Hawaii Letter regarding trust money

Description

How to fill out Letter Regarding Trust Money?

If you need to aggregate, acquire, or print legal document templates, use US Legal Forms, the largest selection of legal forms available online.

Utilize the site’s user-friendly and convenient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories, states, or keywords.

Step 5. Complete the transaction. You may use your credit card or PayPal account to process the payment.

Step 6. Choose the format of the legal document and download it to your device. Step 7. Fill out, modify, and print or sign the Hawaii Letter concerning trust funds.

- Use US Legal Forms to obtain the Hawaii Letter concerning trust funds in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to get the Hawaii Letter concerning trust funds.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the appropriate city/state.

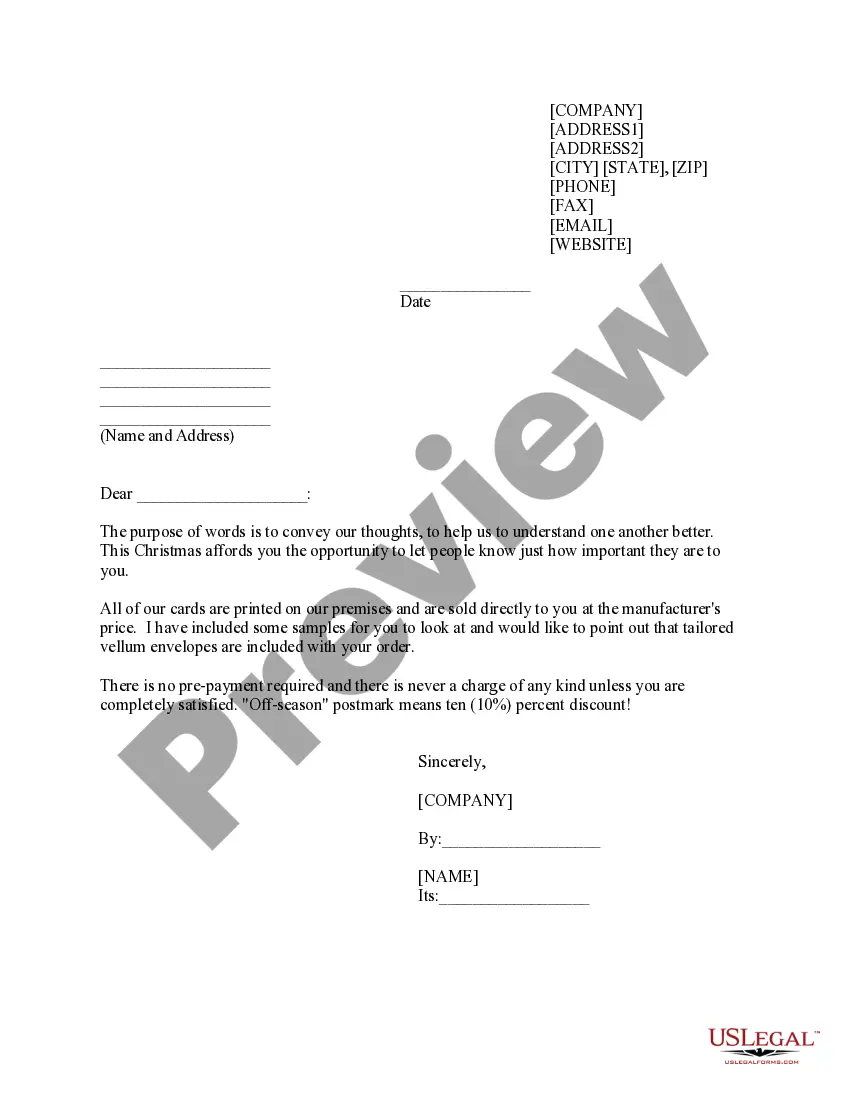

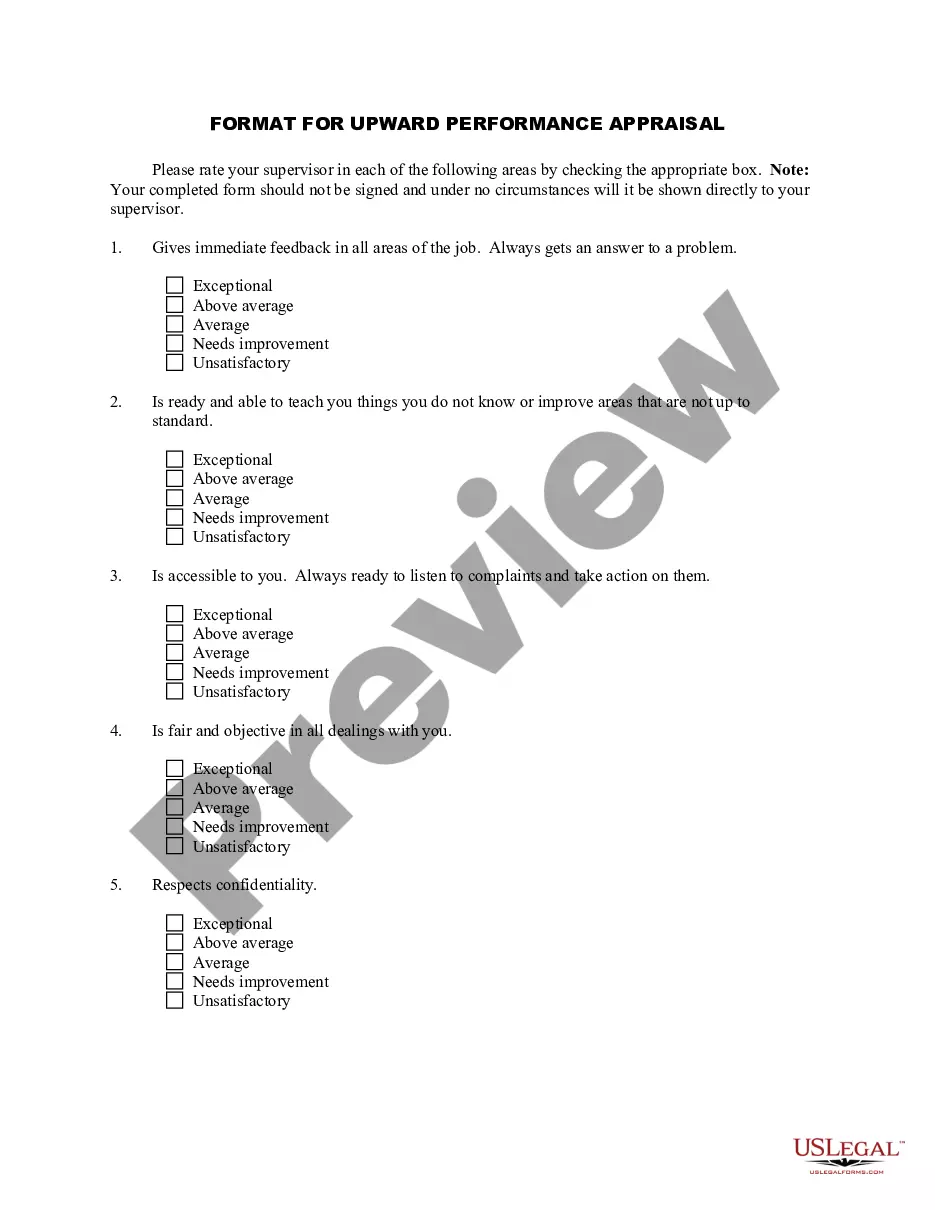

- Step 2. Use the Preview option to review the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, select the Get now button. Choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

If the trust fund is cash only, trust fund distribution involves writing checks to beneficiaries. Real estate is deeded out of the trust and into the names of beneficiaries. Stocks and bonds can be transferred from the trust into the beneficiary's brokerage accounts.

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

Outright - Outright distributions make Trust asset distribution easy and tend to have nominal fees. In this case, assets are simply given without any restrictions to the beneficiaries upon the death of the Trust creator (once all the estate's debts and taxes are paid).

