Alabama Revocable Living Trust for Single Person

Description

How to fill out Revocable Living Trust For Single Person?

Selecting the appropriate legal document template can be challenging. Clearly, there are numerous designs accessible online, but how can you locate the legal document you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the Alabama Revocable Living Trust for Single Individual, which can be utilized for professional and personal purposes.

If you are already registered, sign in to your account and click on the Download button to obtain the Alabama Revocable Living Trust for Single Individual. Use your account to browse through the legal documents you have previously purchased. Visit the My documents section of your account and download an additional copy of the document you need.

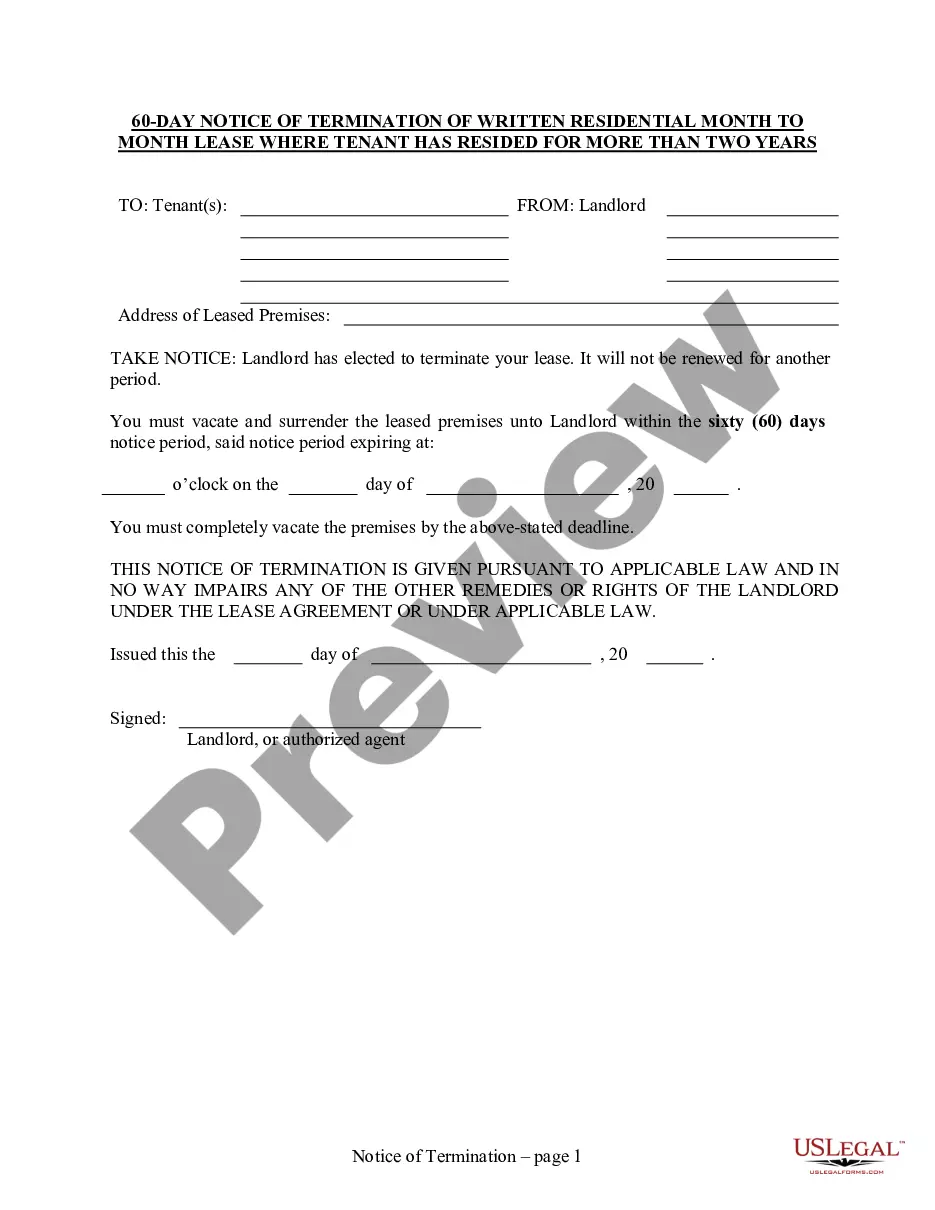

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct document for your city/state. You can review the document using the Preview button and read its details to confirm it is suitable for you.

