Hawaii Assignment of Assets

Description

How to fill out Assignment Of Assets?

If you desire to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest array of legal documents available online.

Take advantage of the website's straightforward and convenient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Every legal document template you download is yours indefinitely. You have access to each form you saved in your account. Choose the My documents section and select a form to print or download again.

Complete and obtain, and print the Hawaii Assignment of Assets with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to find the Hawaii Assignment of Assets in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Hawaii Assignment of Assets.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

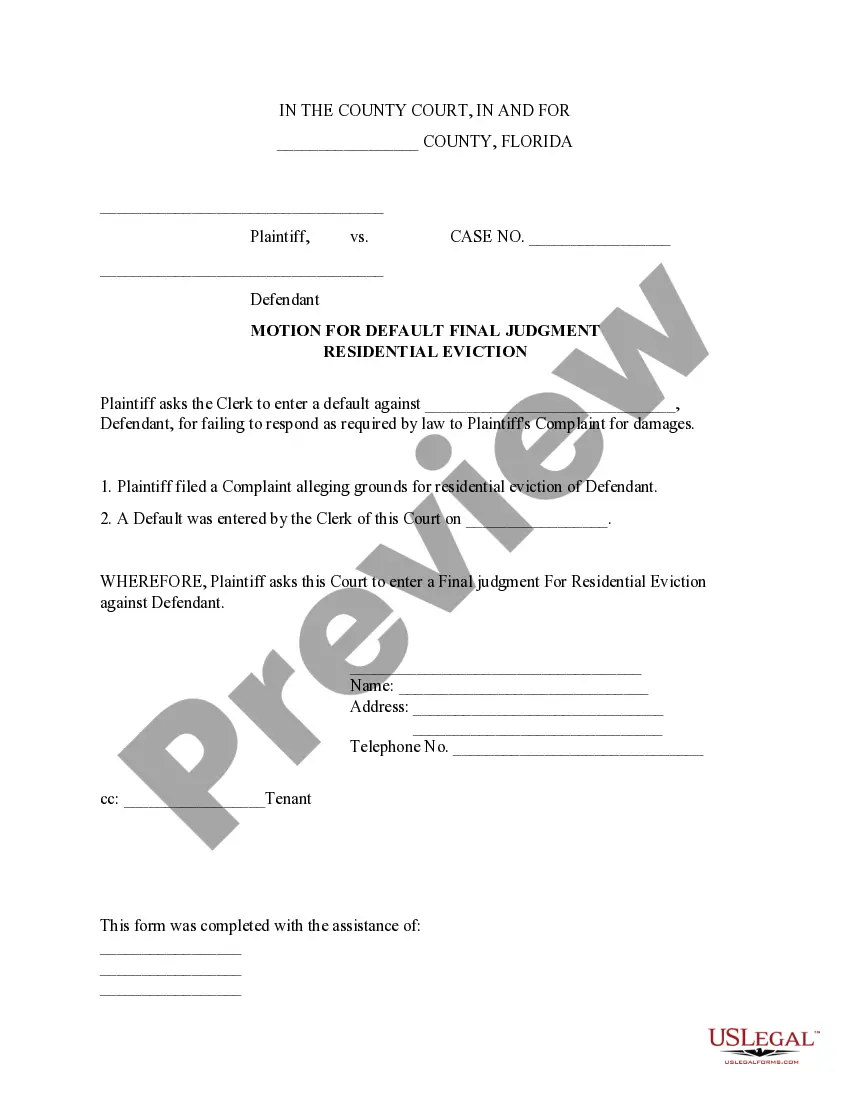

- Step 2. Use the Preview option to review the form’s details. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you want, click the Acquire now button. Choose your preferred payment plan and enter your information to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify and print or sign the Hawaii Assignment of Assets.

Form popularity

FAQ

To avoid Hawaii taxes on home sales, leverage the primary residence exclusion if you qualify. Additionally, considering the timing of your sale and the type of property can help reduce tax obligations. Engaging with the Hawaii Assignment of Assets framework can provide valuable insights and strategies tailored to minimize tax impacts effectively.

One effective method for avoiding capital gains tax involves utilizing the homeowner exclusion effectively. By ensuring you meet the ownership and use tests, you could potentially exclude significant profits from taxation. Understanding the Hawaii Assignment of Assets will better position you to take advantage of these exclusions.

G 45 and G 49 are forms related to real estate transactions in Hawaii. G 45 is the form used for conveyance tax purposes, while G 49 deals with the reporting of certain exemptions. Familiarizing yourself with these forms is crucial in the context of the Hawaii Assignment of Assets, as they can impact your sale or transfer process.

Transferring property ownership in Hawaii typically involves executing a deed that details the change. This deed must be signed, notarized, and recorded with the Bureau of Conveyances. Engaging with professionals familiar with the Hawaii Assignment of Assets can streamline this process and ensure that all legal requirements are met.

In Hawaii, homeowners can benefit from an exclusion when selling their primary residence. This exclusion allows individuals to avoid capital gains tax on up to $250,000 of profit if single, or $500,000 if married, provided certain conditions are met. If you're planning a sale, understanding the Hawaii Assignment of Assets can help maximize these benefits.

The transient accommodations tax (TAT) is a tax imposed on revenue earned from rental properties in Hawaii. It is vital for property owners to understand the TAT, especially if you are involved in a Hawaii Assignment of Assets, as it can influence your investment decisions and profitability. Make sure to stay updated on the rates and regulations to maintain compliance.

The Hawaii Real Property Tax Act (HARPTA) tax is typically withheld by the buyer from the seller's proceeds at closing. This tax is important to consider in a Hawaii Assignment of Assets, as it directly affects the amount you receive from the sale. Being informed of this tax can help you plan your financial moves better.

In Hawaii, the G49 form can be filed online or submitted to the state Department of Taxation. This form is used to report real property taxes, which play a significant role in planning an effective Hawaii Assignment of Assets. Ensure you file it accurately and on time to avoid any penalties.

Transferring property title in Hawaii requires completing a deed, which must then be executed and notarized. You will need to file this deed with the Bureau of Conveyances in Hawaii to ensure the change is recorded. If you're exploring different options for a Hawaii Assignment of Assets, be sure to consult with a legal professional to navigate the process correctly.

In Hawaii, the transient accommodations tax (TAT) is also primarily the responsibility of property owners and operators. This tax applies to rental income generated from transient lodging, which could affect your profits if you decide to engage in a Hawaii Assignment of Assets. Understanding these tax obligations will help you maintain compliance and optimize your financial returns.