Hawaii Partnership Agreement for LLP

Description

How to fill out Partnership Agreement For LLP?

Are you in the position where you frequently require documents for possibly your business or particular tasks nearly every day.

There are numerous authentic form templates accessible online, but finding ones you can trust is not straightforward.

US Legal Forms offers thousands of form templates, such as the Hawaii Partnership Agreement for LLP, which can be downloaded to meet federal and state regulations.

When you find the correct form, click Purchase now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Hawaii Partnership Agreement for LLP template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it’s for the correct city/region.

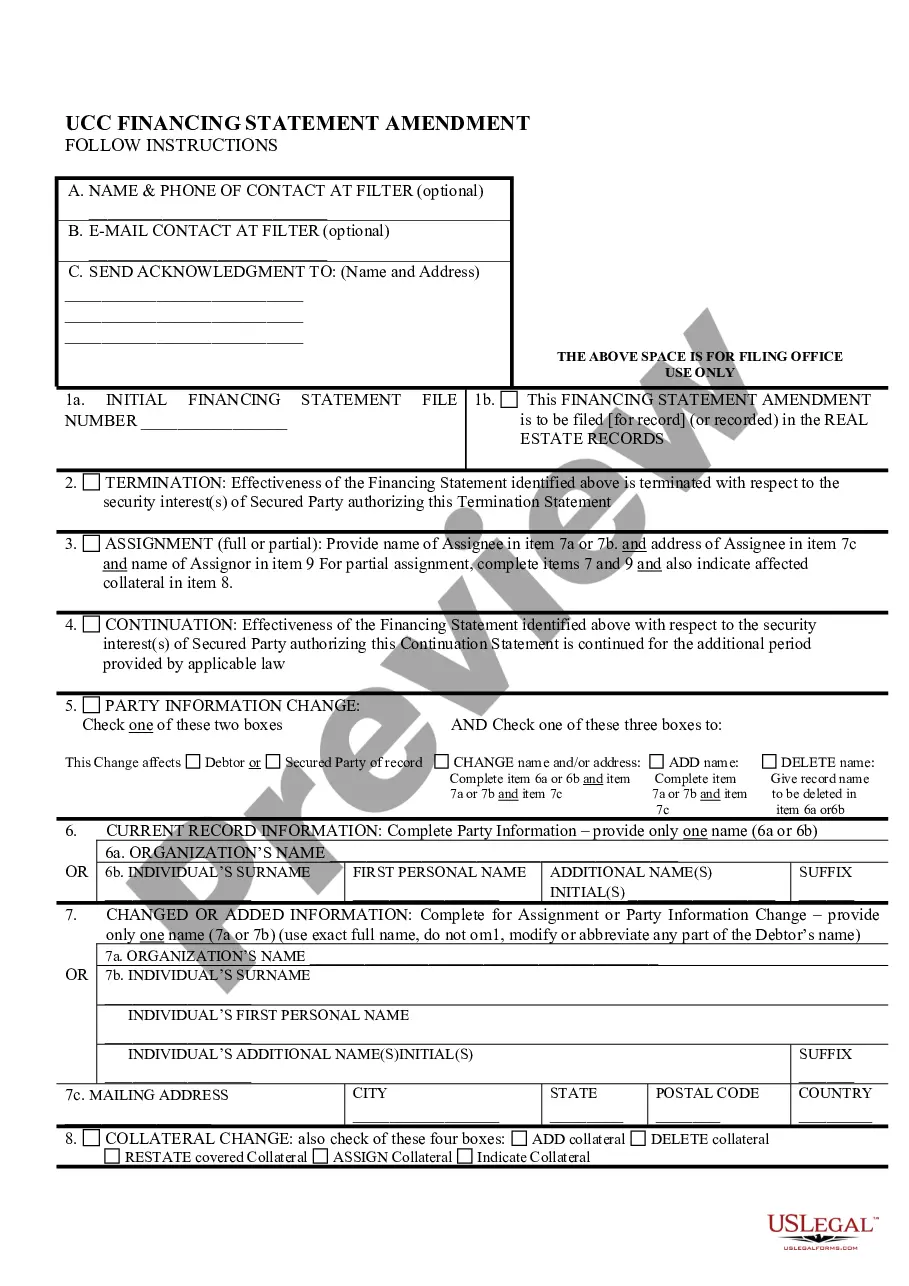

- Use the Preview button to examine the form.

- Review the details to confirm that you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

A partnership has no separate legal status apart from its partners, as the partners are individually known as a partner and collectively known as firm. Unlike, LLP which is a separate legal entity. The partner's liability is limited to the extent of the capital contributed by them.

Are there rules on how partnerships are run? The only requirement is that in the absence of a written agreement, partners don't draw a salary and share profits and losses equally. Partners have a duty of loyalty to the other partners and must not enrich themselves at the expense of the partnership.

If there is no written partnership agreement, partners are not allowed to draw a salary. Instead, they share the profits and losses in the business equally. The agreement outlines the rights, responsibilities, and duties each partner has to the company and to each other.

The rights and duties of designated partners are governed by the LLP agreement....LLP Registration ProcessStep 1: Obtain Digital Signature Certificate (DSC)Step 2: Apply for Director Identification Number (DIN)Step 3: Name Approval.Step 4: Incorporation of LLP.Step 5: File Limited Liability Partnership (LLP) Agreement.01-Feb-2022

To register a Domestic Limited Liability Partnership in Hawaii, you must file a Registration Statement for Partnership (Form GP-1) prior to or simultaneously with a Statement of Qualification (Form LLP-1), along with the appropriate filing fee(s) with the Department of Commerce and Consumer Affairs (DCCA), Business

A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilities. It therefore can exhibit elements of partnerships and corporations. In an LLP, each partner is not responsible or liable for another partner's misconduct or negligence.

It's not a legal requirement to enter into a limited liability partnership agreement and an LLP can be set up without one. However, it's a very common and generally sound recommendation that a new LLP puts a partnership agreement in place.

Key Takeaways. Limited liability partnerships (LLPs) allow for a partnership structure where each partner's liabilities are limited to the amount they put into the business. Having business partners means spreading the risk, leveraging individual skills and expertise, and establishing a division of labor.

A limited partnership is different from a general partnership in that it requires a partnership agreement. Some information about the business and the partners must be filed with the appropriate state agency (usually the secretary of state). Additionally, a limited partnership has both limited and general partners.

A limited partnership is a type of partnership that consists of at least one general partner and at least one limited partner. A limited liability partnership does not have a general partner, since every partner in an LLP is given the ability to take part in the management of the company.