Hawaii Assignment of Debt

Description

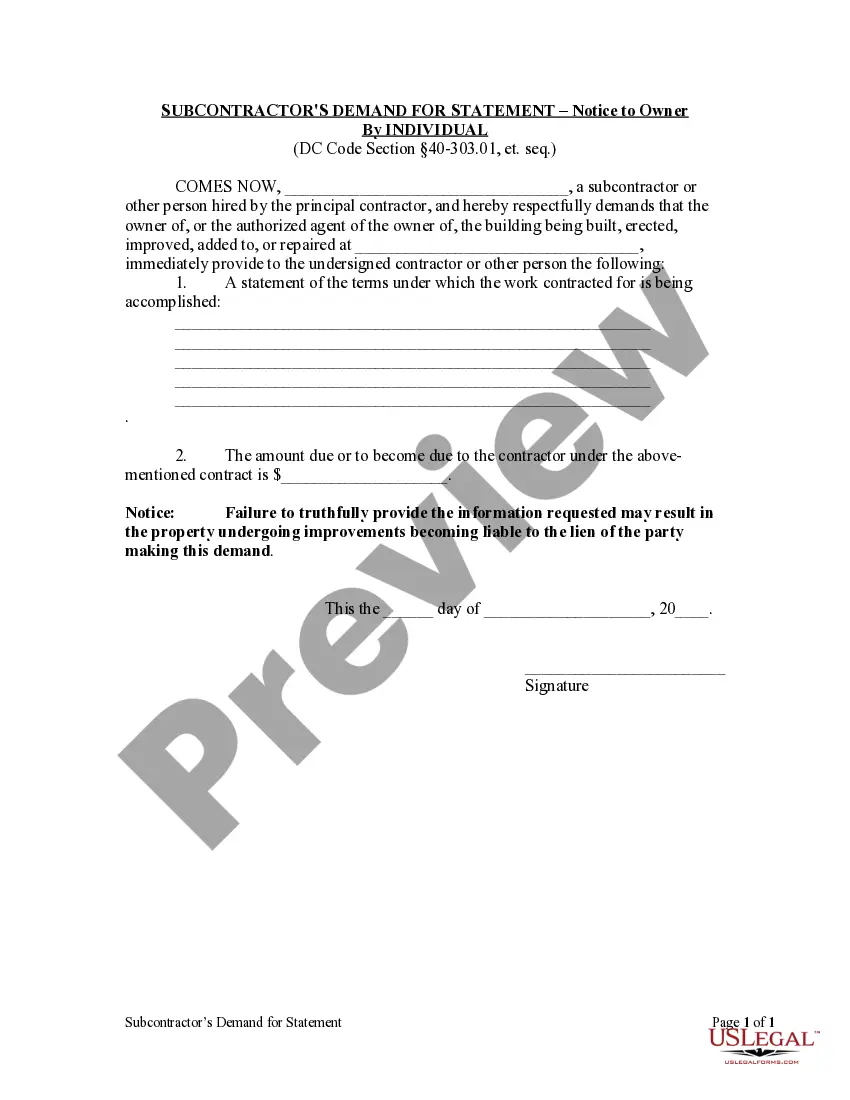

How to fill out Assignment Of Debt?

If you need to finalize, acquire, or produce sanctioned document templates, utilize US Legal Forms, the premier collection of sanctioned forms, accessible online.

Take advantage of the website's user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or by keywords.

Step 4. Once you have located the form you need, click on the Purchase now button. Select the payment plan you prefer and provide your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Utilize US Legal Forms to find the Hawaii Assignment of Debt with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Hawaii Assignment of Debt.

- You can also access forms you've previously acquired in the My documents section of your account.

- If this is your first time using US Legal Forms, adhere to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

Use the phrase 'I do not owe this debt, please stop.' This statement clearly communicates your position and requests them to cease contact regarding the matter. It's a straightforward way to assert your rights while dealing with debt collectors. Learning about the Hawaii Assignment of Debt can enhance your negotiation skills and protect your interests.

When communicating with a creditor, avoid admitting to the debt without verifying its validity. Do not provide unnecessary personal details or agree to payment terms without understanding your options. This knowledge about your rights is essential, especially concerning matters like the Hawaii Assignment of Debt. For clarity, consider using resources like USLegalForms.

Outsmarting a debt collector involves knowing your rights and staying informed about the debt collection process. Always verify any debt they claim you owe and never provide personal information without confirming the debt. Familiarizing yourself with the Hawaii Assignment of Debt can provide a strategic advantage in negotiations. Tools like USLegalForms can help you craft the right responses.

To stop debt collectors effectively, you can send them a written request to cease communication. Be clear and firm in your letter, stating that you do not wish to be contacted further. Additionally, understanding the Hawaii Assignment of Debt can empower you to take control of your financial situation. Seeking assistance through platforms like USLegalForms can simplify this process.

The 777 rule refers to a guideline where debt collectors should not contact you after you have informed them of your right to dispute the debt. It is crucial to communicate clearly with these collectors. This means you can request validation of the debt and expect them to stop communications until they provide this information. Gaining insight into the Hawaii Assignment of Debt can better inform your interactions with debt collectors.

When a debt is assigned, the responsibility for paying that debt transfers from the original creditor to another party. This often happens when debts go unpaid for an extended period. The new creditor can then seek payment from the debtor. Understanding the Hawaii Assignment of Debt process helps you know your rights in such situations.

Debt collectors are forbidden from engaging in unfair practices such as contacting you at unreasonable hours or misrepresenting themselves. They also cannot disclose sensitive information about your debts to third parties. Knowing these prohibitions can empower you as you navigate the challenges that arise from Hawaii Assignment of Debt.

In Hawaii, a debt typically becomes uncollectible after six years from the date of the last payment or acknowledgment of the debt. After this period, collectors may lose their legal right to pursue you for payment. Understanding this timeline can be vital if you are dealing with Hawaii Assignment of Debt and want to protect your rights effectively.

Yes, in Hawaii, an assignment of debt should generally be documented in writing to ensure it is legally binding. This written agreement protects all parties involved by outlining terms and conditions clearly. Utilizing services like US Legal Forms can help you easily create and verify these important legal documents regarding Hawaii Assignment of Debt.

The worst that a debt collector can do includes resorting to unlawful practices like filing a lawsuit without basis or reporting false information to credit bureaus. They may also use tactics to mislead you about the amount owed or the consequences of nonpayment. It is important to stay informed, as knowing your rights in relation to Hawaii Assignment of Debt can help you avoid such situations.