Hawaii Articles of Association of a Professional Association

Description

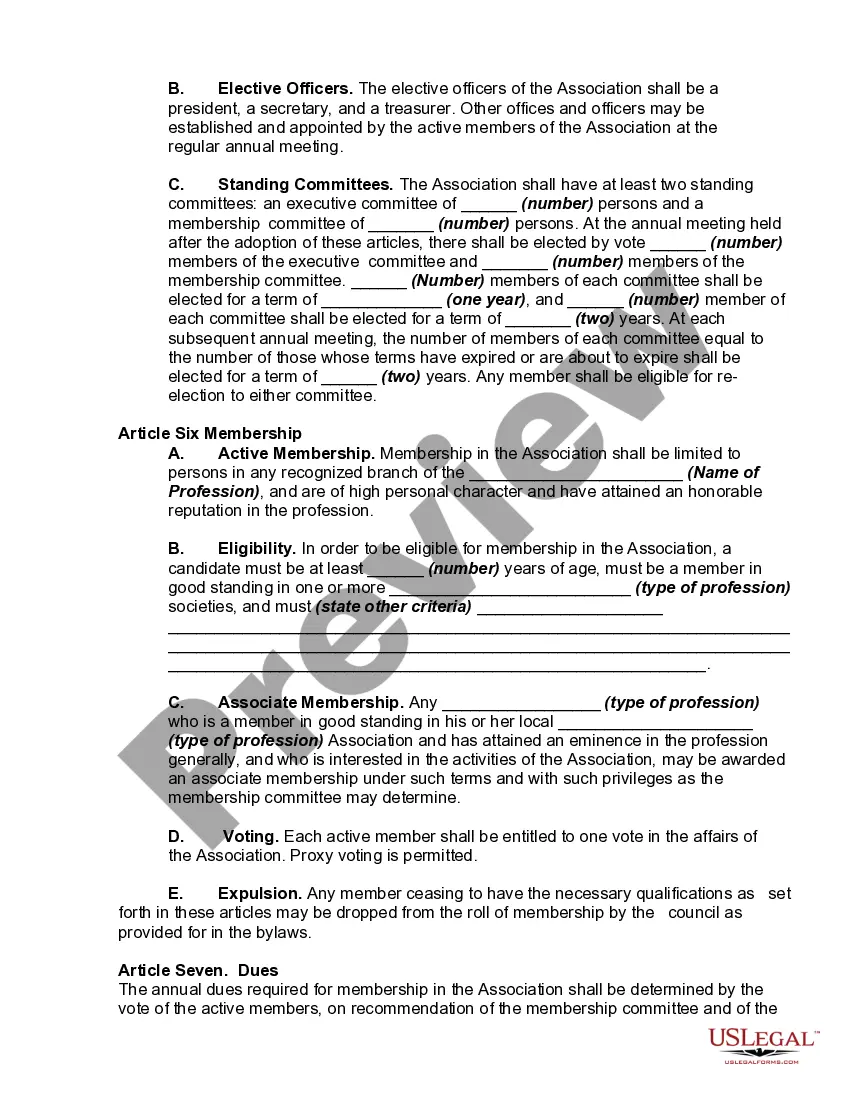

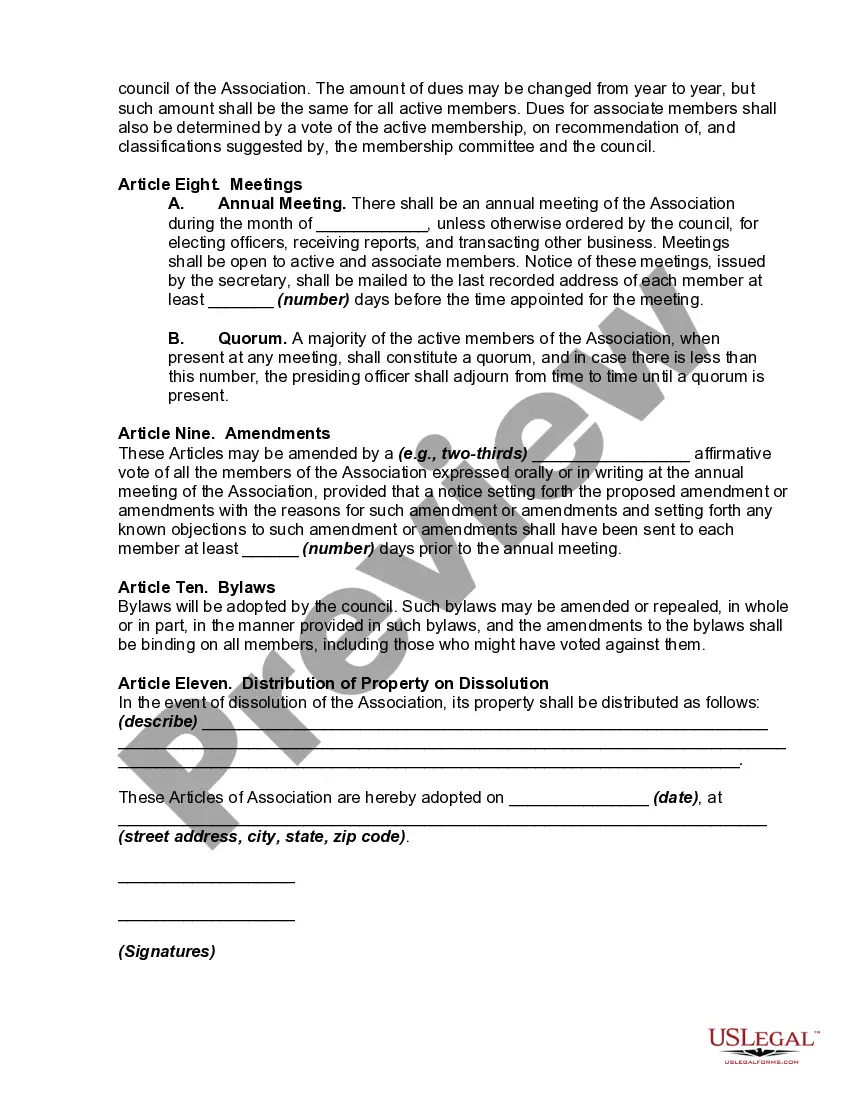

Statutes in some jurisdictions require that the constitution or articles of association, and the bylaws, be acknowledged or verified. In some jurisdictions, it is required by statute that the constitution or articles of association be recorded, particularly where the association or club owns real property or any interest in real property.

How to fill out Articles Of Association Of A Professional Association?

You may spend several hours on the web searching for the legitimate file design which fits the state and federal requirements you will need. US Legal Forms supplies 1000s of legitimate forms that are reviewed by experts. You can actually down load or print the Hawaii Articles of Association of a Professional Association from our services.

If you already possess a US Legal Forms bank account, it is possible to log in and click the Obtain button. Following that, it is possible to full, edit, print, or sign the Hawaii Articles of Association of a Professional Association. Every single legitimate file design you purchase is your own property for a long time. To acquire yet another version of any acquired kind, go to the My Forms tab and click the corresponding button.

If you are using the US Legal Forms site the first time, keep to the basic instructions under:

- Initially, make certain you have chosen the right file design for your region/metropolis of your choice. See the kind description to make sure you have chosen the right kind. If readily available, take advantage of the Preview button to check from the file design also.

- If you wish to find yet another version of your kind, take advantage of the Lookup field to get the design that meets your requirements and requirements.

- Upon having discovered the design you would like, click on Acquire now to carry on.

- Pick the prices strategy you would like, key in your credentials, and sign up for your account on US Legal Forms.

- Complete the purchase. You can utilize your charge card or PayPal bank account to fund the legitimate kind.

