Are you presently inside a position that you need to have paperwork for both organization or person uses virtually every day time? There are a lot of lawful file layouts available on the net, but finding kinds you can trust isn`t effortless. US Legal Forms delivers a large number of develop layouts, such as the Hawaii Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company, which can be composed to fulfill federal and state requirements.

If you are currently informed about US Legal Forms internet site and possess an account, just log in. Next, it is possible to down load the Hawaii Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company design.

Unless you have an account and need to start using US Legal Forms, adopt these measures:

- Discover the develop you require and ensure it is for your appropriate city/state.

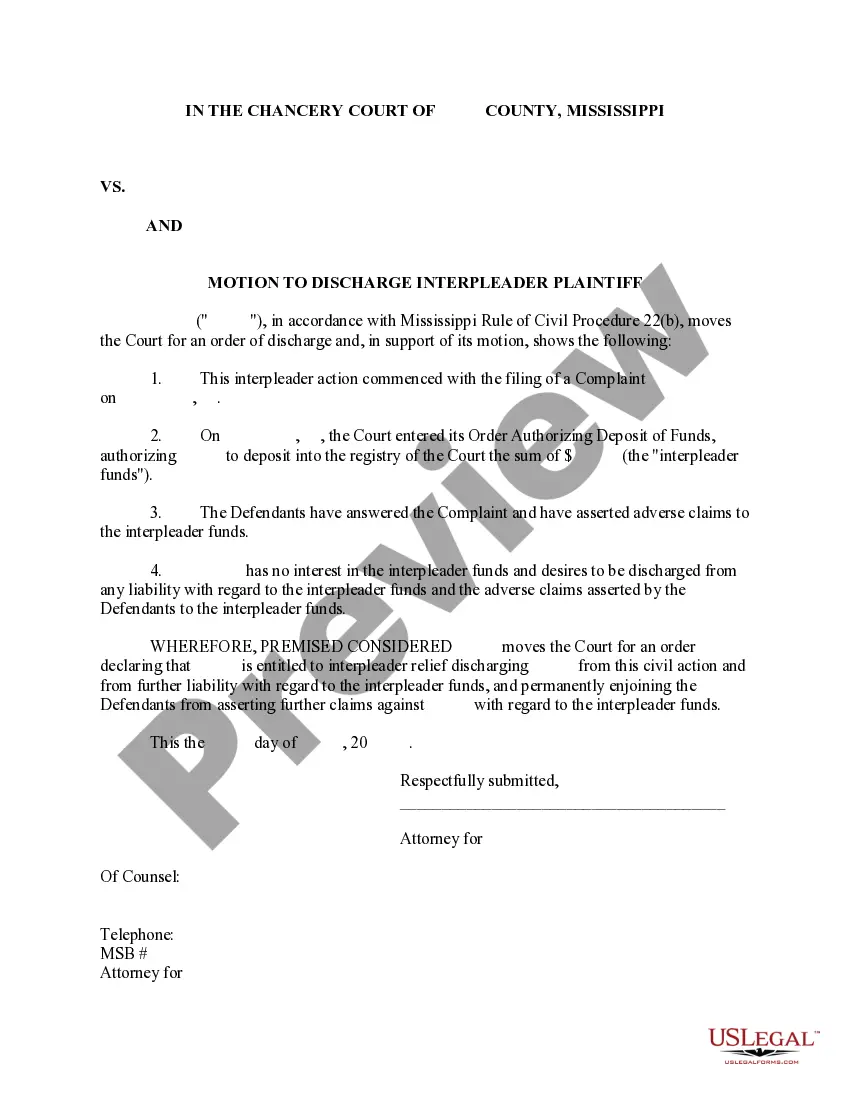

- Take advantage of the Review option to analyze the shape.

- Browse the description to ensure that you have selected the correct develop.

- In the event the develop isn`t what you are looking for, take advantage of the Lookup area to obtain the develop that fits your needs and requirements.

- If you obtain the appropriate develop, click on Acquire now.

- Pick the prices prepare you desire, fill in the required info to create your money, and purchase an order making use of your PayPal or charge card.

- Decide on a handy file structure and down load your backup.

Locate every one of the file layouts you have bought in the My Forms food selection. You can get a extra backup of Hawaii Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company any time, if possible. Just click the required develop to down load or print the file design.

Use US Legal Forms, the most substantial variety of lawful types, to save some time and steer clear of errors. The assistance delivers professionally made lawful file layouts that you can use for a variety of uses. Make an account on US Legal Forms and begin making your lifestyle a little easier.