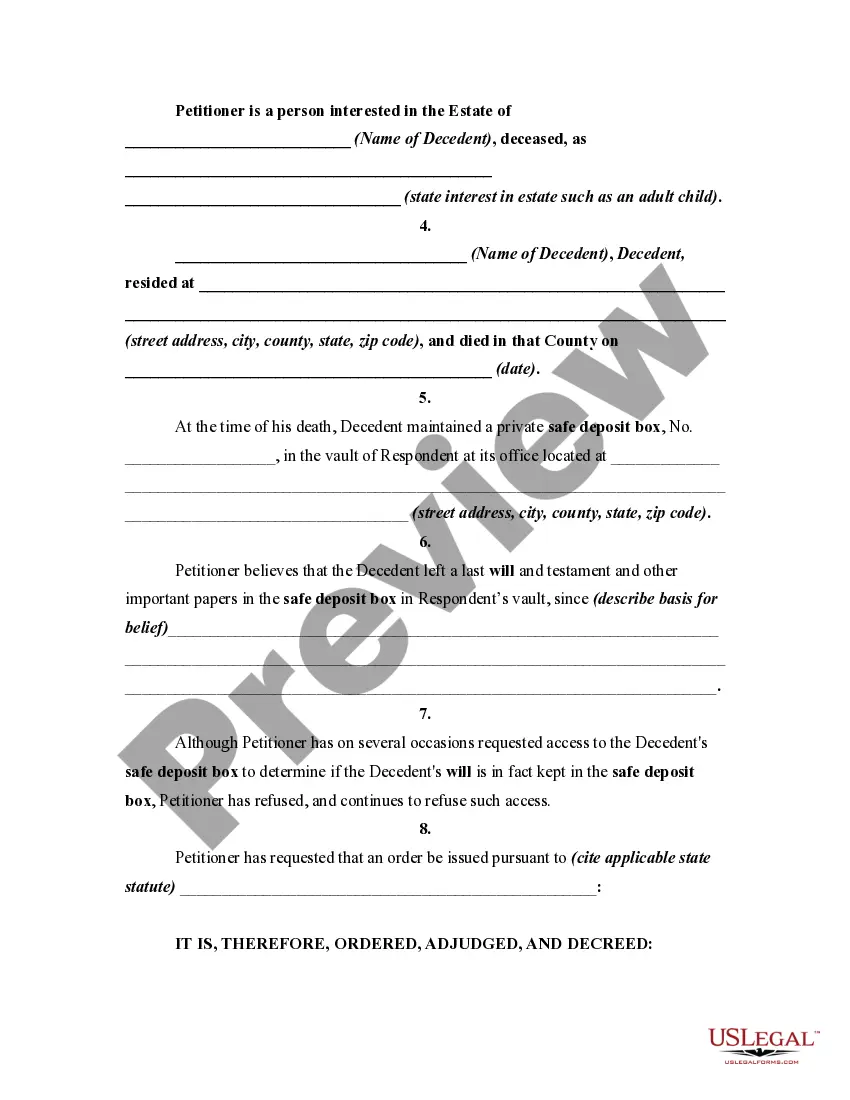

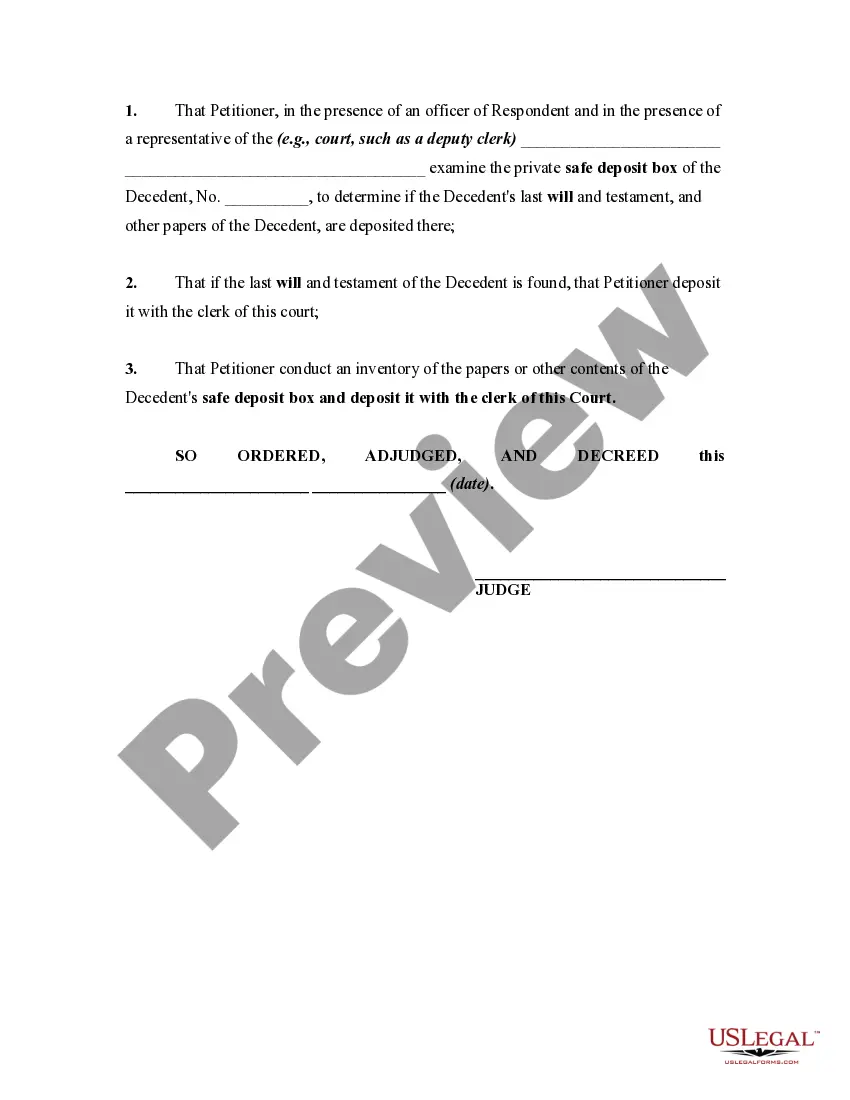

This order goes along with a petition for an order to open a safe deposit box of a decedent. Whether your will should be in a safe deposit box at a bank or elsewhere, such as with your attorney, depends on what your state law says about who has access to your safe deposit box when you die. The recent trend in many states is to make it relatively easy for family members or the executor to remove the will and certain other documents (such as life insurance policies and burial instructions) from a deceased person's safe deposit box. In those states, it might be a good idea to leave your will in the safe deposit box. However, in some states, it may require a court order to remove the will, which can take time and money.

Hawaii Order Authorizing Petitioner to Open Safe Deposit Box of Decedent

Description

How to fill out Order Authorizing Petitioner To Open Safe Deposit Box Of Decedent?

Choosing the right authorized document template might be a struggle. Of course, there are a lot of layouts available on the net, but how can you find the authorized type you want? Take advantage of the US Legal Forms website. The services gives 1000s of layouts, including the Hawaii Order Authorizing Petitioner to Open Safe Deposit Box of Decedent, which you can use for organization and personal demands. All the types are checked out by pros and fulfill federal and state needs.

If you are previously registered, log in in your accounts and click the Download button to obtain the Hawaii Order Authorizing Petitioner to Open Safe Deposit Box of Decedent. Make use of your accounts to look with the authorized types you have purchased in the past. Proceed to the My Forms tab of your respective accounts and have one more version of the document you want.

If you are a fresh customer of US Legal Forms, listed below are simple directions for you to follow:

- Initial, make sure you have chosen the correct type for your personal city/county. It is possible to look through the form while using Preview button and look at the form information to make sure this is the right one for you.

- In case the type fails to fulfill your needs, take advantage of the Seach area to obtain the correct type.

- Once you are sure that the form is acceptable, click on the Get now button to obtain the type.

- Pick the prices plan you desire and enter in the essential info. Make your accounts and buy your order with your PayPal accounts or Visa or Mastercard.

