Hawaii Verification (Investment Adviser) is the process of verifying that an investment adviser is legally registered and qualified to provide investment advice services in the state of Hawaii. This process is conducted by the Hawaii Securities Commissioner or the Hawaii Department of Commerce and Consumer Affairs, and includes a review of the adviser's registration and licensing documents, background checks, financial disclosure, criminal history, and other relevant information. The verification process is intended to ensure that investment advisers are qualified to provide reliable advice to investors. There are two types of Hawaii Verification (Investment Adviser): Initial Verification and Renewal Verification. Initial Verification is for new investment advisers and involves the submission of all required documentation, while Renewal Verification is for existing advisers and is conducted annually.

Hawaii Verification (Investment Adviser)

Description

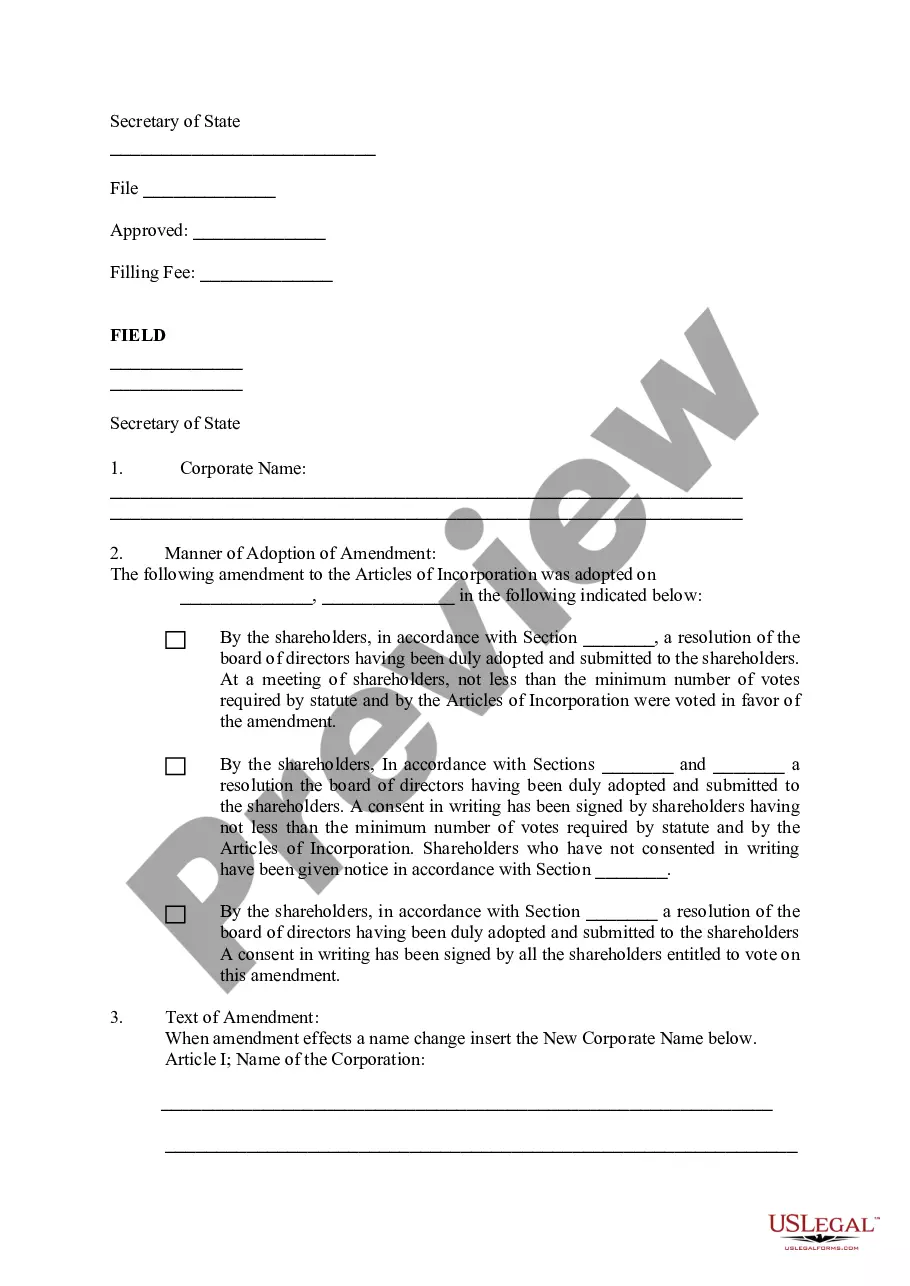

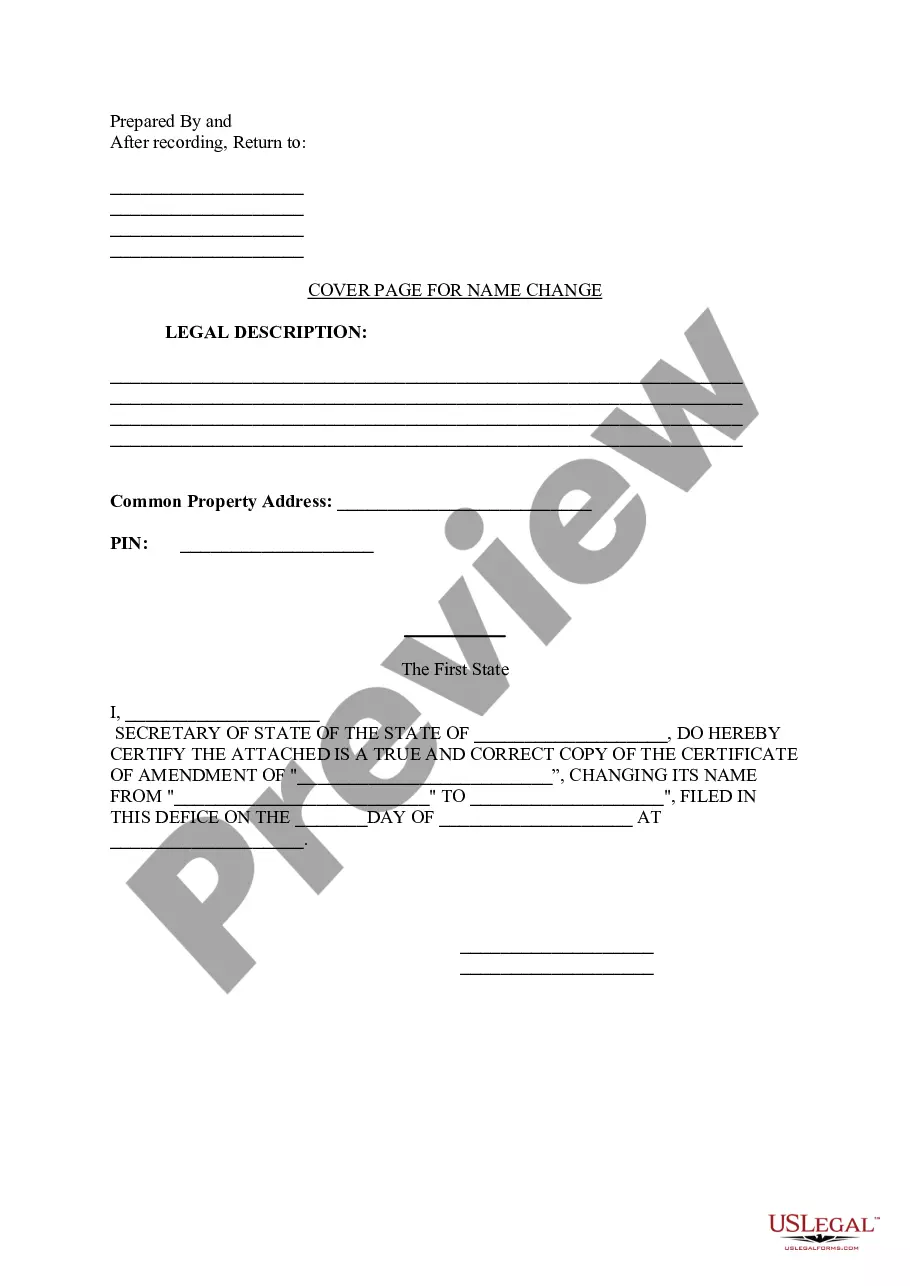

How to fill out Hawaii Verification (Investment Adviser)?

