Hawaii Property Division Chart Instructions are guidelines to help individuals divide assets and debts in the event of a divorce or dissolution of a civil union. Chart instructions can vary by county, but generally, they specify what documents are necessary to file for a property division, outline the process of dividing assets and debts, and provide a checklist of items to consider when dividing maritalProperty. Generally, there are two types of Hawaii Property Division Chart Instructions: those for divorcing couples, and those for couples who are dissolving a civil union. Divorcing couples must provide proof of marriage, a list of assets and debts, and may need to have a court hearing. Couples who are dissolving a civil union must provide proof of the civil union, a list of assets and debts, and may also need to have a court hearing. Additionally, Hawaii Property Division Chart Instructions provide information on common issues such as retirement accounts, real estate, business interests, and spousal support.

Hawaii Property Division Chart Instructions

Description

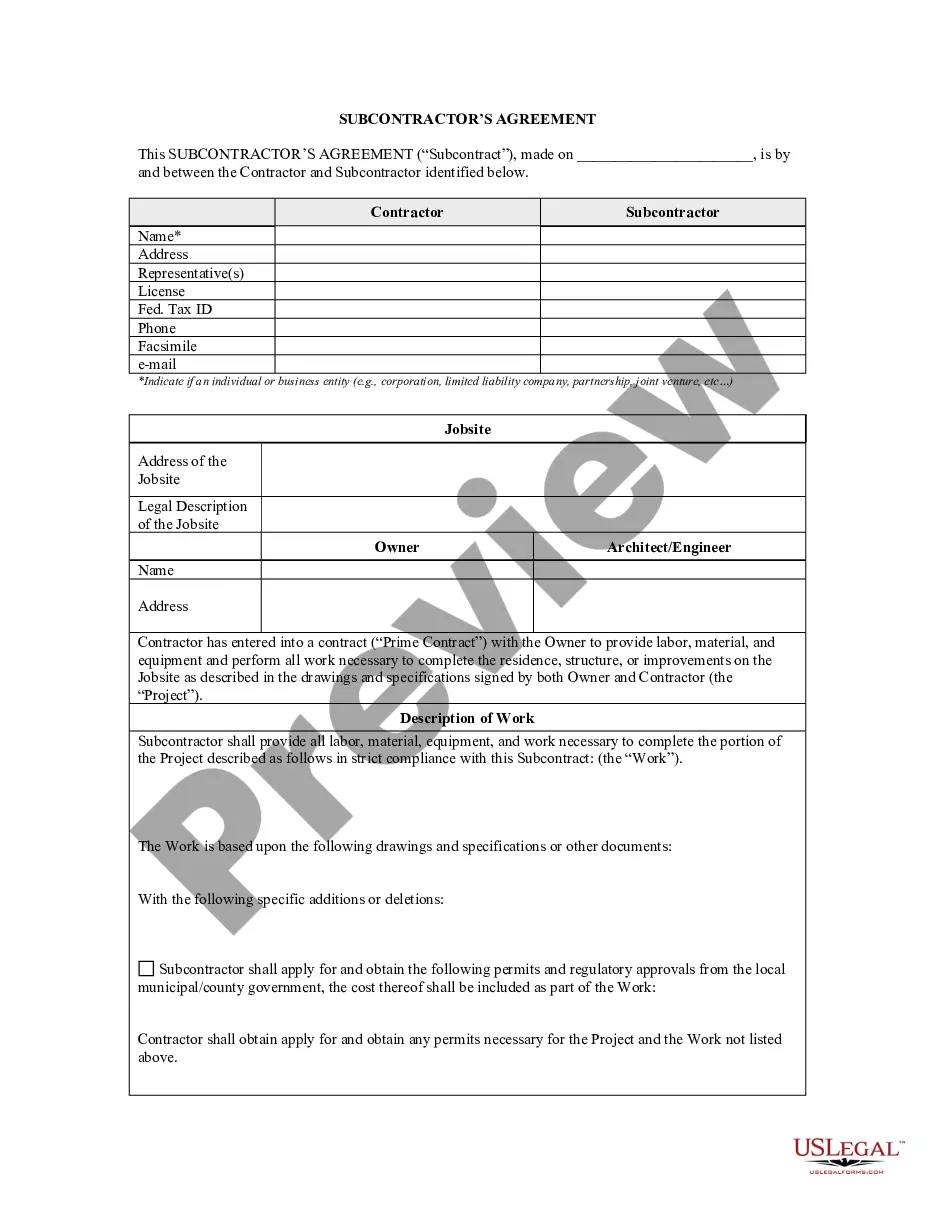

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Property Division Chart Instructions?