- Select the document format and down load the authorized document template in your gadget.

- Full, revise and printing and signal the obtained Hawaii Order Authorizing Petitioner to Open Safe Deposit Box of Decedent.

US Legal Forms will be the biggest local library of authorized types in which you will find a variety of document layouts. Take advantage of the service to down load professionally-made documents that follow condition needs.

Form popularity

FAQ

A safe deposit box may be owned as an individual or jointly. You may want to own one with your spouse, children, or a close family member. During your lifetime, your safe deposit box can be accessed by you, a joint owner, or a Deputy designee.

If the signers are spouses and the contents are considered their community property, the survivor likely owns the contents. However, for joint signers who are not spouses, whether or not the survivor owns the contents is unclear.

After the separation gets nasty, one spouse could simply access the safe, take the money, and then deny the money was ever there in the first place. Unlike your local bank, a safety deposit box does not make records of who accessed the money and when.

Most banks who offer safety boxes offer to lease them in joint tenancy form, with their lease provisions providing that all the joint tenants have: Not only access to the contents of the box regardless of whether any of them has died. But also the right to remove its contents.

You cannot pass a safe deposit box key to anyone. Only the owner of the safe deposit box has legal access to it. The bank will not allow this at all. You must sign a record of entry, date and time.

A person can place just about anything that will fit in a safe deposit box in one. Holders of these boxes are granted complete privacy by the financial institutions where they're located. Someone could store cash, jewelry and other valuables, savings bonds, deeds to property and information about an inheritance there.

Can a safety deposit box be traced? Yes, this can happen only on rare occasions when a safety deposit box owner is suspected of a crime or dies. A safe deposit box is an essential feature in everyone's financial life.

You'll be left alone in private in the vault when you use your safety deposit box. As such, the bank won't know what you put inside your safety deposit box. Banks also won't vet your items which is another reason why safety deposit boxes aren't insured. The bank doesn't even know what valuables are kept inside.