Handling official documentation necessitates focus, precision, and employing correctly-prepared templates. US Legal Forms has been assisting individuals nationwide accomplish this for 25 years, so when you select your Hawaii Verification (Investment Adviser) form from our service, you can be confident it complies with federal and state laws.

Utilizing our service is straightforward and swift. To obtain the required document, all you’ll need is an account with an active subscription. Here’s a brief guide for you to acquire your Hawaii Verification (Investment Adviser) in just minutes.

All documents are prepared for multiple uses, including the Hawaii Verification (Investment Adviser) you see on this page. If you require them in the future, you can fill them out without additional payment - simply access the My documents tab in your profile and complete your document whenever needed. Try US Legal Forms and expedite your business and personal paperwork swiftly and in complete legal compliance!

- Ensure to thoroughly review the form's content and its alignment with general and legal standards by previewing it or examining its description.

- Seek another official template if the one previously viewed does not correspond with your circumstances or state regulations (the tab for that is located at the top page corner).

- Sign in to your account and store the Hawaii Verification (Investment Adviser) in your desired format. If it’s your initial experience with our website, click Purchase now to proceed.

- Create an account, choose your subscription option, and pay using your credit card or PayPal account.

- Select the format in which you wish to save your document and click Download. Print the template or upload it to a professional PDF editor to prepare it electronically.

Form popularity

FAQ

Certain individuals or entities may be exempt from registering with FINRA, such as those who provide advice only incidental to their primary business. However, financial advisers should tread carefully, as their primary role may still demand registration. To clarify your exemption status or ensure compliance in Hawaii, consider the resources provided by Hawaii Verification (Investment Adviser).

Firms that engage in the securities industry generally need to become FINRA members. This membership confirms adherence to regulatory standards and allows access to various financial markets. For investment advisers specifically operating in Hawaii, understanding terms related to Hawaii Verification (Investment Adviser) is crucial in this context.

Yes, investment advisers must register with FINRA if they deal with securities. This registration would affirm that they meet all necessary regulatory requirements. To ensure you are following the correct procedures, consider utilizing Hawaii Verification (Investment Adviser) services to clarify any specific state obligations.

To become a financial advisor in Hawaii, start with a bachelor's degree in finance or a related field. After obtaining your degree, acquire necessary licenses and certifications, such as passing the Series 65 exam. Don’t forget to navigate the Hawaii Verification (Investment Adviser) process to ensure compliance with state regulations.

To verify a financial advisor, check their professional background using tools like the SEC’s Investment Adviser Public Disclosure website. This step allows you to ensure they are compliant with all regulations, including Hawaii’s requirements. Always look for updates and details about their registration status; this forms a key part of your Hawaii Verification (Investment Adviser).

You can find Form ADV on the SEC’s website, or through your state’s securities regulator. This form is crucial as it provides important information about an investment adviser’s business, ownership, and practices. For those seeking investment advisers in Hawaii, ensuring you've reviewed their Form ADV can enhance your Hawaii Verification (Investment Adviser) process.

Becoming a financial advisor usually takes about four years, depending on your education and certification process. Completing a bachelor's degree is often essential, and many advisors pursue further certifications afterward. Keep in mind that some states, including Hawaii, have specific requirements that could affect your timeline, emphasizing the importance of Hawaii Verification (Investment Adviser).

Yes, investment advisers typically need to register with FINRA if they operate in securities. This registration helps ensure compliance with industry standards and regulations. For specific situations, such as those based in Hawaii, you may want to explore Hawaii Verification (Investment Adviser) to confirm local requirements.

To find a registered investment advisor, visit the Investment Adviser Registration Depository (IARD) through the SEC or your state’s securities agency. You can search by the investment advisor's name or firm, ensuring that you have reliable data for Hawaii Verification (Investment Adviser). This search helps you make informed decisions about potential financial partnerships, promoting transparency and security in your investments.

To look up a Central Registration Depository (CRD) number, visit the Financial Industry Regulatory Authority (FINRA) website. There, you can access the BrokerCheck tool, which lets you search for investment advisers using their names or CRD numbers. This process ensures you obtain trustworthy information related to Hawaii Verification (Investment Adviser). By verifying their CRD number, you confirm their registration and legitimacy in the investment industry.