Hawaii Partnership Dissolution Agreement

Description

How to fill out Partnership Dissolution Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

Through the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can access the latest versions of documents like the Hawaii Partnership Dissolution Agreement in a matter of minutes.

If you have an active subscription, Log In and download the Hawaii Partnership Dissolution Agreement from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously obtained forms in the My documents section of your account.

Complete the payment. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make changes. Fill out, edit, print, and sign the downloaded Hawaii Partnership Dissolution Agreement. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply visit the My documents section and click on the document you need. Access the Hawaii Partnership Dissolution Agreement through US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

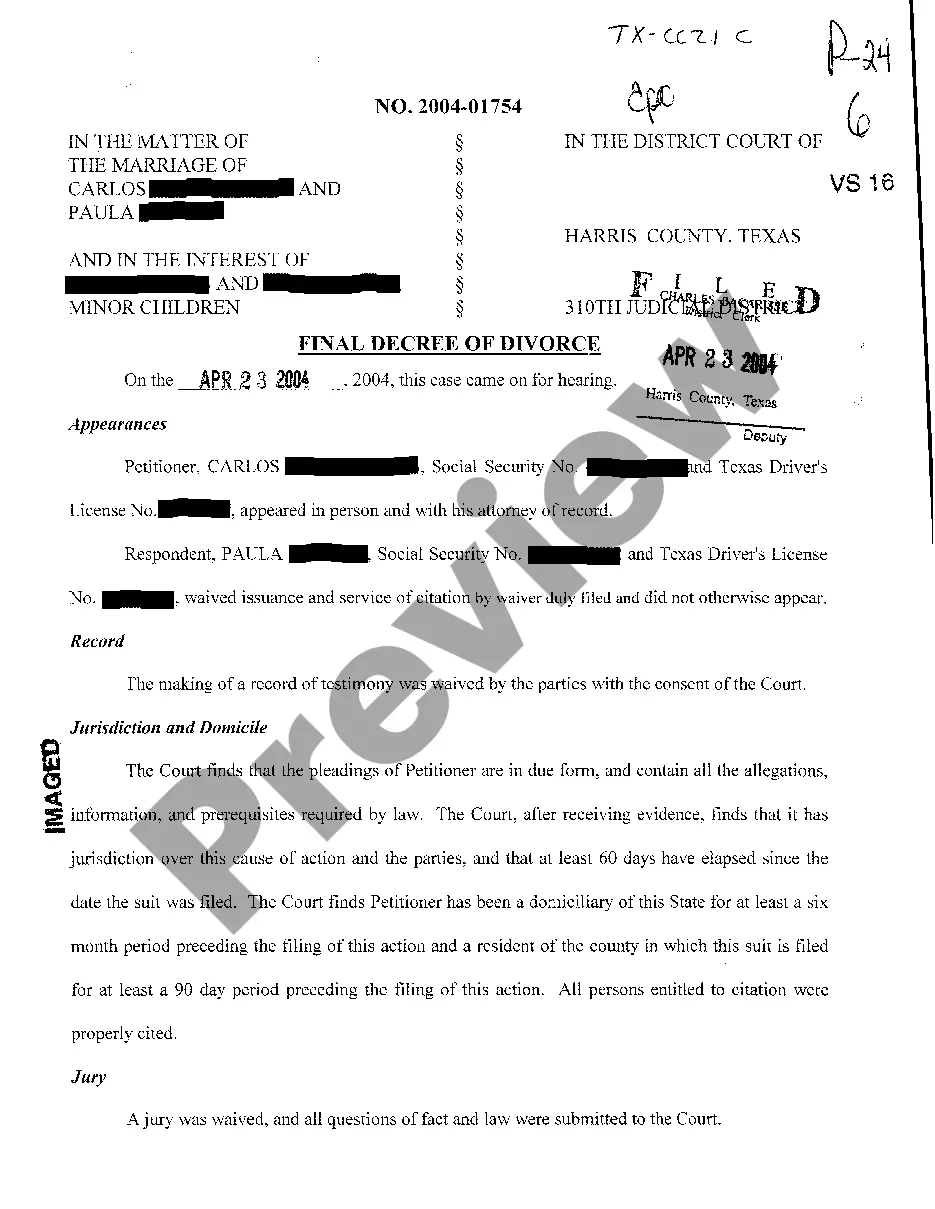

- Click on the Preview button to review the form's content.

- Examine the form details to confirm that you have chosen the right document.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- When you are satisfied with the form, confirm your choice by clicking on the Get it now button.

- Next, choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Dissolving a partnership firm involves several key procedures that partners must follow. Begin by reviewing the partnership agreement for specific guidelines, then notify all partners and relevant stakeholders about the decision to dissolve. It is often beneficial to create a Hawaii Partnership Dissolution Agreement, detailing the distribution of assets, resolution of liabilities, and any necessary legal paperwork to formalize the dissolution.

Dissolving a 50/50 partnership requires mutual agreement from both partners on the terms of dissolution. Start by discussing the decision openly to establish how assets and liabilities will be divided. Utilizing a Hawaii Partnership Dissolution Agreement can provide a clear outline of the steps needed to dissolve the partnership, ensuring a fair and organized process.

Removing yourself from a business partnership involves communicating your intention to the other partners as outlined in your partnership agreement. It is crucial to follow the specified processes in the agreement, which may include a buyout or other arrangements. To finalize the removal, a Hawaii Partnership Dissolution Agreement can help formalize your exit and ensure that all obligations are clearly settled.

To dissolve a partnership, the partners should first review their partnership agreement for specific dissolution procedures. Next, all partners need to agree on the dissolution terms and notify relevant parties, such as clients, vendors, and employees. Finally, partners should settle any outstanding debts, distribute remaining assets, and file a formal dissolution, often referred to as a Hawaii Partnership Dissolution Agreement, with the appropriate state authority.

On the dissolution of a partnership firm, partners must create a record that details the settlement of accounts and the distribution of assets. This record should clearly outline sales, remaining liabilities, and individual partner distributions as guided by the Hawaii Partnership Dissolution Agreement. Keeping thorough records ensures that all financial obligations are met and minimizes any potential disputes among partners.

Dissolving a partnership involves several key steps: First, review the partnership agreement and inform all partners of the decision. Next, settle outstanding debts and distribute remaining assets according to the Hawaii Partnership Dissolution Agreement. Finally, file any necessary paperwork with the state and ensure that all financial records are accurately updated.

To record the dissolution of a partnership, list all assets and liabilities, and create journal entries to reflect the distribution among partners. Each partner's final capital account should be updated according to the terms established in the Hawaii Partnership Dissolution Agreement. By meticulously recording these details, you can maintain clarity and transparency throughout the dissolution process.

The entry for dissolution of accounts involves closing out all partnership accounts and transferring balances to the individual partners' accounts. This entry should include the distribution of any remaining assets, liabilities, and income among partners. It's essential to document these transactions in line with the Hawaii Partnership Dissolution Agreement for accurate records.

To dissolve a business in Hawaii, you must file a dissolution form with the Department of Commerce and Consumer Affairs. Additionally, you should notify creditors and settle all debts. By following the guidelines within a Hawaii Partnership Dissolution Agreement, you can ensure a smooth process that respects all legal requirements and protects your interests.

When dissolving a partnership in Hawaii, the accounting treatment involves settling debts, distributing assets, and closing out any outstanding accounts. It's crucial to properly document all transactions to reflect the final status of the partnership. The Hawaii Partnership Dissolution Agreement will guide you in allocating remaining assets to partners while ensuring all obligations are met.