An independent contractor is a person or business who performs services for another person under an express or implied agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The person who hires an independent contractor is not liable to others for the acts or omissions of the independent contractor. An independent contractor is distinguished from an employee, who works regularly for an employer. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays their own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor

Description

How to fill out Contract With Skateboard Instructor As A Self-Employed Independent Contractor?

Have you ever been in a situation where you require paperwork for either professional or personal purposes nearly every day.

There are numerous legal document templates available online, but finding ones you can trust is not simple.

US Legal Forms offers thousands of document templates, such as the Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor, which are designed to comply with federal and state requirements.

Select the payment plan you need, fill in the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/region.

- Use the Review button to examine the form.

- Check the description to confirm you have chosen the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that suits your needs.

- If you locate the appropriate form, click on Purchase now.

Form popularity

FAQ

The two-year contractor rule relates to how independent contractors are classified in Hawaii, especially those working as instructors like a skateboard instructor. This rule helps determine if a contractor is genuinely self-employed or should be treated as an employee. For a Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor, it is essential to understand that if you maintain continuous work for two years, the state may consider you an employee rather than a contractor. Therefore, consulting legal resources, like those available on the US Legal Forms platform, can guide you through effective contract creation and compliance with local regulations.

Whether board members are classified as independent contractors depends on their specific arrangement with the organization. Generally, if there is a formal agreement in place detailing their responsibilities similar to a Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor, they may be considered independent contractors. Understanding this distinction is essential for tax purposes.

You should file your taxes as an independent contractor by April 15th of the following year, regardless of whether you have a Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor. It’s crucial to stay on top of your tax obligations since penalties apply for late filing. Consider using platforms like uslegalforms to simplify the process and ensure compliance.

As a self-employed individual receiving a 1099, you are required to report earnings when you make $600 or more in a calendar year. This applies to individuals with a Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor. Even if you earn less than this amount, it's a good practice to report your income to maintain accurate records.

Independent contractors, including those under a Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor, can earn up to $400 in net income without being liable for federal taxes. Exceeding this amount requires you to file a tax return. To maximize your financial outcomes, consider documenting your expenses, which can help lower your taxable income.

If you made less than $5,000 as a self-employed independent contractor under a Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor, you may still need to file taxes if your net earnings exceed $400. Filing can help you claim any deductions and ensure compliance with tax laws. Always consider consulting with a tax professional for personalized advice.

As a self-employed independent contractor in Hawaii, you need to file taxes if you earn $400 or more in a year. This threshold applies to your net income from your Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor. It's a good idea to keep thorough records of your earnings, as this can assist you with filing taxes accurately.

Yes, independent contractors classified under a 1099 may be required to attend meetings, depending on the contract terms. It’s essential to clarify such expectations in the Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor. Regular meetings can foster communication and enhance collaboration. Clearly stating these requirements in the agreement helps prevent misunderstandings.

Yes, you can provide training to an independent contractor. In the context of a Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor, such training can be beneficial. It helps to establish clear expectations and improve performance. Structuring training sessions allows both parties to align on skills and teaching methods.

