Hawaii Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

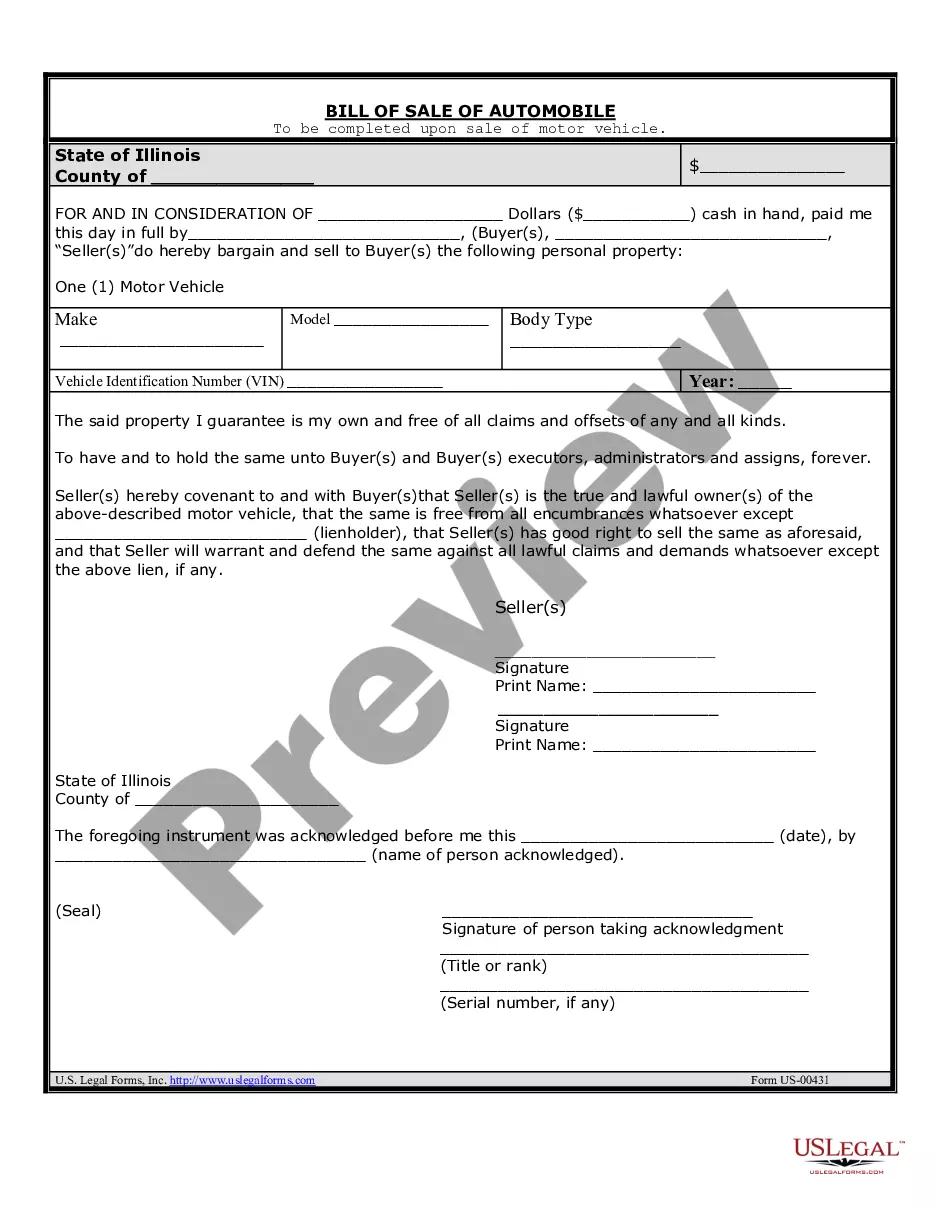

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal document templates that you can download or print.

Utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can swiftly obtain the latest forms such as the Hawaii Bill of Sale of Personal Property - Reservation of Life Estate in Seller.

Check the form description to confirm you have chosen the right document.

If the form does not suit your preferences, utilize the Search field at the top of the screen to find one that does.

- If you have an account, sign in to download the Hawaii Bill of Sale of Personal Property - Reservation of Life Estate in Seller from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously acquired forms in the My documents section of your account.

- To begin using US Legal Forms, follow these simple steps.

- Ensure you have selected the correct form for your area/region.

- Click the Review button to examine the form's details.

Form popularity

FAQ

Non-residents planning to engage in transactions involving property in Hawaii must file certain documents, including the Hawaii Bill of Sale of Personal Property - Reservation of Life Estate in Seller. This document helps clarify ownership and rights concerning personal property. Additionally, non-residents may also need to file tax forms depending on the nature of the transaction. Consulting with a professional or utilizing uslegalforms can streamline the process.

What are the pros and cons of life estates?Possible tax breaks for the life tenant.Reduced capital gains taxes for remainderman after death of life tenant.Capital gains taxes for remainderman if property sold while life tenant still alive.Remainderman's financial problems can affect the life tenant.More items...?

Life estates split ownership between the giver and receiver. An irrevocable trust allows an individual to give away part of an asset.

Life estate consThe life tenant cannot change the remainder beneficiary without their consent.If the life tenant applies for any loans, they cannot use the life estate property as collateral.There's no creditor protection for the remainderman.You can't minimize estate tax.More items...

If you have created a life estate and are looking to remove someone from it, you cannot do so without consent from all parties unless you have a clause or document known as a power of appointment. These powers may be written within the deed or attached to it.

A conventional life estate is an estate created by deed or will. It is created by the express act of the grantor. There are two types of conventional life estates depending on the person whose life limits the duration of the estate. They are either for one's own life or during the life of another person.

Key Takeaways. A life estate is a type of joint property ownership. Under a life estate, the owners have the right to use the property for life. Typically, the life estate process is adopted to streamline inheritance while avoiding probate.

A life estate helps avoid the probate process upon the life tenant's death. The property will automatically transfer to the remainderman, making the process simple and easy a will isn't needed for the transfer to happen.