This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

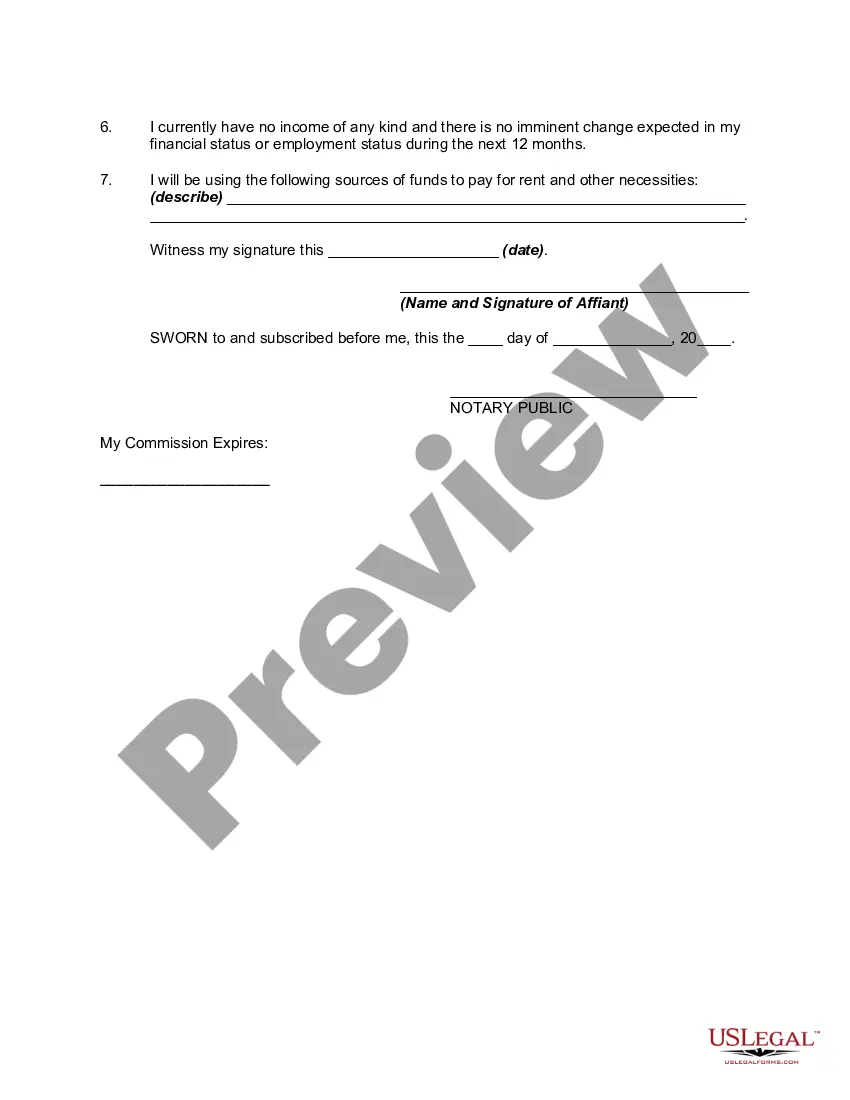

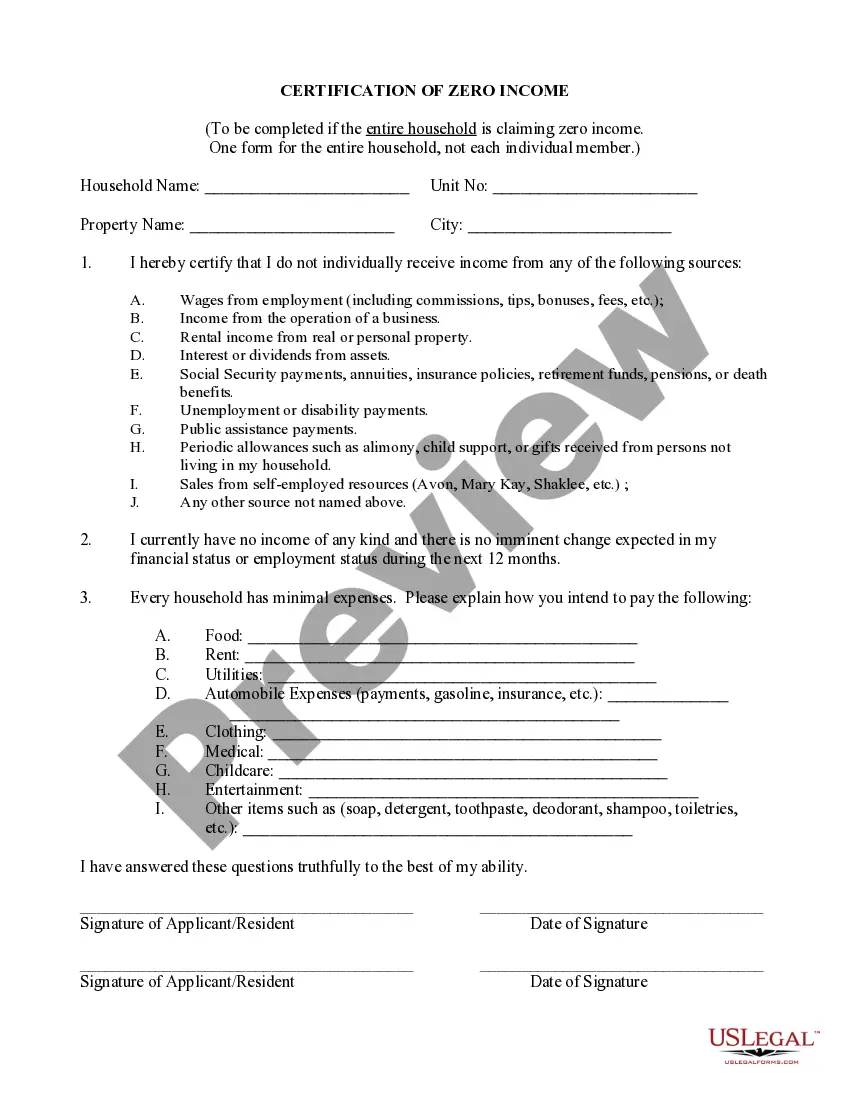

Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities

Description

How to fill out Affidavit Or Proof Of No Income - Unemployed - Assets And Liabilities?

Locating the appropriate legal document template can be somewhat challenging.

Of course, there are numerous templates available online, but how do you secure the legal form you require.

Utilize the US Legal Forms website. The platform offers a plethora of templates, such as the Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, that can be employed for both business and personal purposes.

If the form does not meet your requirements, utilize the Search field to find the appropriate document. Once you are confident the form is suitable, click the Purchase now button to obtain it. Select the pricing plan you wish and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, and print and sign the acquired Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities. US Legal Forms is the largest repository of legal documents where you can find various document templates. Take advantage of this service to download professionally crafted paperwork that meets state requirements.

- All documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities.

- Use your account to browse the legal forms you have previously purchased.

- Go to the My documents section of your account to retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and examine the form description to ensure this is indeed the right one for you.

Form popularity

FAQ

The G-45 form is used for reporting estimated monthly or quarterly tax liabilities, while the G-49 form is used to report annual income tax information for independent contractors. Both forms serve distinct purposes in maintaining compliance with Hawaii tax laws. Understanding how each applies, particularly when dealing with a Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, is important for your financial health.

Filing G-45 in Hawaii involves providing a report of your gross income for the quarter and calculating your tax liability. You'll need to submit this form by the required deadlines to avoid penalties. If you find yourself submitting a Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, consider reaching out for guidance on accurately completing your G-45.

Eligibility for the Hawaii Food credit typically extends to low-income individuals and families who meet specific income requirements. This program helps alleviate food costs, which can be beneficial if you are unemployed. If you're preparing a Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, you may qualify for support that eases your financial burden.

