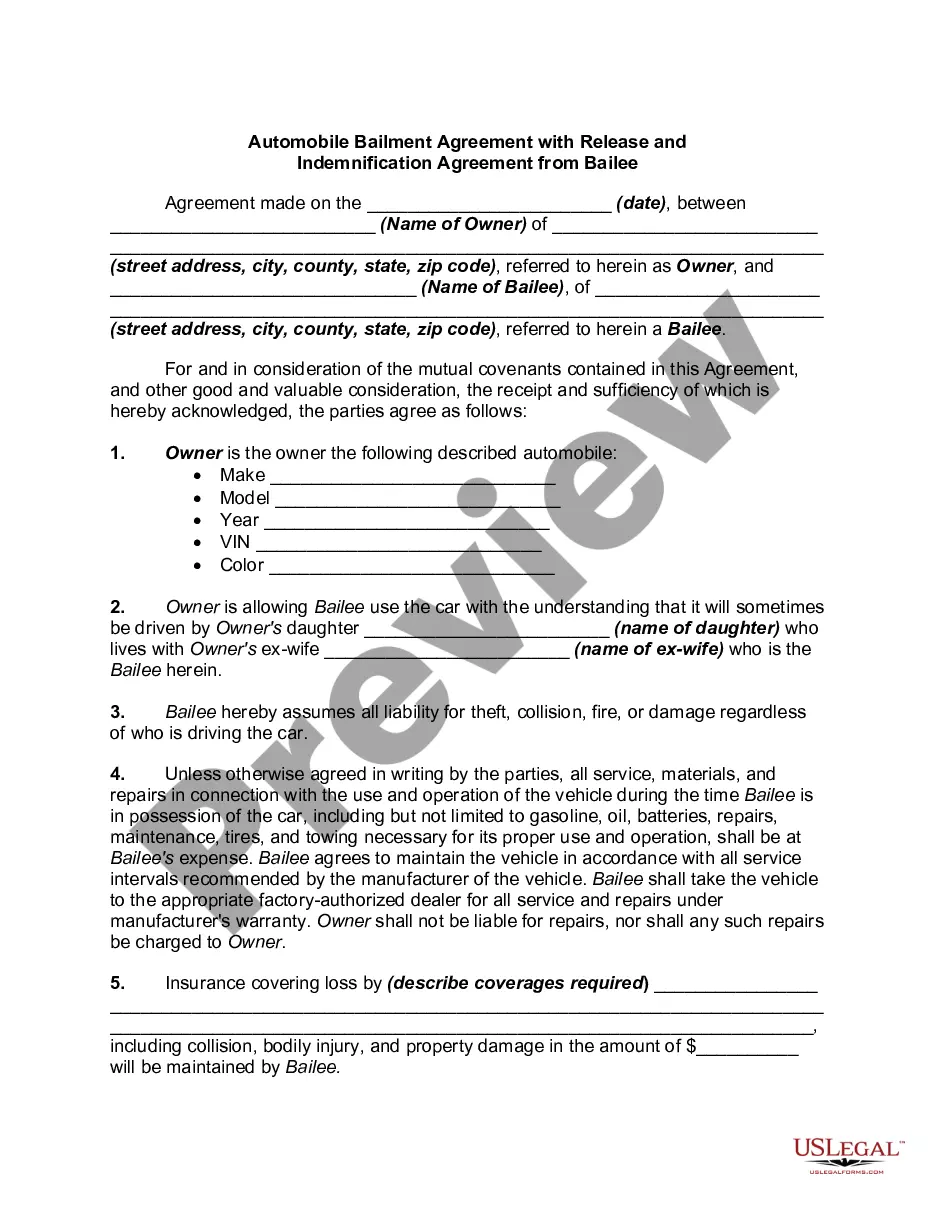

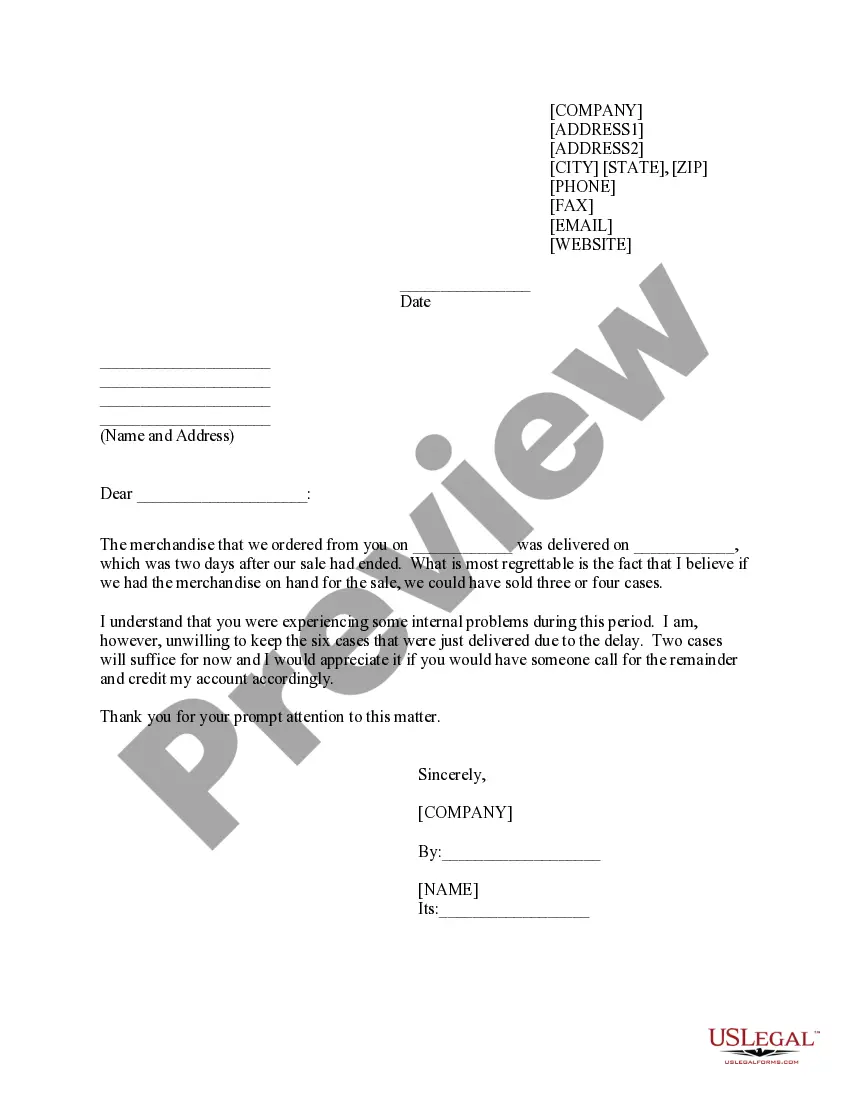

US Legal Forms offers a vast selection of form templates, including the Hawaii Sample FCRA Letter to Applicant, specifically designed to comply with state and federal regulations.

Access all the document templates you have purchased in the My documents section.

You can obtain another copy of the Hawaii Sample FCRA Letter to Applicant at any time if needed. Just choose the necessary form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service offers professionally drafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Sample FCRA Letter to Applicant template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you require and make sure it’s for the correct city/state.

- Utilize the Review option to examine the form.

- Check the description to ensure that you have selected the appropriate form.

- If the form isn’t what you’re looking for, use the Search section to find the form that fits your needs and specifications.

- Once you find the right form, click Purchase now.

- Select the pricing plan you want, fill in the necessary information to create your account, and pay for your order using PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report. Legally Permissible Purposes.

If, after the candidate has issued a response to the pre-adverse action letter and requested necessary corrections to their background check document, you still decide that you will not hire the candidate based on the contents of a background check, you must issue an official adverse action notice, which explains your

As you are aware, the Fair Credit Reporting Act (FCRA) requires providing the consumer with both a pre-adverse and adverse action letter any time a report is used in a hiring decision. The FCRA has no specific requirement to provide these letters via the mail, so the use of email is an acceptable alternative.

Credit Report Adverse Action Letter A post-decision form sent by entities to consumers after deciding to deny/reject them due to their credit score and/or other information found in a consumer credit report.

Before you take adverse action, you will provide the applicant or employee a notice that includes a copy of the background check/consumer report you used to make your decision and provide them with a summary of their rights under the FCRA. This is commonly referred to as a Pre-Adverse Action Notice.

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and. privacy of information in the files of consumer reporting agencies.

The Process of Handling Adverse ActionStep 1: Provide Disclosure and Send a Notice for Pre-Adverse Action.Step 2: The Waiting Period.Step 3: Review the Report Results Again.Step 4: Provide the Notice of Adverse Action.Step 5: Properly Dispose of Sensitive Information.06-May-2020

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application.

The FCRA For Employment Purposes Consumer reports can include a broad range of categories, including driving records, criminal records, credit reports, and other reports from third parties, such as drug tests.