- Pick the formatting of your file and down load it for your product.

- Make adjustments for your file if possible. You may full, edit and sign and print Hawaii Articles of Association of a Professional Association.

Obtain and print 1000s of file templates while using US Legal Forms website, which provides the most important assortment of legitimate forms. Use expert and condition-certain templates to tackle your company or individual demands.

Form popularity

FAQ

Status. If you want your LLC to be taxed as an S corp., you need to file IRS Form 2553, Election by a Small Business Corporation. If you file Form 2553, you do not need to file Form 8832, Entity Classification Election, as you would for a C corp. You may use online tax filing or file by fax or mail.

You don't need a general business license in Hawaii just to operate your business. You need a General Excise Tax License, which gives you your tax ID for the state. You also need to apply for specific business licenses and permits if you operate in an industry that requires it.

To form a Hawaii S corp, you'll need to ensure your company has a Hawaii formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

Hawaii recognizes the federal S corporation election and does not require a state-level S corporation election.

Setting up a DBA in Hawaii You can search for conflicting business name on the department's Search for Business Entity & Documents page. The site is also where DBA registration forms will be found. After you've determined if your name is available, you can move on with registering the name with the state government.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, email, phone or in person, but we recommend faxing. Normal processing takes up to 5 days, plus additional time for mailing, and costs $10.

To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors.

What paperwork is required to form an S corp? To form an S corp, you must prepare and file Articles of Incorporation or a Certificate of Incorporation with the proper state authorities. You must also pay filing fees and any applicable initial franchise taxes or other fees.