To file a G-45 form in Hawaii, you need to report your estimated income and calculate your tax liabilities quarterly. This form is crucial for businesses wanting to stay compliant with tax obligations. If you are self-employed and have a Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, ensure your earnings, or lack thereof, are accurately reflected in your filing.

Any individual or entity receiving income in Hawaii that exceeds the filing thresholds is required to file a state tax return. This includes residents and non-residents earning income from Hawaii sources. If you find yourself in a situation where you've submitted a Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, know that you might still have to submit, depending on your unique circumstances.

Yes, Hawaii allows taxpayers to file their state tax returns electronically using approved e-filing software. E-filing can be an efficient way to submit your documentation, including any Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities you may need to provide. Look for compliant software that is easy to navigate and ensures a smooth filing experience.

Non-residents in Hawaii typically use Form N-15 to file their state income tax return. This form allows non-residents to report income earned within the state. If you're a non-resident and need to submit a Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, ensure that you report only the income that applies to your situation.

Form N-356 is the Hawaii tax form required for claiming a tax refund for overpayment of income taxes. If you believe you have overpaid after filing a Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, be sure to utilize this form to potentially recoup those funds. Filing accurately can provide you with additional financial relief.

Yes, Hawaii does require the filing of Form 1099 for certain payments made to independent contractors and service providers. These forms must be submitted to both the state and federal tax agencies. If you are preparing a Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, it’s crucial to keep accurate records for any 1099 income reported.

To file an amended Hawaii tax return, use Form N-101A. Complete the form with your corrected information and submit it to the Hawaii Department of Taxation. If you have submitted a Hawaii Affidavit or Proof of No Income - Unemployed - Assets and Liabilities previously, ensure your amendments align correctly with your updated financial status.