Hawaii Work for Hire Addendum - Self-Employed

Description

How to fill out Work For Hire Addendum - Self-Employed?

You might spend countless hours online attempting to locate the valid document template that meets the federal and state requirements you are seeking.

US Legal Forms offers a vast collection of valid templates reviewed by experts.

You can download or print the Hawaii Work for Hire Addendum - Self-Employed from our service.

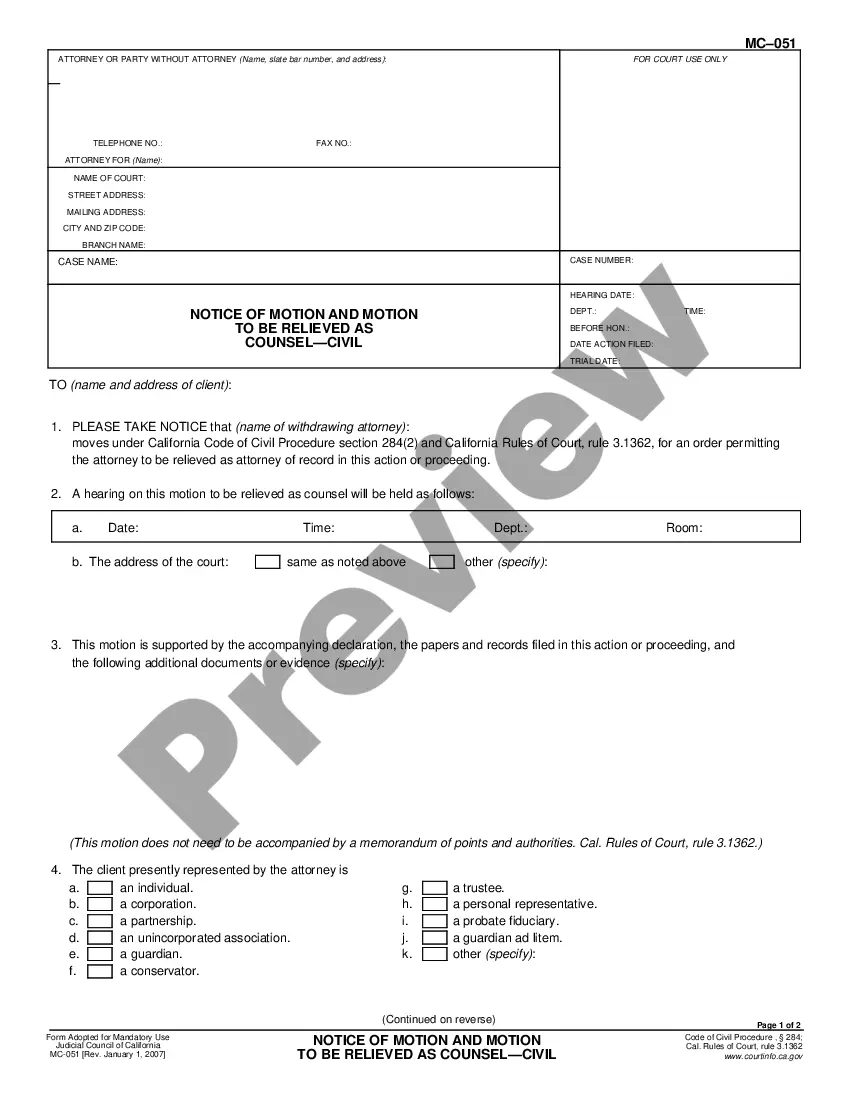

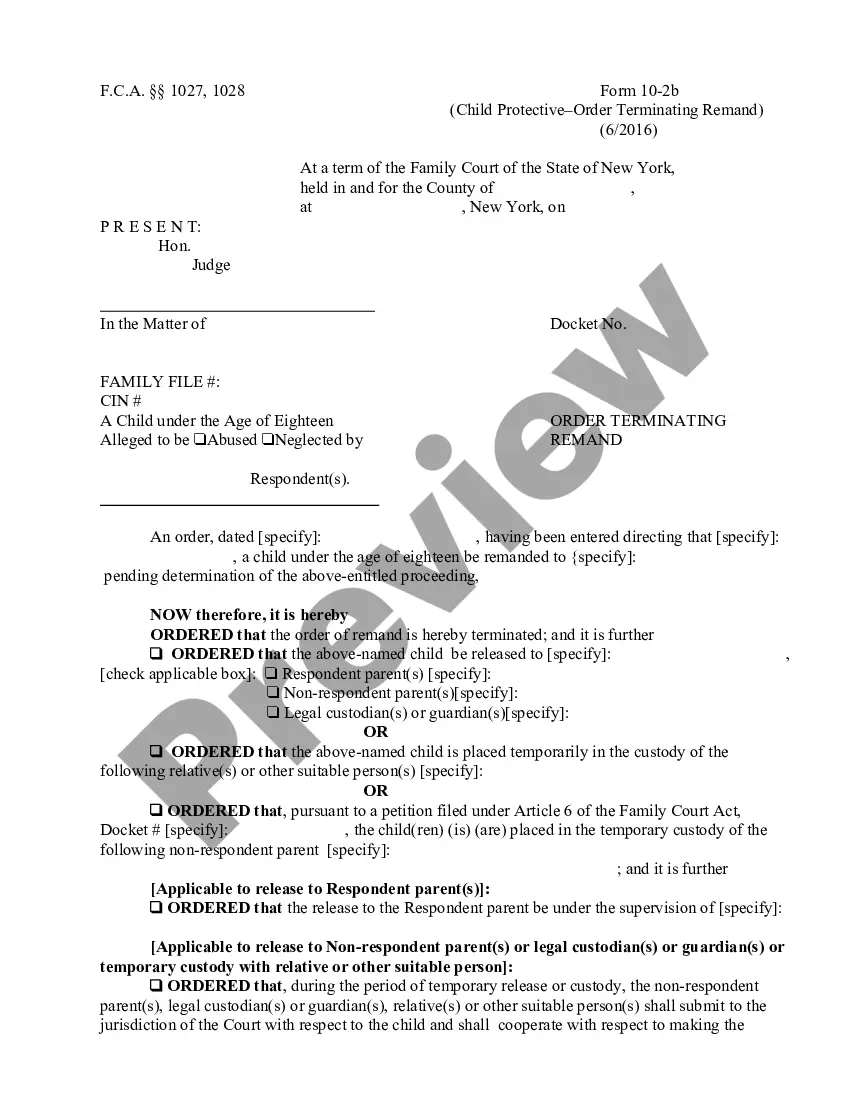

If available, utilize the Preview button to review the document template as well. In order to locate another version of your form, use the Search field to find the template that suits your needs and criteria.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can fill out, modify, print, or sign the Hawaii Work for Hire Addendum - Self-Employed.

- Every valid document template you purchase belongs to you for a long duration.

- To acquire another copy of any obtained form, head to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your area/town of choice.

- Check the form description to make certain you have chosen the right form.

Form popularity

FAQ

The form includes the amount of benefits paid and other information to meet Federal, State, and personal income tax needs for the tax year. The 1099-G information will be available for viewing on or about January 19, 2021 at: .

Employers must complete Form UC-B6, Employer's Quarterly Wage, Contribution and Employment and Training Assessment Report and pay all contributions and assessments by end of the month after the end of the calendar quarter.

Yes, any unemployment compensation received during the year must be reported on your federal tax return.

