Hawaii Agreement Adding Silent Partner to Existing Partnership

Description

How to fill out Agreement Adding Silent Partner To Existing Partnership?

Have you ever been in a location where you require documents for both professional or personal purposes nearly every time.

There are many legal document templates accessible online, but discovering reliable ones is not simple.

US Legal Forms offers a vast array of form templates, such as the Hawaii Agreement Adding Silent Partner to Existing Partnership, which can be tailored to fulfill state and federal standards.

You can find all the document templates you have purchased in the My documents section.

You can obtain another copy of the Hawaii Agreement Adding Silent Partner to Existing Partnership anytime, if necessary. Just click on the needed form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Agreement Adding Silent Partner to Existing Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your correct city/state.

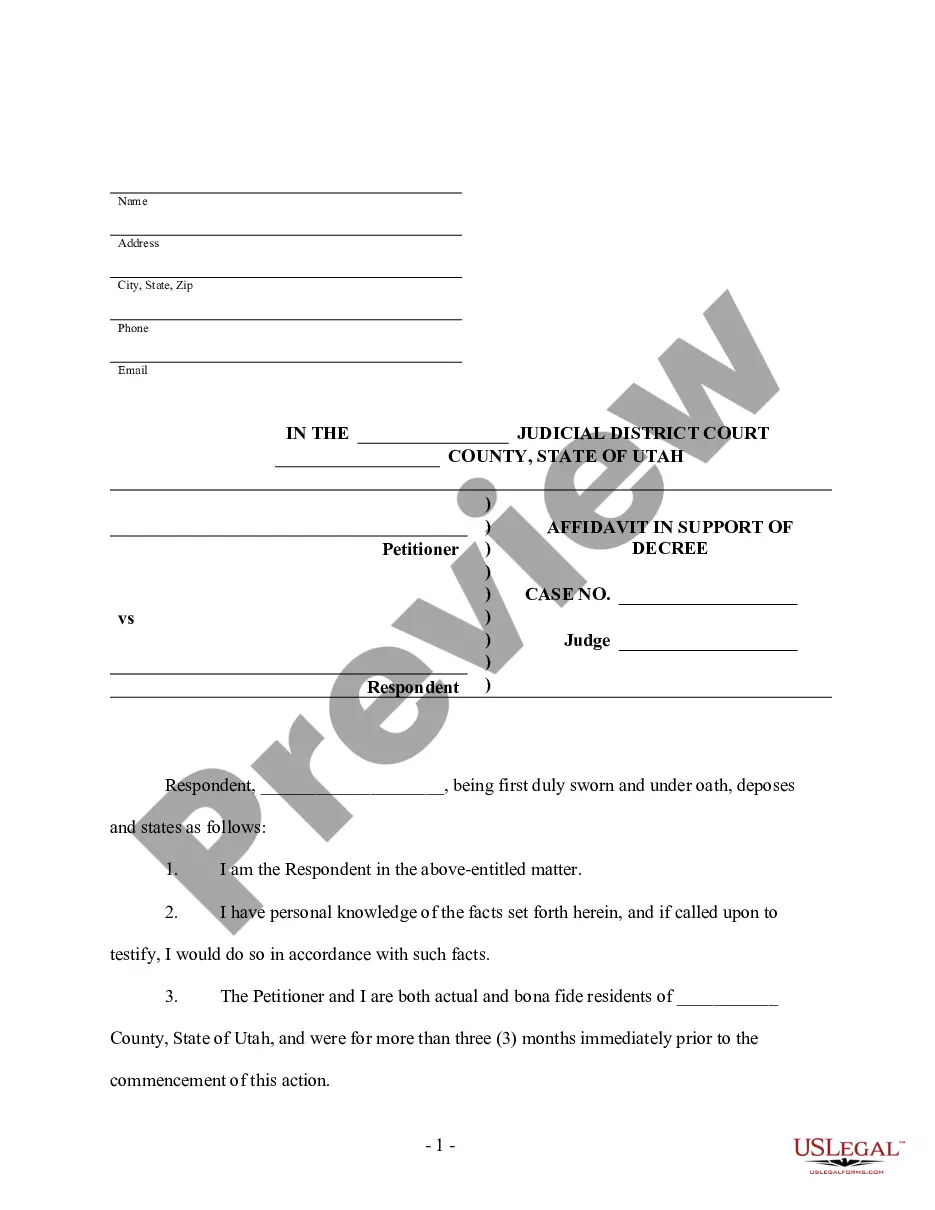

- Utilize the Preview button to inspect the form.

