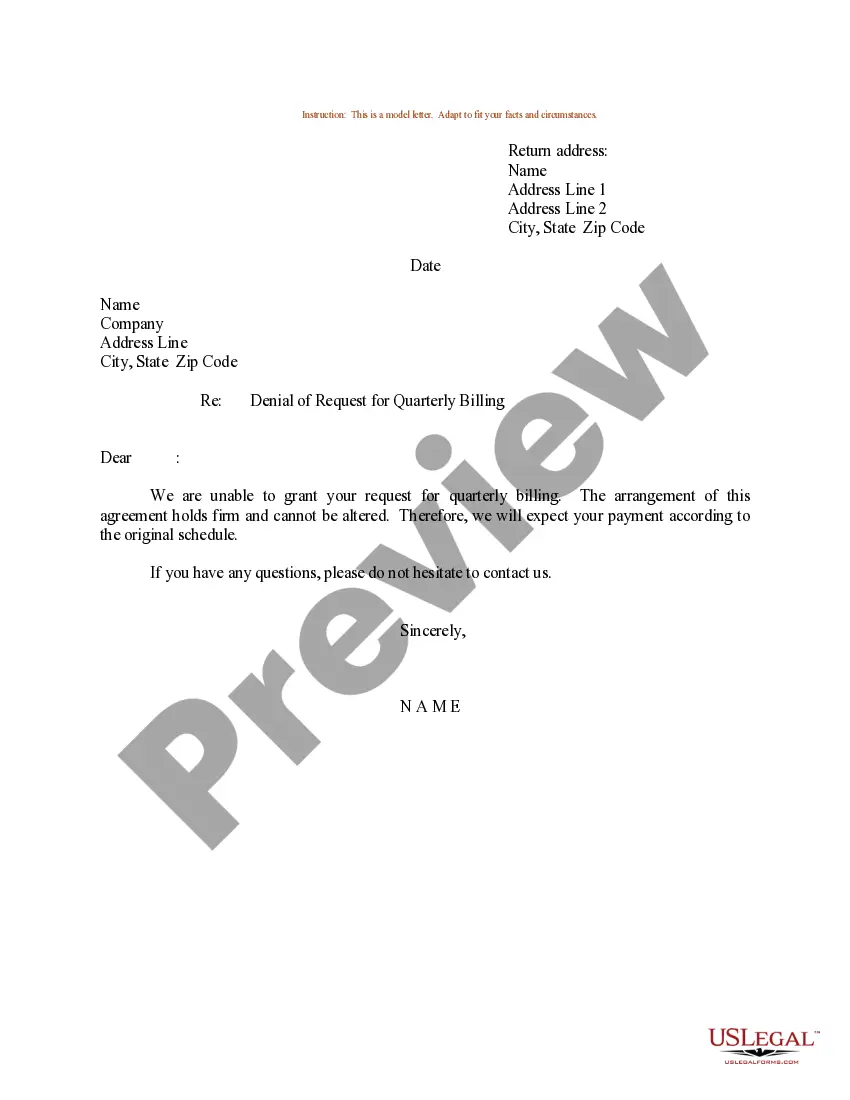

Hawaii Sample Letter for Denial of Request for Quarterly Billing

Description

How to fill out Sample Letter For Denial Of Request For Quarterly Billing?

It is feasible to allocate time on the Internet seeking the legal document template that complies with the federal and state stipulations you will require. US Legal Forms offers a multitude of legal forms that are verified by professionals.

It is straightforward to download or print the Hawaii Sample Letter for Denial of Request for Quarterly Billing from our service.

If you currently possess a US Legal Forms account, you can Log In and then click the Obtain button. After that, you can complete, modify, print, or sign the Hawaii Sample Letter for Denial of Request for Quarterly Billing. Each legal document template you acquire is yours to keep indefinitely.

Complete the transaction. You can use your Visa, Mastercard, or PayPal account to pay for the legal document. Choose the format of the file and download it to your device. Make edits to your document if needed. You can complete, modify, sign, and print the Hawaii Sample Letter for Denial of Request for Quarterly Billing. Access and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document template for the location/area of your choice. Review the form description to confirm you have selected the right one.

- If available, utilize the Preview button to examine the document template as well.

- If you wish to obtain an additional version of the form, utilize the Search field to locate the template that fits your needs and requirements.

- Once you have found the template you need, click on Purchase now to proceed.

- Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

The G49 form is used for reporting other types of income and adjustments in Hawaii. It is typically filed in conjunction with your individual tax return filings. Accurate completion of this form is essential to ensure that all income is reported correctly. If you encounter challenges, refer to a Hawaii sample letter for denial of request for quarterly billing to outline your issues effectively.

The N11 form in Hawaii is used by residents to file individual income tax returns. This simplified form is suitable for those with straightforward tax situations, making it easier to report income and claim deductions. To ensure accuracy, review your information carefully before submission. If you receive any notices regarding your return, a Hawaii sample letter for denial of request for quarterly billing can help clarify your position.

Filing Hawaii N-15 involves a few straightforward steps. First, you need to download the N-15 form from the Hawaii Department of Taxation website or use a reliable tax service. Fill out the form accurately, ensuring all income and deductions are reported correctly. If you have questions during the process, a Hawaii sample letter for denial of request for quarterly billing can guide you on communicating with the tax department.

Yes, you can file your Hawaii state tax online using various e-filing services, including the official Hawaii Department of Taxation website. This method allows you to submit your return quickly and securely while receiving immediate confirmation. Make sure to have all your financial information ready to ensure a smooth filing process. Additionally, if you encounter any issues, having a Hawaii sample letter for denial of request for quarterly billing can be beneficial.

To file an amended Hawaii tax return, you should start by completing Form N-20 or N-15, depending on your original return type. Ensure you provide all necessary documentation that supports your amendments. The submission should be sent to the appropriate tax office along with any required payment or documentation. Using a Hawaii sample letter for denial of request for quarterly billing can also help clarify any outstanding issues with your tax request.