Businesses that have run payroll in Hawaii in the past can find their Tax ID on notices received from the Hawaii Department of Taxation, such as the Withholding Tax Return (Form HW-14), or by calling the agency at (800) 222-3229. The Hawaii Withholding ID number format is WH-000-000-0000-01 (or -02).

Hawaii Tax ID's that were issued prior to the modernization project begin with the letter "W" and are followed by 10 digits. (Example: W99999999-01.) Hawaii SalesTax ID's that are issued after the modernization project begin with the letters "GE" and are followed by 12 digits. (Example: GE-999-999-9999-01.)

You may be eligible for PUA if you are self-employed, do not have sufficient work history to qualify for regular UI, or have exhausted your rights to regular UI benefits or extended benefits. The individual has quit their job as a direct result of COVID-19.

How do I get a withholding (WH) account number? Use Form BB-1 to request a withholding (WH) account number. You may also add a withholding account on Hawaii Tax Online if you already have a login.

The UI number is assigned only after confirmation of the existence of taxable payroll in Hawaii. To obtain a determination on your unemployment insurance liability and to find out if you will be issued a UI number, go to .

UC-B6, Quarterly Wage, Contribution and Employment and Training Assessment Report Hawaii employers are required to fb01le quarterly unemployment insurance tax reports on the new and interactive Employer Website at: .

If you have employees, you generally need to apply for a State Withholding Number. This number is entered on state employment tax forms used to report state income taxes withheld from employee's pay. Some states, like Nevada, don't impose an income tax on individuals.