Hawaii Personal Guaranty - Guarantee of Lease to Corporation

Description

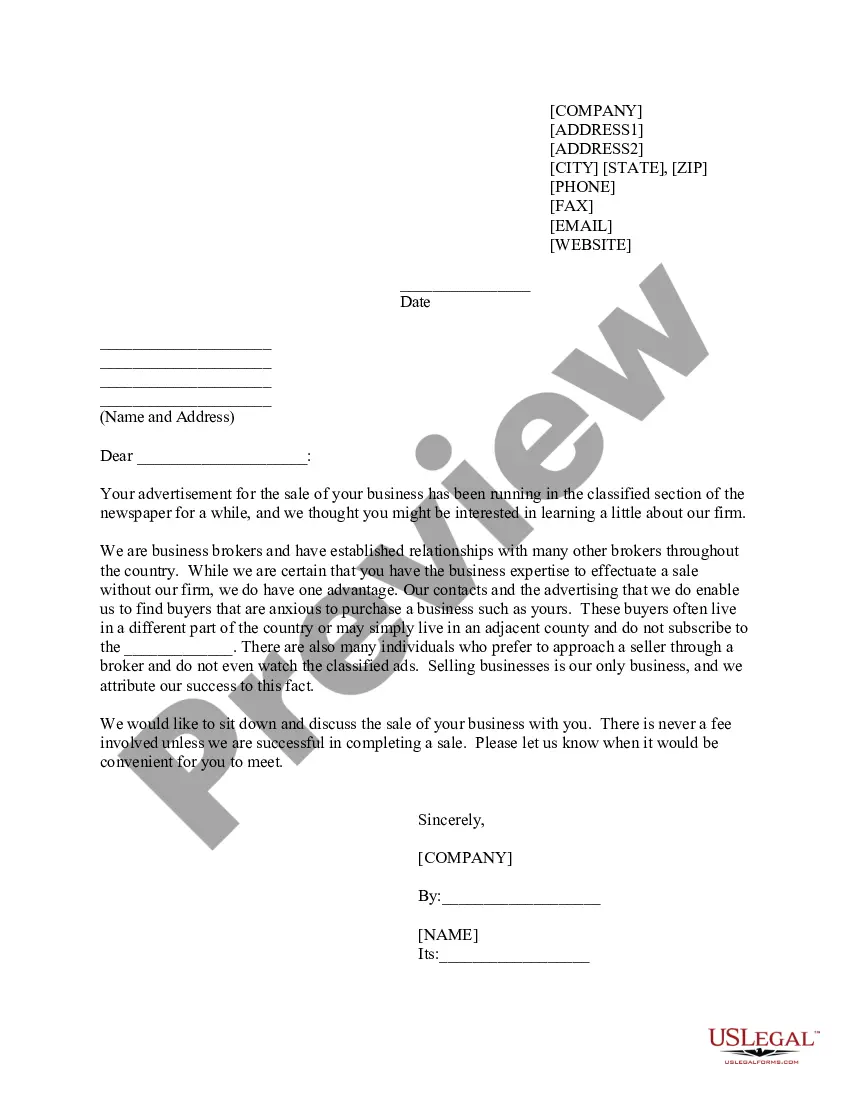

How to fill out Personal Guaranty - Guarantee Of Lease To Corporation?

If you require to complete, retrieve, or create official document formats, utilize US Legal Forms, the largest collection of legal forms that are accessible on the web.

Make the most of the site’s straightforward and user-friendly search feature to find the documents you need.

A range of templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. After locating the form you require, select the Purchase now option. Choose your preferred payment plan and enter your details to register for an account.

Step 5. Process the order. You can use your Visa, MasterCard, or PayPal account to complete the transaction.

- Utilize US Legal Forms to acquire the Hawaii Personal Guaranty - Guarantee of Lease to Corporation with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire option to get the Hawaii Personal Guaranty - Guarantee of Lease to Corporation.

- You can also view forms you previously saved under the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document format.

Form popularity

FAQ

The difference between corporate and personal guarantors is quite simple: a personal guarantor is an individual who agrees to take on the obligations of a debt for a debtor, whereas a corporate guarantor is a corporation that takes on payment responsibilities.

In writing The guarantee must be evidenced in writing to be enforceable. Signed The document must be signed by the guarantor or their authorised agent. Their name can be written or printed. Secondary liability The document must establish that the guarantor has secondary liability for the debt.

A personal guaranty is not enforceable without consideration A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party. Here, the bank gives a loan (the consideration) in exchange for the guarantor's promise to repay it.

A corporate guaranty is one usually signed by a parent or more developed affiliated company. It is a comfort to a landlord to have an extra set of assets to go after should its tenant default.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

A corporate guarantee is an agreement in which one party, called the guarantor, takes on the payments or responsibilities of a debt if the debtor defaults on the loan.

When you sign an unlimited personal guarantee, you are agreeing to allow the lender to recover 100% of the loan amount in question, plus any legal fees associated with the loan through whatever means they have to.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

A personal guarantee is an agreement that allows a lender to go after your personal assets if your company, relative, or friend defaults on a loan. For instance, if your business goes under, the creditor can sue you to collect any outstanding balance.

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.