Hawaii Notice of Assignment of Security Interest

Description

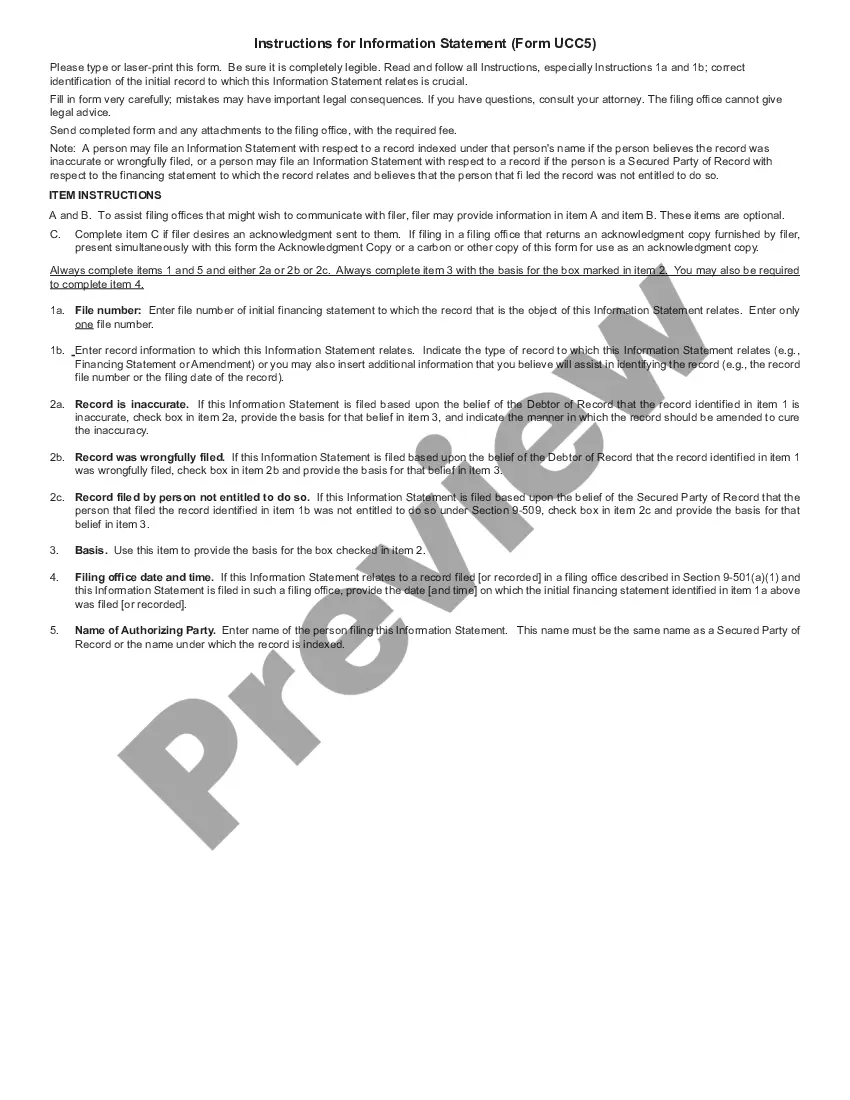

How to fill out Notice Of Assignment Of Security Interest?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide selection of legal form templates you can download or print.

Using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the latest forms such as the Hawaii Notice of Assignment of Security Interest in moments.

If you already have an account, Log In and download the Hawaii Notice of Assignment of Security Interest from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, and print the downloaded Hawaii Notice of Assignment of Security Interest. Every document you added to your account has no expiration date and is yours to keep forever. Therefore, if you wish to download or print an additional copy, simply go to the My documents section and click on the form you desire. Access the Hawaii Notice of Assignment of Security Interest with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have selected the appropriate form for your area/state. Click on the Review button to check the form's details.

- Review the form information to confirm you have selected the correct form.

- If the form does not meet your needs, use the Lookup field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

The most common real property security instru- ment is a mortgage, which can encumber any interest in real property that can legally be transferred (including, for example, absolute ownership, a tenant's interest under a lease, or the interest that a beneficiary of an easement holds).

The term 'assignment by way of charge only' is also often used. This just means that the security interest constitutes a charge, ie an encumbrance over the asset, rather than an assignment, ie a transfer of title to the chose in action (whether legal or beneficial) to the secured party.

One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

If at any time any Grantor shall take a security interest in any property of an Account Debtor or any other Person to secure payment and performance of an Account, such Grantor shall be deemed to have assigned such security interest to the Collateral Agent.

It is recommended that the security agreement include a provision giving the creditor a right to enter on the debtor's premises and retake the collateral in the event of default. Second, the creditor can file a claim & delivery lawsuit and have a court order the property be turned over to the creditor.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the

(c) Except as otherwise provided in subsection (e), a lessee of goods takes free of a security interest or agricultural lien if the lessee gives value and receives delivery of the collateral without knowledge of the security interest or agricultural lien and before it is perfected.

Which of the following is necessary for a security interest to attach to collateral? The parties must agree to create a security interest; The secured party must give value; The debtor must have rights in the collateral.

For a security interest to attach, the following events must have occurred: (A) value must have been given by the Secured Party; (B) the Debtor must have rights in the collateral; and (C) the Secured Party must have been granted a security interest in the collateral.

The three requirements of: giving value, debtor rights in the collateral, and an authenticated security agreement apply to the most common types of collateral, such as equipment, inventory and even payments due under a contract.