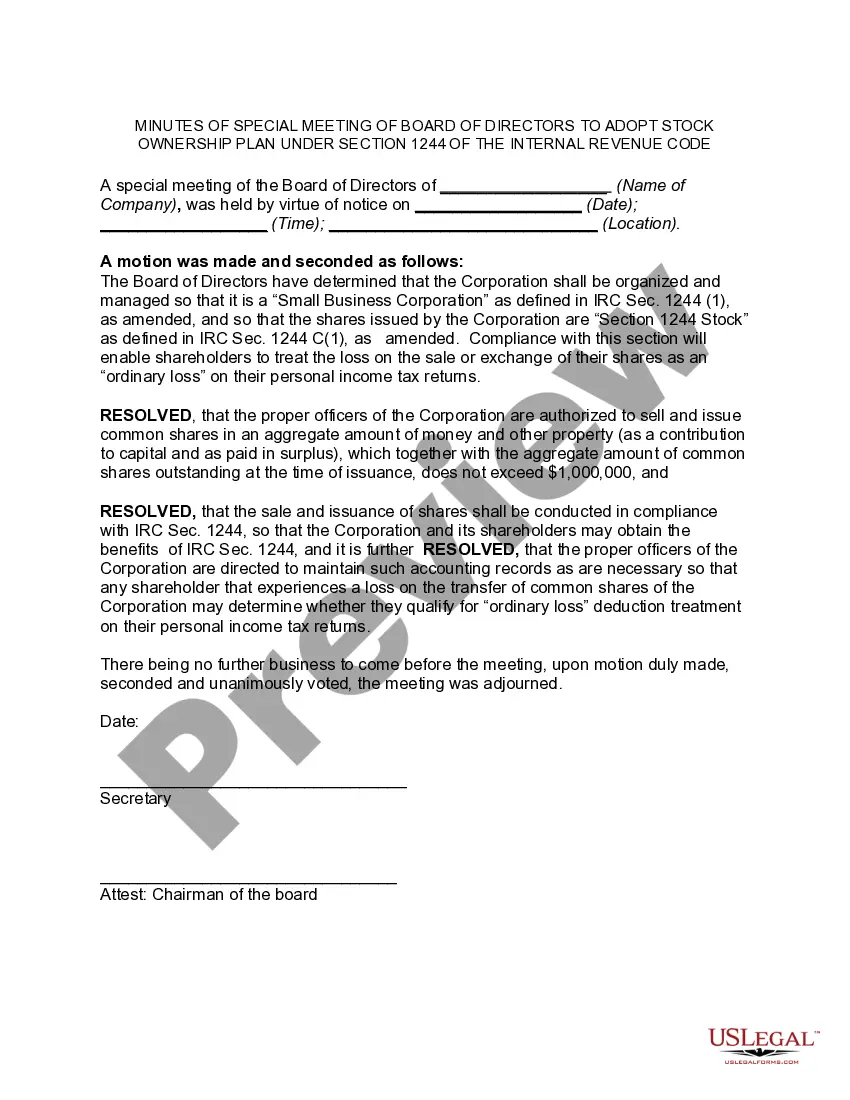

Hawaii Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

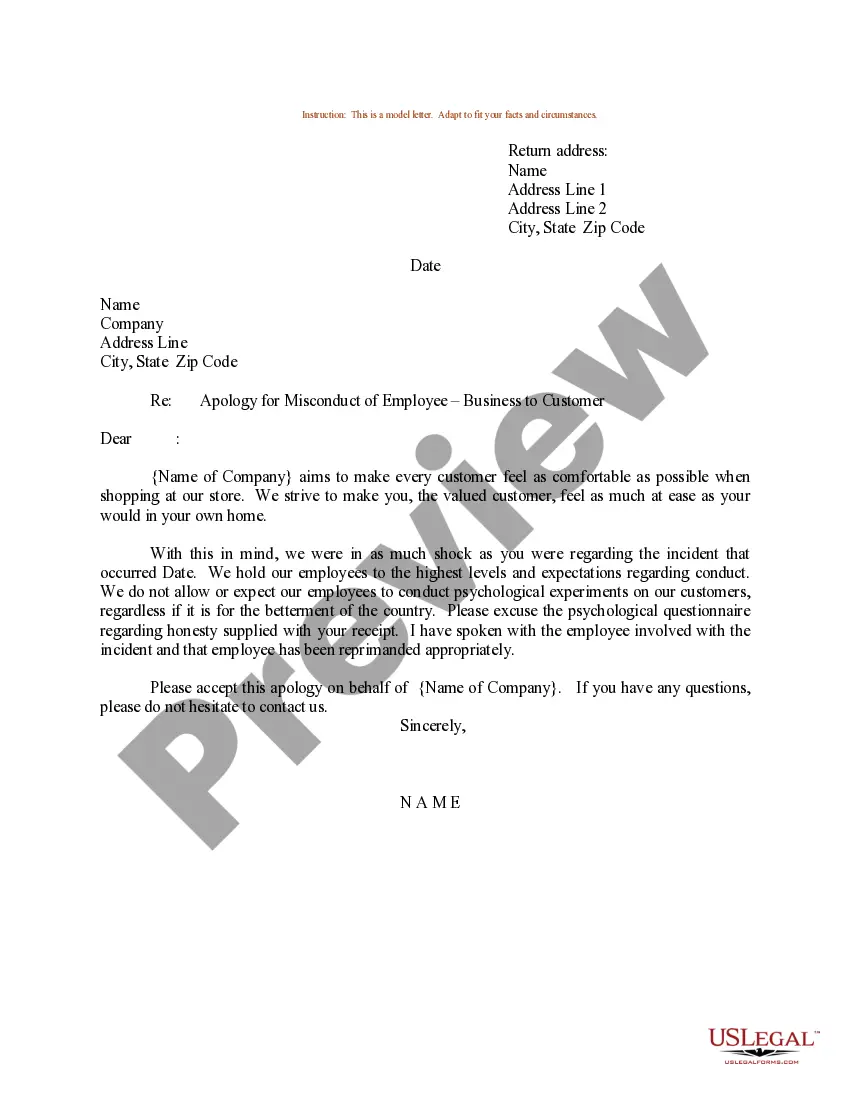

How to fill out Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

It is feasible to allocate time online trying to discover the legal document template that meets the federal and state requirements you will require.

US Legal Forms offers a significant number of legal templates that can be reviewed by professionals.

You can obtain or create the Hawaii Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code with my assistance.

If available, utilize the Preview button to preview the document template. If you wish to find another version of the template, use the Search field to locate the template that meets your needs and requirements.

- If you have a US Legal Forms account, you may Log In and then click the Download button.

- Subsequently, you can complete, modify, create, or sign the Hawaii Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

- Every legal document template you obtain is yours permanently.

- To get an additional copy of any purchased template, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple guidelines below.

- First, ensure you have selected the correct document template for the county/region of your choice.

- Review the template description to confirm you have chosen the appropriate one.

Form popularity

FAQ

Under the current 2020 tax tables, a long-term capital gain that results from the sale of this Section 1244 stock will be taxed at the regular preferential rate of 15% for most individuals or 20% for high-income individuals with taxable income over $441,450. The 3.8% Net Investment Income Tax (NIIT) may also be due.