- Review the details to confirm you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and requirements.

- When you discover the appropriate form, click Purchase now.

- Choose the pricing plan you want, provide the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a suitable file format and download your copy.

Form popularity

FAQ

Yes, you can add partners to a partnership through a Hawaii Agreement Adding Silent Partner to Existing Partnership. This formal document outlines the terms under which a new silent partner joins the existing partnership. By including a silent partner, you can secure additional investment while allowing the existing partners to maintain operational control. Using a reliable platform like uslegalforms, you can easily create this agreement to ensure that all aspects are clearly defined and legally binding.

Determining a fair percentage for a silent partner often depends on their capital contribution and the overall profit-sharing structure of the partnership. Generally, the percentage can range from a small share to a significant portion, depending on the agreement between the partners. Using the Hawaii Agreement Adding Silent Partner to Existing Partnership can assist you in establishing a fair and equitable distribution.

Silent partners generally have specific rules guiding their involvement in the partnership. They do not participate in management decisions, yet they enjoy a share of the profits. It is advisable to outline these rules clearly in the Hawaii Agreement Adding Silent Partner to Existing Partnership to ensure transparency and mutual understanding.

The silent partner clause in a partnership deed outlines the roles, responsibilities, and rights of the silent partner. This clause is essential to protect the interests of both the active partners and the silent partner, specifying financial contributions and profit-sharing arrangements. Incorporating this clause into your Hawaii Agreement Adding Silent Partner to Existing Partnership can help prevent future conflicts.

Yes, a partnership can indeed have a silent partner. A silent partner contributes capital but does not take an active role in the day-to-day operations. By including provisions for the silent partner in your Hawaii Agreement Adding Silent Partner to Existing Partnership, you establish clear expectations for both parties.

To add a partner to your existing partnership, you typically need to draft an agreement that outlines the terms of the addition. This includes specifying the new partner's contributions, roles, and share of profits and losses. For a smooth process, consider using the Hawaii Agreement Adding Silent Partner to Existing Partnership template, which can help ensure all legal aspects are covered.

Yes, you can have a silent partner in a business venture. Such partners contribute financially without participating in management decisions. Implementing a Hawaii Agreement Adding Silent Partner to Existing Partnership is crucial to ensure that all parties understand their roles and rights. This legal framework strengthens relationships and protects interests within the partnership.

The silent partner rule refers to the understanding within a partnership that allows a partner to remain uninvolved in day-to-day operations while still sharing in the profits. A Hawaii Agreement Adding Silent Partner to Existing Partnership should define the specific rights and responsibilities of the silent partner. By clearly stating these terms, you can maintain a smooth partnership dynamic and ensure both active and silent partners benefit financially.

If a partnership deed is silent on certain issues, it is essential to address these gaps to avoid misunderstandings. A Hawaii Agreement Adding Silent Partner to Existing Partnership can clarify roles, responsibilities, and profit-sharing adjustments. It is advisable to discuss these issues among partners and amend the existing deed to reflect any agreements made. This ensures everyone has clear expectations moving forward.

Adding a silent partner in business involves several key steps. First, you should assess and discuss the investment structure with your current partners. Next, create a Hawaii Agreement Adding Silent Partner to Existing Partnership, which details each partner's responsibilities, profit distribution, and any other pertinent terms. Finally, finalize the agreement with all parties involved, ensuring legality and clarity in your partnership.