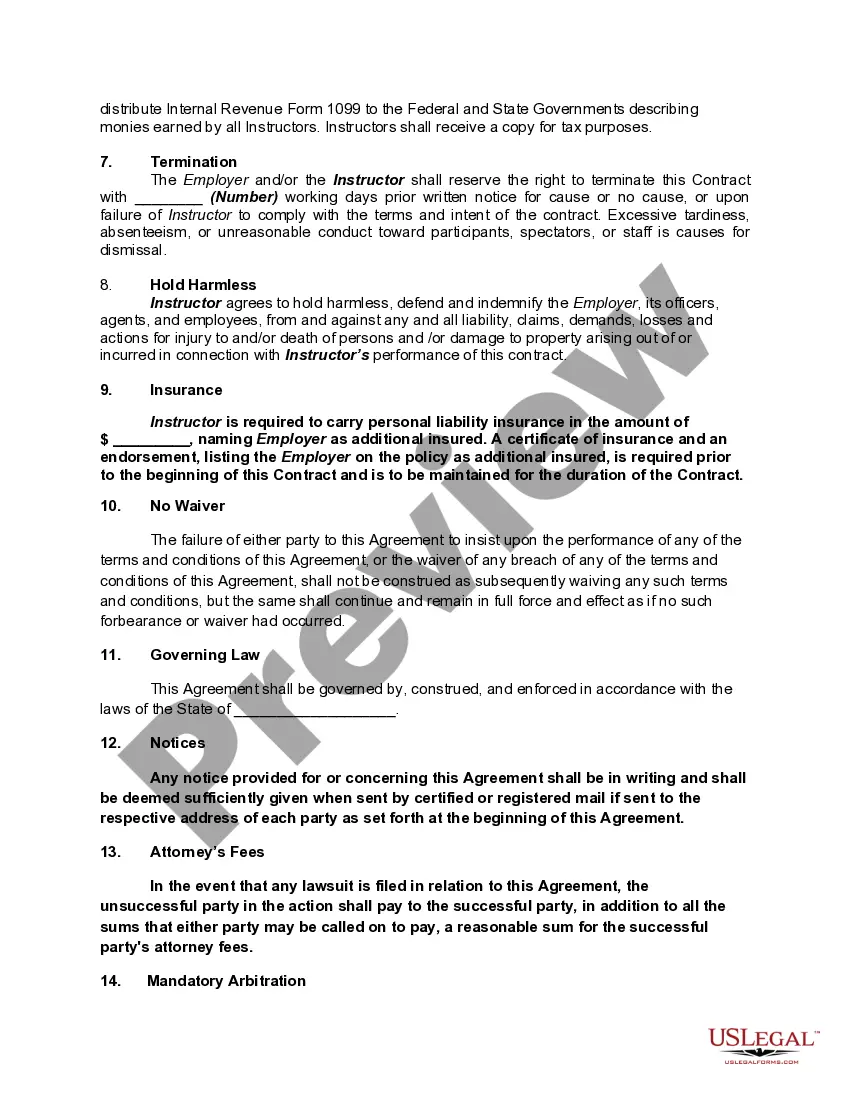

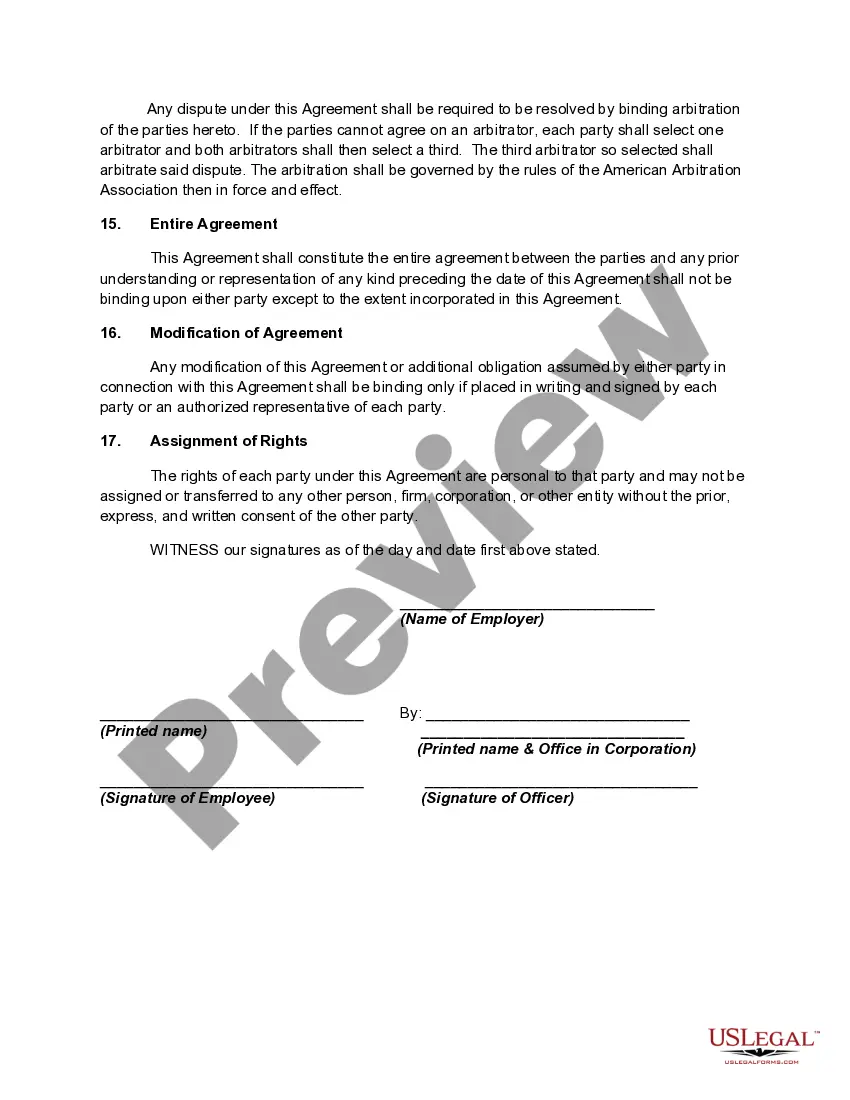

Writing an independent contractor agreement involves outlining the terms of the working relationship. You should specify the services to be provided, payment terms, and deadlines. Including details about the Hawaii Contract with Skateboard Instructor as a Self-Employed Independent Contractor can ensure clarity. For convenience, you can also use online platforms like uslegalforms to generate a comprehensive agreement.