This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii Agreement to Renew Trust Agreement

Description

How to fill out Agreement To Renew Trust Agreement?

You can dedicate hours online trying to locate the proper legal template that complies with state and federal standards you require.

US Legal Forms offers thousands of legal templates vetted by professionals.

You can effortlessly download or print the Hawaii Agreement to Renew Trust Agreement from my support.

To find another version of the template, use the Search section to locate the format that suits your needs and specifications.

- If you already possess a US Legal Forms account, you can sign in and press the Download button.

- After that, you can complete, modify, print, or sign the Hawaii Agreement to Renew Trust Agreement.

- Every legal template you receive is your own property permanently.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct template for your state/area of choice.

- Review the form summary to confirm you have chosen the appropriate document.

Form popularity

FAQ

In Hawaii, certain types of income are not taxed, such as gifts received, inheritances, and qualified distributions from certain retirement accounts. Additionally, capital gains from the sale of specific types of properties may not be taxable. Understanding these exemptions can provide valuable relief for trust stakeholders. For those looking to navigate Hawaii's tax landscape, the Hawaii Agreement to Renew Trust Agreement can serve as a strategic tool.

States that do not tax trust income include Alaska, Florida, Nevada, and South Dakota, among others. These states create a more favorable environment for asset growth within trusts. It's important to note that laws can change, so regularly reviewing state regulations is wise. If you're considering the benefits of a Hawaii Agreement to Renew Trust Agreement in relation to your income tax obligations, you may find a consultation helpful.

To set up a living trust in Hawaii, begin by creating the trust document, which outlines the terms of the trust. It is essential to include a Hawaii Agreement to Renew Trust Agreement to ensure the trust can be properly administered. After drafting, funding the trust with your assets is crucial to activate its benefits. You may want to work with an attorney or use trusted platforms like USLegalForms for additional support.

Yes, Hawaii does tax trust income at both the state and federal levels. The tax rate varies based on the amount of income generated by the trust. However, understanding the specific tax obligations for a trust in Hawaii can be complicated. Consulting with a tax professional or using the Hawaii Agreement to Renew Trust Agreement may help clarify these duties.

To record a trust in Hawaii, you must prepare a trust agreement that meets state requirements. After drafting the Hawaii Agreement to Renew Trust Agreement, you should consider recording the document with the Bureau of Conveyances for greater legal recognition. This process helps establish public notice of the trust and its terms. For detailed guidance, consider utilizing the resources available at USLegalForms.

