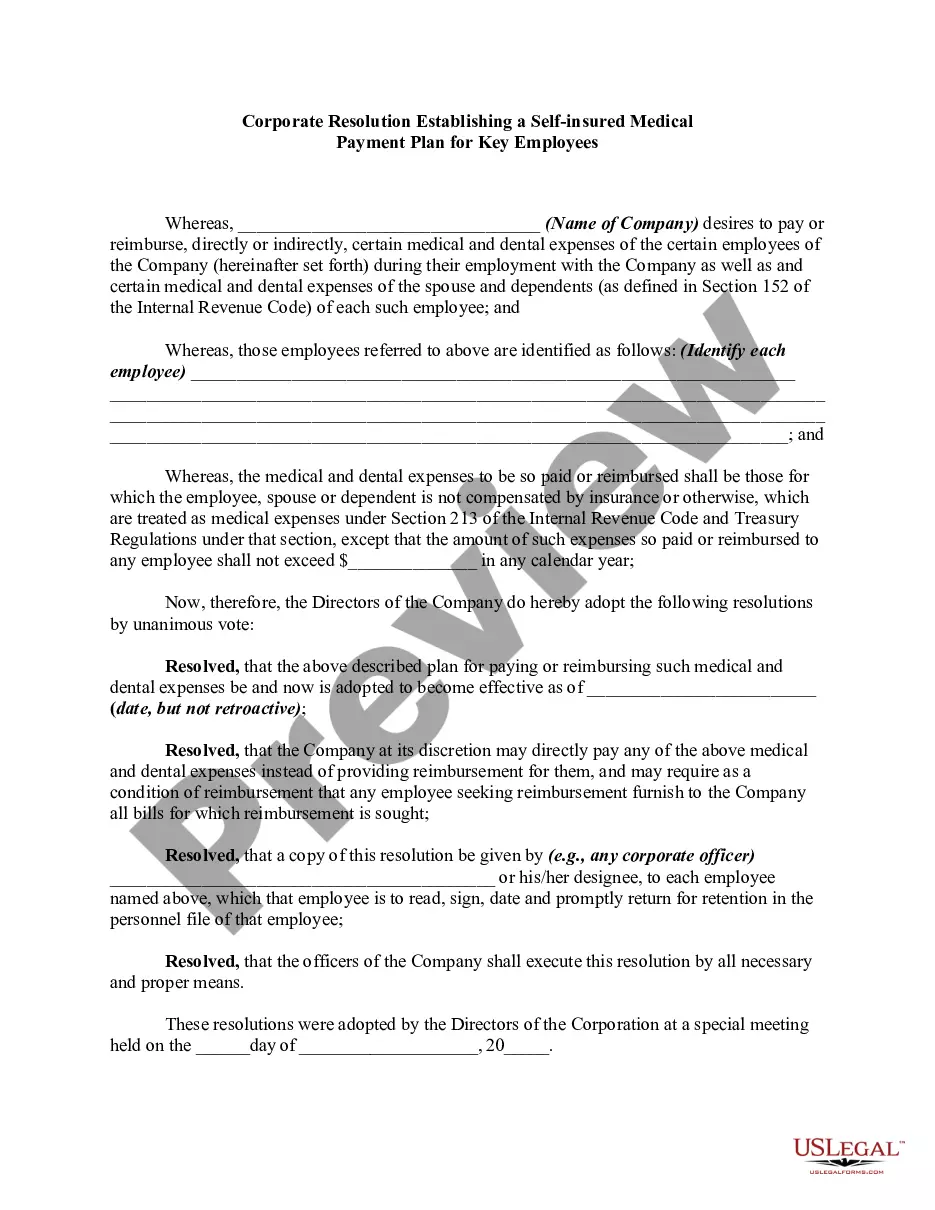

Discrimination favoring management or highly paid employees is not permitted for deductible health and accident insurance plans. For self-insured medical reimbursement plans (i.e., direct payment or reimbursement by the employer of the medical bills of the employee or family), no discrimination, either in eligibility or benefits, is permitted if "highly compensated individuals" are to receive all plan benefits tax-free. The plan must benefit, in general, at least 70% of employees who are not highly compensated employees. However, there are exceptions. A "highly compensated employee" is one who has a significant ownership interest in the company, or who is one of the five highest paid officers or employees. An alternative designation is an income threshold, currently $80,000. If a self-insured plan is discriminatory, an employee who is considered a highly compensated employee must include the amount of discriminatory benefits received in gross income.

Hawaii Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees

Description

How to fill out Corporate Resolution Establishing A Self-insured Medical Payment Plan For Key Employees?

Are you presently in the position where you require documents for potential business or particular purposes almost every day.

There are numerous legal document templates available online, but locating ones you can rely on isn't straightforward.

US Legal Forms offers a vast collection of document templates, such as the Hawaii Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, designed to comply with federal and state regulations.

If you locate the right form, simply click Purchase now.

Select the payment plan you want, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Hawaii Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the template you need and ensure it is suitable for your specific city/county.

- Utilize the Preview button to review the form.

- Check the summary to confirm you've selected the correct template.

- If the template is not what you're looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

The Hawaiian Homes Commission Act aimed to provide homesteading opportunities to Native Hawaiians. It allowed eligible individuals access to land for residential, agricultural, and business development. This Act supports economic and community growth for Native Hawaiian families. Establishing a Hawaii Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees can complement these efforts by providing vital health benefits that support these families.

Employers can deduct health insurance premiums as a business expense on their taxes. The amount depends on the employer's contributions and can significantly reduce taxable income. This deduction helps companies manage their healthcare costs efficiently. Implementing a Hawaii Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees can enhance this deductibility while promoting a robust health plan.

The 1.5 medical rule in Hawaii refers to the requirement that employers must provide health insurance for employees who work 20 or more hours per week. This statute stipulates that the employer's contribution must be at least 1.5 times the minimum wage to ensure adequate health coverage. It underscores the importance of employer responsibility in providing health benefits. By utilizing a Hawaii Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, businesses can effectively navigate these regulations.

Yes, an employee in Hawaii can waive health insurance, but there are specific conditions that apply. An employee must be given the option to opt-out of coverage when the employer presents it. This waiver should be documented properly to comply with state regulations. A Hawaii Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees can streamline the process of managing such waivers and ensuring compliance.

The Hawaii PHC Act, or Prepaid Health Care Act, mandates employers to provide health insurance to eligible employees. It establishes guidelines for health insurance coverage and specifies minimum benefit requirements. Employers need to understand their responsibilities under this Act to avoid penalties. Implementing a Hawaii Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees can be a strategic solution for managing these obligations.

The Native Hawaiian Health Care Improvement Act is a federal law aimed at improving the health status of Native Hawaiians. It provides funding for health programs that focus on the unique health needs of this community. This Act seeks to enhance preventive, educational, and medical services. For businesses, a Hawaii Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees may also help address the needs of Native Hawaiian employees effectively.

The Hawaii Prepaid Health Care Act statute is a law that requires employers in Hawaii to provide health insurance benefits to employees. Under this statute, employers must offer medical care that meets certain criteria. This ensures that employees have access to necessary medical services. A Hawaii Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees can offer an employer a structured approach to comply with this law while managing costs.