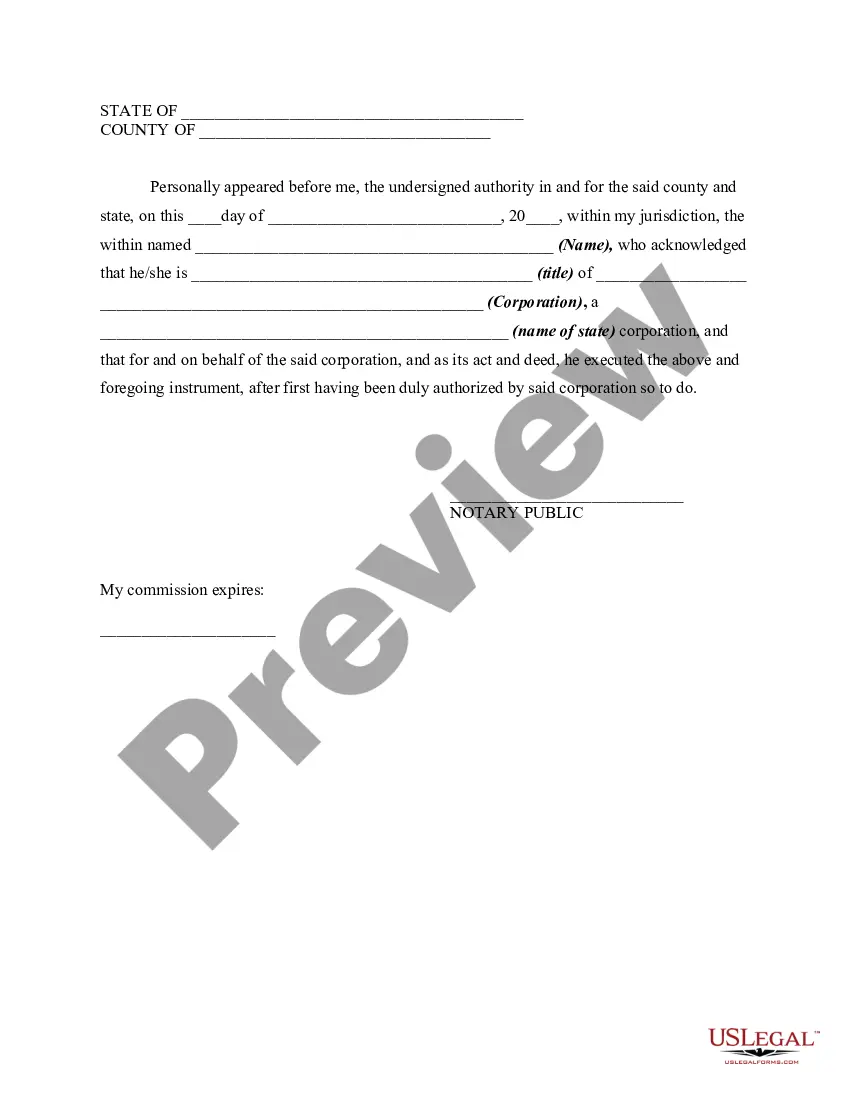

Agency is a relationship based on an agreement authorizing one person, the agent, to act for another, the principal. An agency can be created for the purpose of doing almost any act the principal could do. In this form, a person is being given the authority to collect money for a corporation, the principal.

Title: Understanding the Hawaii Notice to Debtor of Authority of Agent to Receive Payment: Types and Detailed Description Introduction: The Hawaii Notice to Debtor of Authority of Agent to Receive Payment is a crucial legal document that outlines the authority granted to an agent to receive payment on behalf of the creditor. This detailed description explores the purpose, importance, and different types of this notice. 1. General Overview: The Hawaii Notice to Debtor of Authority of Agent to Receive Payment serves to inform debtors about the creditor's authorized agent, empowering them to accept payments on behalf of the creditor. It ensures transparency, clear communication, and compliance within financial transactions in Hawaii. 2. Key Components of the Notice: — Creditor Information: The notice must contain details about the creditor, including their legal business name, mailing address, and contact information. — Agent Information: The authorized agent's full name, address, contact details, and their authority to receive payments on behalf of the creditor. — Debtor Information: The debtor's full name, mailing address, and any specific information relevant to the debt in question. 3. Types of Hawaii Notice to Debtor of Authority of Agent to Receive Payment: a) Standard Notice: This type of notice is used in general debt collection scenarios, authorizing an agent to receive payments on behalf of the creditor. b) Notice for Specific Debts: In cases where a specific debt is assigned to a particular agent or collection agency, this notice ensures the debtor is aware of the authorized agent's authority and where to direct payments. c) Company Restructuring: When a company undergoes restructuring, merging, or acquisition, this notice informs the debtor of any changes to the creditor's authorized agent for payment collection. d) Legal Process Notice: This type of notice is served when a creditor initiates legal proceedings to recover a debt and designates an agent to collect payments as part of the legal process. 4. Importance and Legal Implications: — Clarity and Accountability: The notice provides debtors with clear instructions on where and how to make payments, thus minimizing confusion and ensuring accountability. — Compliance with Debt Collection Laws: By documenting the agent's authority, the notice helps the creditor comply with Hawaii's specific debt collection regulations. — Protection from Unauthorized Collections: Debtors are protected from paying unauthorized entities by verifying the agent's authority through this notice. — Dispute Resolution: The notice assists in resolving payment-related disputes more effectively, as it establishes a record of the authorized agent's involvement. Conclusion: Understanding the Hawaii Notice to Debtor of Authority of Agent to Receive Payment is essential for both creditors and debtors, as it facilitates transparent and lawful debt collection processes. By being aware of the different types and their significance, individuals can ensure compliance and clarity throughout financial transactions in Hawaii.