Hawaii Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out Exchange Addendum To Contract - Tax Free Exchange Section 1031?

Locating the appropriate legal documents template can be challenging.

Naturally, there are numerous designs accessible online, but how do you discover the specific legal type you require.

Utilize the US Legal Forms website. This service offers thousands of designs, such as the Hawaii Exchange Addendum to Contract - Tax Free Exchange Section 1031, suitable for both business and personal purposes.

You can explore the form using the Review option and examine the form outline to ensure it is indeed the correct document for you.

- All templates are reviewed by professionals and comply with federal and state regulations.

- If you are already subscribed, Log In to your account and select the Obtain button to access the Hawaii Exchange Addendum to Contract - Tax Free Exchange Section 1031.

- Utilize your account to review the legal templates you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, make sure you have chosen the correct form for your locality.

Form popularity

FAQ

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind.

A 1031 Exchange allows you to defer paying capital gains tax on the sale of an investment property if you use the proceeds of the sale to acquire a similar replacement property.

Nontaxable Exchanges - A nontaxable exchange is an exchange in which any gain is not taxed and any loss can not be deducted. If you receive property in a nontaxable exchange, its basis is usually the same as the basis of the property you exchanged.

HOW TO REPORT THE EXCHANGE. Your 1031 exchange must be reported by completing Form 8824 and filing it along with your federal income tax return. If you completed more than one exchange, a different form must be completed for each exchange.

Notes and the 1031 ExchangeThough a contract sale can be incorporated in an exchange, it may not be possible to accomplish this goal all the time. In order for a note to be used in an exchange, you, the Exchangor, must not have actual or constructive receipt of the note.

Any rental property sold by those who qualify in accordance with IRS rules as real estate professionals is not considered passive and thus will not be counted as net investment income. The gain deferred in a 1031 exchange is not included in your Adjusted Gross income (AGI) or Net Investment Income (NII).

Potential Drawbacks of a 1031 DST Exchange1031 DST investors give up control.The 1031 DST properties are illiquid.Costs, fees and charges.You must be an accredited investor.You cannot raise new capital in a 1031 DST.Small offering size.DSTs must adhere to strict prohibitions.

The motivation to use a 1031 exchange can be substantial. This is because investor capital that otherwise would be paid as capital gains tax is rolled over as part of the down payment into a replacement property. This provides greater investment benefits than the sold property.

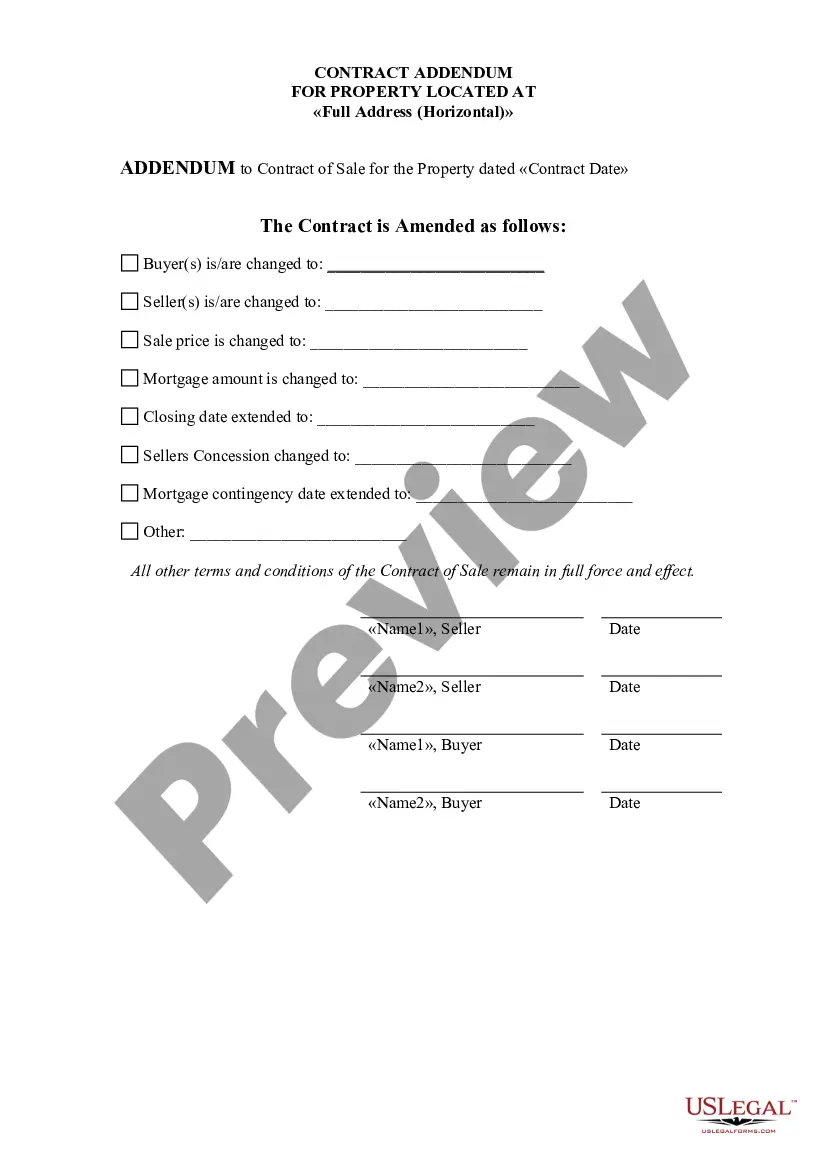

A 1031 addendum will normally clearly show intent to do a 1031 exchange, permit assignment, and advise the other party there will be no expense or liability as a result of the exchange. Sometimes there is cooperation language asserting that both parties to the contract will cooperate with a 1031 exchange.

A 1031 Exchange allows the investment to grow, all while the bulk taxation is deferred. Because there is no limit on how many times an investor can roll over gains from one investment to the next, one is able to profit on each swap and only required to pay tax when property is relinquished without replacement.