Form 4797, Sales of Business Property, is used to report an ordinary loss on the sale of Section 1244 stock or a loss resulting from the stock becoming worthless. Attach Form 4797 to Form 1040.

1244(b)). Any loss in excess of the limit is a capital loss, subject to the capital loss rules. Thus, if the potential loss exceeds the $50,000 (or $100,000) limit, the stock should be disposed of in more than one year to maximize the ordinary loss treatment.

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Under Section 1244, an individual stockholder of a corporation can claim an ordinary (rather than capital) loss of up to $50,000 per year (or $100,000 for on a joint return) from the sale or worthlessness of Section 1244 stock. For most stockholders, an ordinary loss is much more beneficial than a capital loss.

To qualify under Section 1244, these five requirements must be adhered to:The stock must be acquired in exchange for cash or property contributed to the corporation.The corporation must issue the stock directly to the investors.The corporation must be an actual, operating company.More items...?

HW: How are gains from the sale of § 1244 stock treated? losses? The general rule is that shareholders receive capital gain or loss treatment upon the sale or exchange of stock. However, it is possible to receive an ordinary loss deduction if the loss is sustained on small business stock (A§ 1244 stock).

The Tax Benefit of Section 1244 Stock Normally, stock is treated as a capital asset, and if disposed of at a loss, the loss is deducted as a capital loss. The general rule for net capital losses (losses that exceed gains in any tax year) is that they are subject to an annual deduction limit of only $3,000.