US Legal Forms is the largest collection of legal documents where you can discover various document templates. Take advantage of the service to download professionally crafted documents that adhere to state regulations.

- If the document does not fulfill your requirements, use the Search field to find the appropriate document.

- Once you are confident that the document is correct, click the Buy Now button to acquire the document.

- Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card.

- Select the format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Alabama Revocable Living Trust for Single Individual.

Form popularity

FAQ

To establish an Alabama Revocable Living Trust for Single Person, start by creating a trust document that outlines your wishes. You can do this with the help of a legal professional or use a reliable platform like USLegalForms to guide you through the process. After drafting your document, transfer your assets into the trust and review it regularly to keep it updated. This simple process can help ensure that your estate is managed according to your preferences.

One downside of an Alabama Revocable Living Trust for Single Person is that it does not provide protection from creditors. This means that your assets could still be vulnerable to claims against you in the event of financial issues. Additionally, setting up this type of trust involves fees and ongoing maintenance, which some may find burdensome. Be sure to weigh these factors before proceeding with your trust.

Having your parents put their assets in an Alabama Revocable Living Trust for a Single Person can simplify estate management and avoid probate. This option can provide greater control over asset distribution and can be changed as circumstances evolve. It's essential to discuss their specific goals and consult with a legal professional to make the best choice for their unique situation.

To set up an Alabama Revocable Living Trust for a Single Person, start by drafting the trust document that outlines your wishes regarding the management and distribution of your assets. You can work with a legal professional to ensure compliance with Alabama laws. After drafting, transfer your assets into the trust, followed by formally signing and notarizing the document, which helps ensure validity.

Trust funds can pose risks, particularly if the terms are not clearly defined. Unclear instructions may lead to disputes among beneficiaries. Also, misuse of trust assets by a trustee can occur without proper oversight. Understanding these risks can help you make informed decisions when creating an Alabama Revocable Living Trust for a Single Person.

An Alabama Revocable Living Trust for Single Person allows you to manage your assets during your lifetime and dictate how they will be distributed after your passing. This type of trust can help you avoid probate, which simplifies the transfer of assets to your beneficiaries. As the grantor, you maintain control over the trust and can make changes or revoke it at any time while you are alive. By using platforms like US Legal Forms, you can easily create and manage your trust, ensuring that your wishes are carried out seamlessly.

To transfer your house into an Alabama Revocable Living Trust for a Single Person, you need to execute a new deed that names the trust as the owner. This process typically involves completing a deed form and recording it with the county. It’s wise to consult with legal experts or utilize US Legal Forms to ensure compliance with Alabama laws, making the transfer smooth and effective.

Yes, an Alabama Revocable Living Trust for a Single Person can help you avoid probate. Since the trust holds your assets, those assets do not pass through the probate process upon your death. This means your beneficiaries can access their inheritance more quickly, and you can keep your affairs private, reducing costs and delays.

Whether you need a living trust in Alabama largely depends on your personal situation and estate planning goals. An Alabama Revocable Living Trust for a Single Person can help you manage your assets during your lifetime and simplify the transfer of those assets upon your death. It also provides privacy, as it does not go through probate, making it an attractive option for many individuals.

In Alabama, trusts must comply with state laws regarding creation, funding, and management. Generally, a trust can be set up for any lawful purpose, and it must have a clear structure with designated beneficiaries. It’s important to ensure that your Alabama Revocable Living Trust for a Single Person is properly drafted to avoid complications and misunderstandings down the road.