Hawaii Non-Disclosure Agreement for Potential Investors

Description

How to fill out Non-Disclosure Agreement For Potential Investors?

Are you currently in a position where you require documents for both corporate or personal purposes almost every day.

There are numerous legal document templates available online, but locating ones you can trust is not easy.

US Legal Forms provides thousands of form templates, including the Hawaii Non-Disclosure Agreement for Potential Investors, which are designed to comply with federal and state regulations.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Hawaii Non-Disclosure Agreement for Potential Investors template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct city/state.

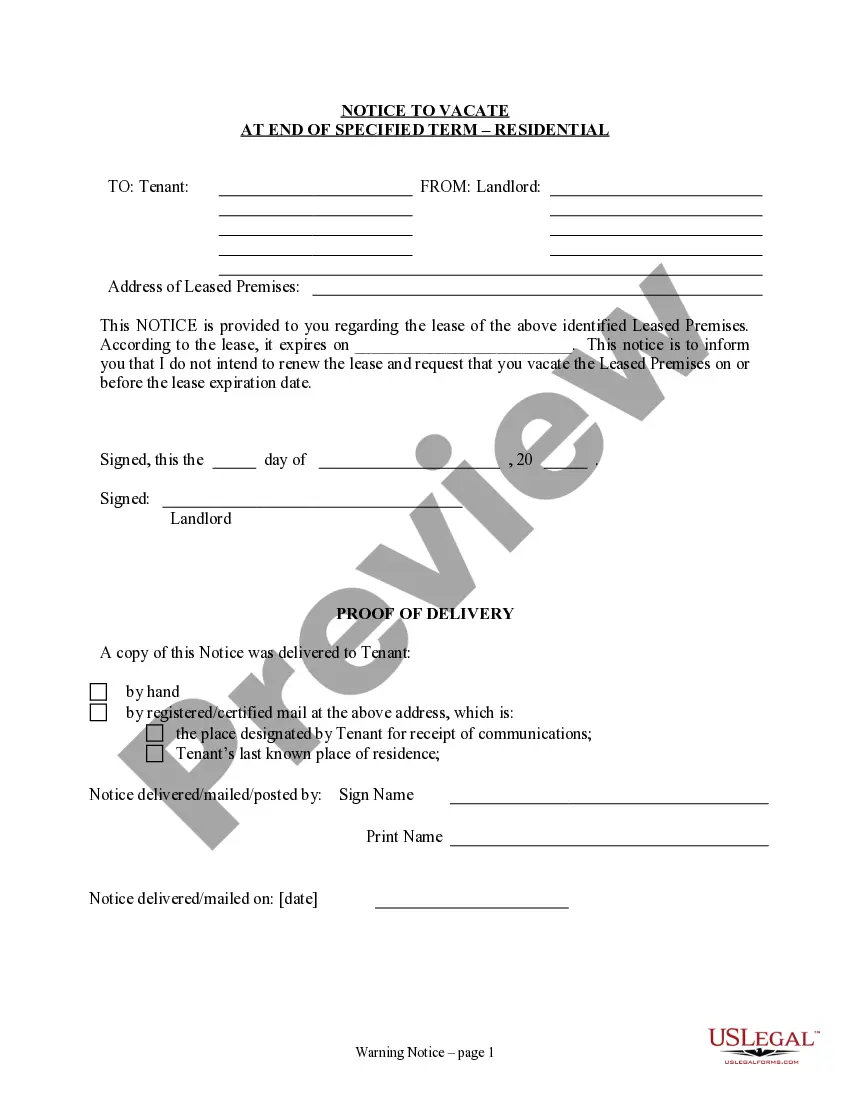

- Use the Review button to examine the form.

- Read the description to confirm you have selected the proper form.

- If the form is not what you seek, use the Search field to find the form that suits your needs and requirements.

- Once you find the appropriate form, click on Purchase now.

Form popularity

FAQ

To properly fill out a non-disclosure agreement, begin by reviewing each section carefully. Include details about what constitutes confidential information, the obligations of the parties, and any exclusions. Consider using the Hawaii Non-Disclosure Agreement for Potential Investors available on uslegalforms, which provides a structured approach and helps you ensure that all critical information is captured consistently.

Filling out a non-disclosure agreement involves several key steps. First, clearly define the parties involved and the confidential information to be protected. Next, specify the duration of the agreement. When using a Hawaii Non-Disclosure Agreement for Potential Investors, follow the prompts provided in the template to ensure you include all essential components.

Yes, you can write your own non-disclosure agreement. However, it's essential to ensure that it covers all necessary aspects to protect your interests. Using a customizable template like the Hawaii Non-Disclosure Agreement for Potential Investors from uslegalforms can simplify the process by providing clear guidance and legal framework, making sure you don't miss critical elements.

disclosure statement serves to protect confidential information shared between parties. For instance, if you are discussing a business opportunity with potential investors in Hawaii, you might use a Hawaii NonDisclosure Agreement for Potential Investors. This agreement ensures that sensitive details about your venture remain private, thus fostering trust and encouraging open communication.

Creating a Hawaii Non-Disclosure Agreement for Potential Investors involves a few key steps. First, clearly define the information that needs protection, such as business plans or financial data. Next, outline the obligations of both parties regarding confidentiality. To simplify this process, consider using the uslegalforms platform, which provides customizable templates specifically designed for non-disclosure agreements tailored to Hawaii's legal standards.

In most cases, a non-disclosure agreement does not need to be notarized to be legally binding. However, notarization can provide an additional layer of authenticity and can be beneficial in disputes. When dealing with a Hawaii Non-Disclosure Agreement for Potential Investors, it might be wise to consult a legal expert to determine your specific needs. This guidance can help you navigate the requirements of your agreement more effectively.

Yes, you can create your own non-disclosure agreement tailored to your needs. However, drafting a comprehensive Hawaii Non-Disclosure Agreement for Potential Investors requires careful consideration of legal language and specific terms. If you're unsure how to proceed, using a platform like USLegalForms can simplify the process. Their templates ensure you cover all necessary points to protect your interests effectively.

The three primary types of Non-Disclosure Agreements include unilateral, bilateral, and multilateral agreements. A unilateral NDA involves one party sharing information while the other party agrees to keep it confidential. In contrast, a bilateral NDA involves mutual exchange of sensitive information between two parties. Multilateral agreements involve three or more parties sharing confidential information, often requiring detailed clauses to protect all interests.

A Hawaii Non-Disclosure Agreement for Potential Investors is essential when you wish to protect sensitive business information. When sharing your ideas or plans with potential investors, an NDA ensures that they cannot disclose or misuse your information. This protective measure fosters trust and encourages open communication during discussions. Without an NDA, your business strategies remain vulnerable.

A Hawaii Non-Disclosure Agreement for Potential Investors is a legal document that ensures confidentiality when discussing sensitive business information with potential investors. This agreement protects proprietary data, trade secrets, and other critical information during investment negotiations. It establishes trust and clarity between parties and helps prevent misuse of shared information. By utilizing this agreement, you safeguard your ideas while exploring funding opportunities.