The grantor can set up the trust, so the money distributes directly to the beneficiaries free and clear of limitations. The trustee can transfer real estate to the beneficiary by having a new deed written up or selling the property and giving them the money, writing them a check or giving them cash.

The federal gift tax law provides that every person can give a present interest gift of up to $14,000 each year to any individual they want. This means that each parent can each give each of their children and grandchildren $14,000 (two parents permits a total gift per recipient of $28,000).

How Can I Get My Money Out of a Trust?Create a Revocable Trust. There are revocable and irrevocable living trusts.List Your Rights. Spell out your right to withdraw money in the trust documents.Name Yourself a Trustee. Put the name of the trust, with yourself as trustee, on the ownership documents.Transfer Your Assets.

If you have a revocable trust, you can get money out by making a request via the trustee. Should you yourself be listed as the trustee, you'll be able to transfer funds and assets out of the trust as you see fit.

Distribution of Trust Assets to Beneficiaries Beneficiaries may have to wait between 1 to 2 years to get inheritance money or assets from the trust. Then disbursement is made based on the grantor's wishes when he/she set up the trust.

Trusts can help your heirs avoid a lengthy and expensive probate process after you pass away. You can also arrange gifts of money or property per your instructions to the trustee.

Reference the name of the irrevocable trust, and the trust account number if applicable. Write a salutation followed by a colon. Identify yourself as a beneficiary of the irrevocable trust in the body of the letter. State that you are requesting money from the trust, and the reason for the request.