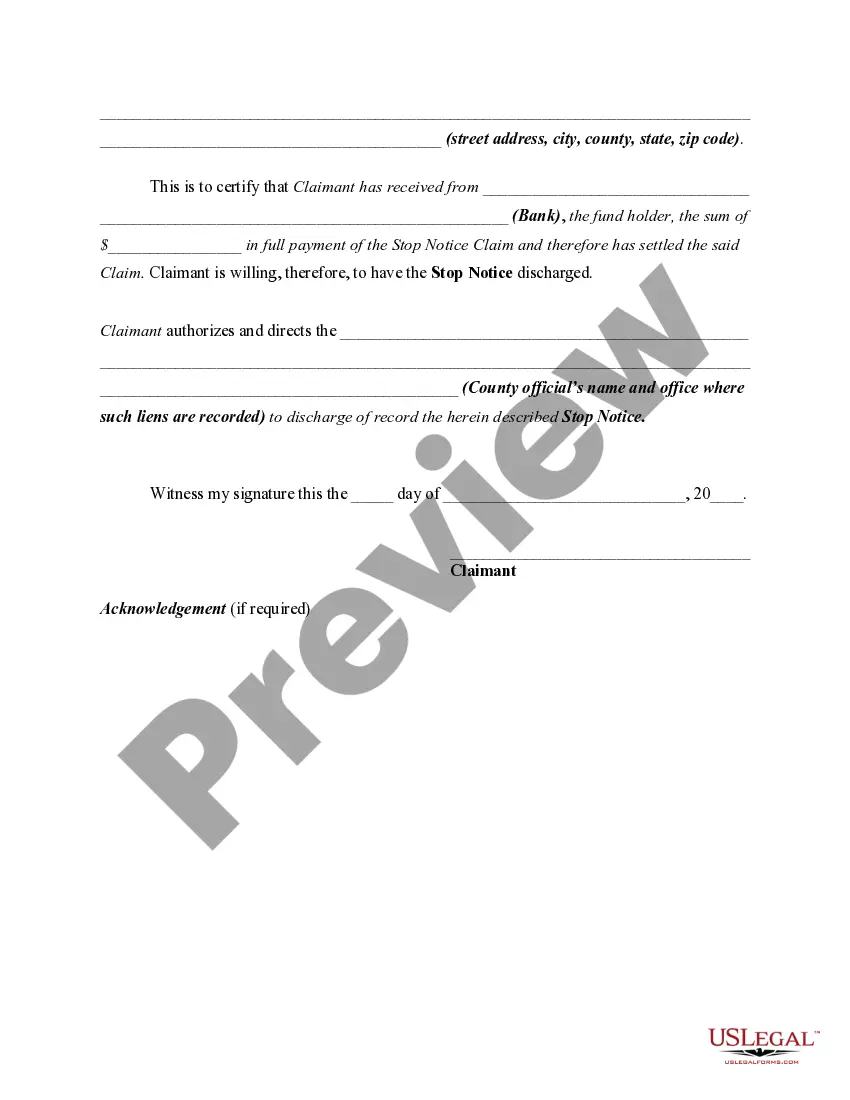

Are you within a situation where you need documents for sometimes organization or person reasons just about every day? There are a variety of legal document layouts available online, but finding kinds you can rely on isn`t effortless. US Legal Forms gives a large number of form layouts, much like the Hawaii Certificate of Satisfaction of Stop Notice Claim or Notice to Withhold Funds, which are published to satisfy state and federal requirements.

When you are presently acquainted with US Legal Forms website and also have an account, basically log in. After that, it is possible to acquire the Hawaii Certificate of Satisfaction of Stop Notice Claim or Notice to Withhold Funds design.

If you do not provide an bank account and wish to begin using US Legal Forms, follow these steps:

- Obtain the form you require and make sure it is for the right area/county.

- Take advantage of the Preview option to analyze the shape.

- See the outline to ensure that you have selected the proper form.

- If the form isn`t what you are seeking, take advantage of the Research area to find the form that meets your requirements and requirements.

- Once you obtain the right form, simply click Purchase now.

- Opt for the rates plan you would like, fill out the specified info to generate your bank account, and pay for your order making use of your PayPal or charge card.

- Choose a practical document formatting and acquire your backup.

Get all of the document layouts you possess purchased in the My Forms menus. You may get a further backup of Hawaii Certificate of Satisfaction of Stop Notice Claim or Notice to Withhold Funds anytime, if necessary. Just click on the required form to acquire or printing the document design.

Use US Legal Forms, by far the most extensive selection of legal varieties, to save efforts and steer clear of errors. The support gives appropriately produced legal document layouts that can be used for an array of reasons. Generate an account on US Legal Forms and initiate making your lifestyle easier.