Hawaii Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Checklist Of Matters To Be Considered In Drafting Escrow Agreement?

Are you currently in a circumstance where you require documents for either professional or specific purposes almost every day.

There is a wide array of authentic document templates accessible online, but finding templates you can trust is not easy.

US Legal Forms offers a vast selection of form templates, including the Hawaii Checklist of Considerations for Drafting an Escrow Agreement, which can be tailored to meet federal and state requirements.

If you find the appropriate form, click Purchase now.

Select the pricing plan you prefer, fill in the required information to create your account, and complete the transaction using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Hawaii Checklist of Considerations for Drafting an Escrow Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

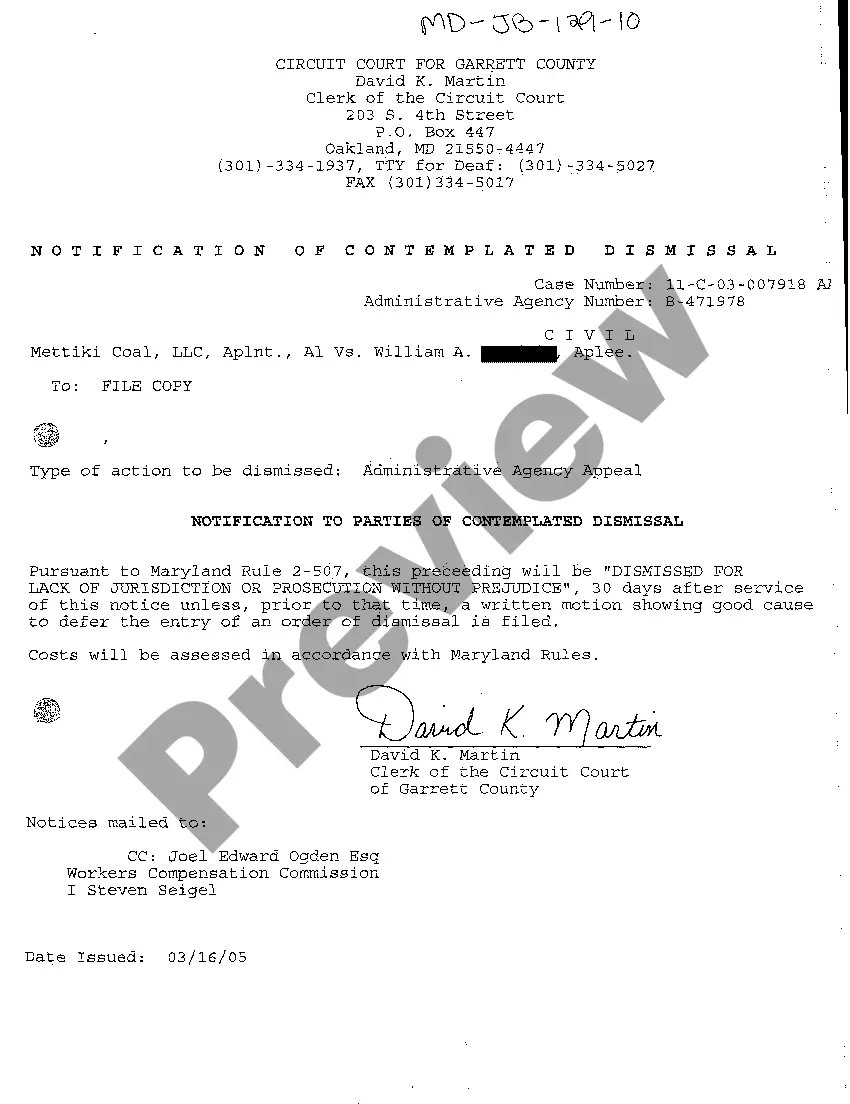

- Use the Preview button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search section to find the form that suits your needs and requirements.

Form popularity

FAQ

When reviewing an escrow agreement, look for clear definitions of roles, the conditions for release of funds, and any fees associated with the escrow service. It is also vital to check for a thorough set of instructions for the escrow agent. The Hawaii Checklist of Matters to be Considered in Drafting Escrow Agreement serves as an excellent tool to help you ensure you haven't overlooked any critical components.

All parties involved in the escrow must agree to any changes made to the escrow instructions. This ensures that everyone is on the same page and that there are no misunderstandings later. Utilizing the Hawaii Checklist of Matters to be Considered in Drafting Escrow Agreement can guide you through modifications effectively.

The escrow agreement itself is the document that defines the terms and conditions between the parties involved. It lays out the obligations, rights, and expectations from each party and the escrow agent. To ensure all aspects are covered, it’s wise to refer to the Hawaii Checklist of Matters to be Considered in Drafting Escrow Agreement during the drafting phase.

The main elements of the escrow rule include the necessity for a neutral third party to hold assets, the requirement for clear instructions from the parties, and the stipulation that the escrow agent must follow those instructions precisely. Adhering to these rules minimizes risks in the transaction process. You can consult the Hawaii Checklist of Matters to be Considered in Drafting Escrow Agreement for a comprehensive overview.

Escrow typically includes the funds or assets involved in the transaction, detailed instructions for the escrow agent, and any contingency clauses that could affect the deal. By addressing these aspects, you create a safer and clearer agreement for all parties. Referencing the Hawaii Checklist of Matters to be Considered in Drafting Escrow Agreement can help identify these crucial components.

To form a valid escrow, you need three key elements: there must be a clear agreement between the parties, an escrow agent must be designated, and the subject matter of the escrow must be identifiable. Ensuring these components are in place can prevent disputes. Following the Hawaii Checklist of Matters to be Considered in Drafting Escrow Agreement facilitates a smoother transaction.

An escrow agreement is a legal document that outlines the responsibilities of the parties involved and specifies the conditions under which the escrow agent can release the funds or documents. It also details any fees, timelines, and the obligations of each party. Understanding the Hawaii Checklist of Matters to be Considered in Drafting Escrow Agreement can greatly enhance the drafting process.

While escrow agents play a critical role in managing the escrow process, they typically do not draft legal documents. Their function is to act as intermediaries, ensuring compliance with the terms outlined in the escrow agreement. For legal document drafting, it is advisable to consult professionals equipped with legal expertise, as emphasized in the Hawaii Checklist of Matters to be Considered in Drafting Escrow Agreement, to ensure accuracy and legality.

The escrow requirement involves legally binding instructions for handling funds or documents during a transaction. A well-prepared escrow agreement should detail the responsibilities of each party, the conditions for release, and the role of the escrow agent. Incorporating the Hawaii Checklist of Matters to be Considered in Drafting Escrow Agreement helps you fulfill these requirements and safeguards everyone involved in the process.

For a valid escrow to exist, three essential elements must be present: a clear agreement between parties, the presence of a neutral third party, and defined instructions for the release of funds or documents. The Hawaii Checklist of Matters to be Considered in Drafting Escrow Agreement ensures that these elements are met. By following this checklist, you can avoid potential disputes and create a solid foundation for your escrow process.