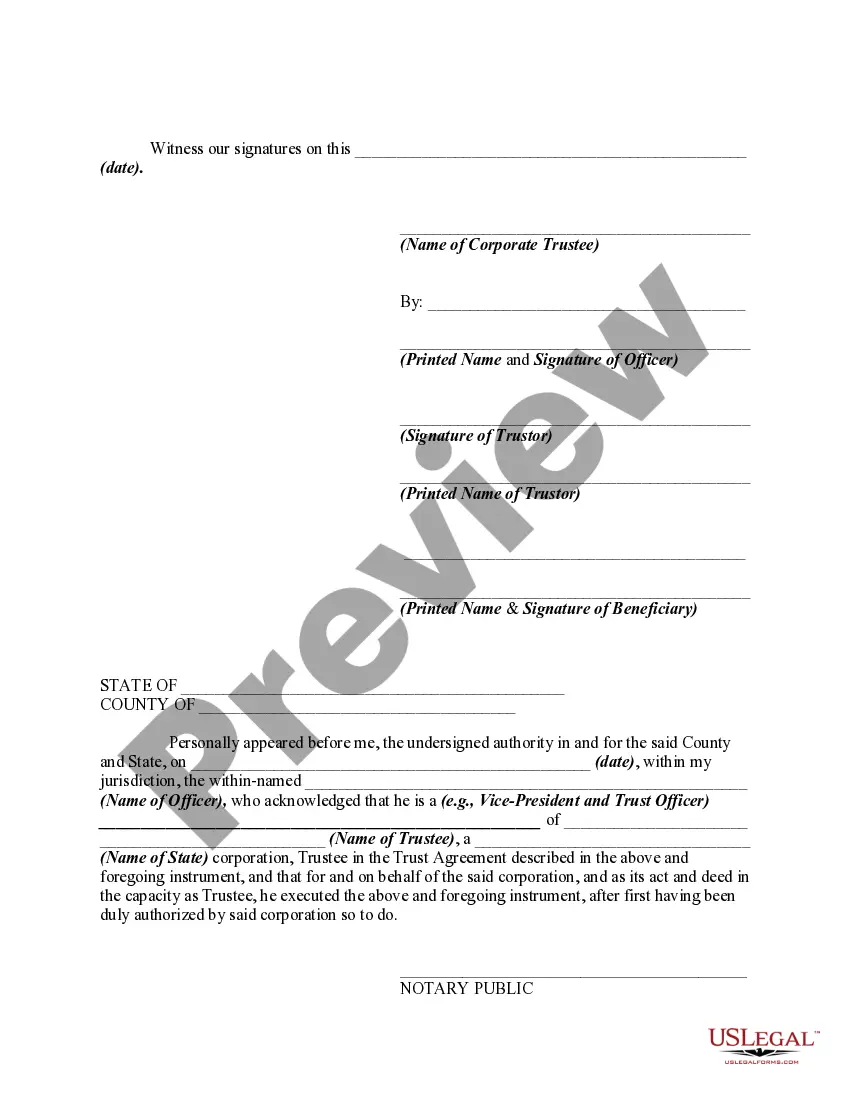

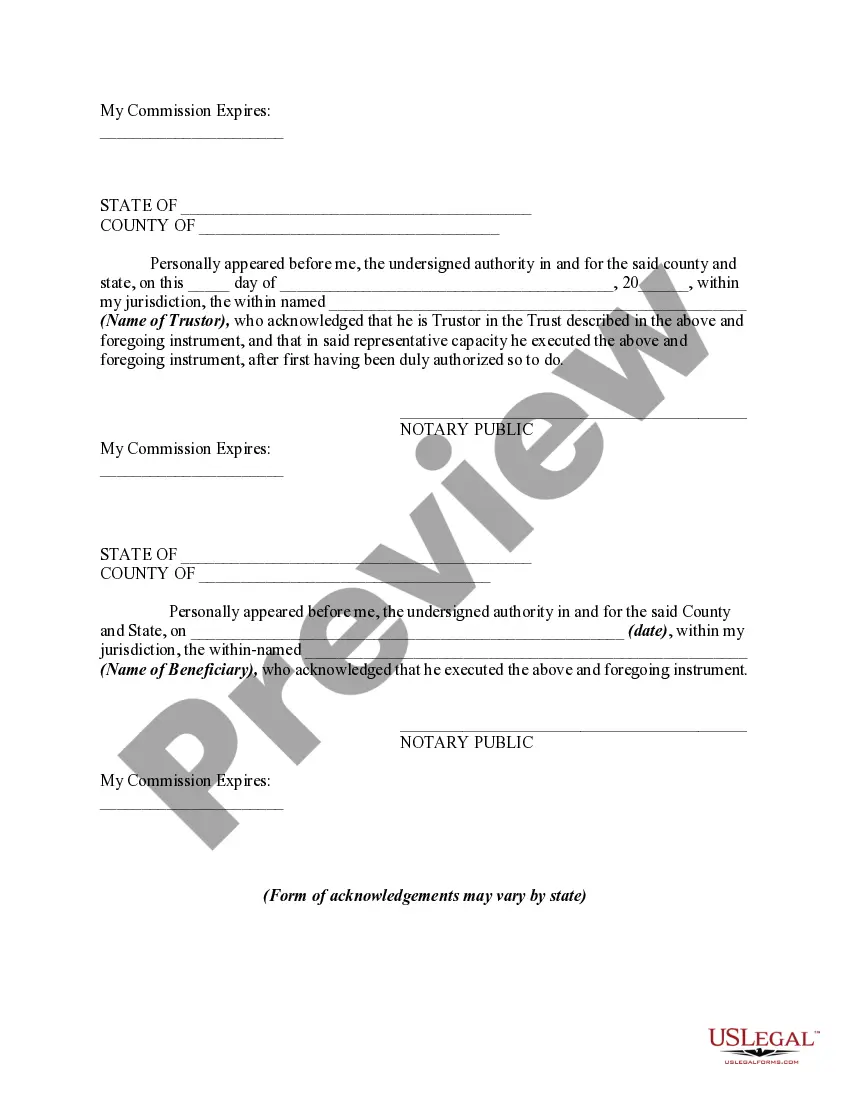

Yes, a trust generally needs to be notarized in Hawaii for it to be legally recognized. Notarization helps validate your Hawaii Agreement to Renew Trust Agreement, ensuring that your wishes are documented properly. While some informal trusts may not require this step, notarizing adds an essential layer of protection against disputes. Always consult legal advice to follow the correct protocols.

Filing the G49 form online in Hawaii is straightforward and often involves visiting the official state website. Once there, you can locate the specific section for filing trust-related documents, including your Hawaii Agreement to Renew Trust Agreement. Completing the process online saves time and creates a paper trail for your records. If you need assistance, platforms like uslegalforms can guide you through the steps.

The N11 form in Hawaii is used for petitions involving the modification of a trust, including its renewal. This form allows individuals to submit necessary changes to their existing Hawaii Agreement to Renew Trust Agreement without significant hassle. It's an important tool for maintaining your trust according to your needs without starting from scratch. Make sure to understand the requirements when utilizing this form.

The form for extending a trust in Hawaii differs based on specific needs, but generally, you'll want to refer to the petition forms available through the state. While the Hawaii Agreement to Renew Trust Agreement is vital, knowing the correct forms to submit can save you time. Always check the latest updated resources or consult a legal expert for clarity in your extension process.

One of the biggest mistakes parents often make when setting up a trust fund is not clearly defining their intentions and wishes. This can lead to confusion among beneficiaries in the long run. An unclear Hawaii Agreement to Renew Trust Agreement might create disputes or misunderstandings later. It's crucial to communicate openly and consider professional guidance to ensure that your trust reflects your goals.