Managing official documentation demands focus, accuracy, and utilizing well-crafted formats.

US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Hawaii Property Distribution Chart Instructions template from our collection, you can be assured it adheres to federal and state laws.

All documents are designed for multiple uses, such as the Hawaii Property Division Chart Instructions you see on this page. If you need them again, you can complete them without additional payment - simply access the My documents tab in your profile and finish your document whenever necessary. Try US Legal Forms and prepare your business and personal documentation quickly and in full legal compliance!

- Make sure to carefully evaluate the content of the form and its alignment with general and legal standards by previewing it or reviewing its description.

- Search for an alternative official template if the one you opened does not meet your needs or state laws (the tab for that is located on the upper corner of the page).

- Log in to your account and store the Hawaii Property Division Chart Instructions in the desired format. If it’s your first time using our site, click Buy now to continue.

- Create an account, select your subscription option, and pay using your credit card or PayPal account.

- Choose in which format you wish to receive your form and click Download. Print the document or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

The divorce process in Hawaii begins with one spouse filing a petition. After submitting the necessary documents, a waiting period usually follows, allowing for potential reconciliation. If both parties agree on the terms, the court can finalize the divorce relatively quickly. For practical steps and more details, consult the Hawaii Property Division Chart Instructions to navigate the process smoothly.

The Linson formula is a method used to determine how to equitably divide assets between spouses in Hawaii. This formula factors in elements such as marital wealth, the duration of the marriage, and individual contributions. It aims to ensure a fair distribution based on unique circumstances. Comprehensive guidance on this topic can be found in the Hawaii Property Division Chart Instructions.

In Hawaii, the court oversees the division of property during a divorce. The judge evaluates various factors, including the length of the marriage and each spouse's financial contributions. Both parties can present arguments and evidence on how they believe the property should be divided. For a clearer understanding of the division process, the Hawaii Property Division Chart Instructions can provide valuable insights.

In Hawaii, certain factors can disqualify you from receiving alimony. If the marriage lasted a short duration, or if you are capable of supporting yourself financially, you may not qualify. The court considers the length of the marriage, the health and earnings of both spouses, and the reasons for the divorce. To understand the impact of these factors better, you might want to refer to the Hawaii Property Division Chart Instructions.

Assets in a Hawaii divorce are split based on equitable distribution, which may not equate to a perfect 50/50 split. Factors like each spouse's earnings, contributions, and age are examined to reach a fair decision. For accurate guidance on asset division, reviewing the Hawaii Property Division Chart Instructions will be very helpful.

Yes, alimony can be awarded in Hawaii based on need and the ability of the paying spouse to provide support. The court assesses various factors, including the duration of the marriage and financial circumstances of both parties. For detailed considerations, check out the Hawaii Property Division Chart Instructions, which can provide further guidance.

Property owned prior to marriage is typically considered separate property and remains with the spouse who owned it. However, if marital funds or efforts have improved its value, this may complicate the situation. To navigate these complexities, the Hawaii Property Division Chart Instructions may offer valuable insights.

Property division in Hawaii involves equitable distribution, meaning that assets acquired during the marriage are divided fairly. Each spouse's financial and non-financial contributions are taken into account during this process. For a clear understanding of how your assets will be divided, consider referring to the Hawaii Property Division Chart Instructions.

The Linson formula is a specific method used to determine the division of property in divorce cases. This formula considers the length of the marriage and the value of properties acquired during that time. Utilizing resources like the Hawaii Property Division Chart Instructions can help clarify how the formula applies to your case.

No, in Hawaii, one spouse can file for divorce without the other’s consent. This option allows an individual to proceed even if their partner does not agree. For a smoother process, you can refer to the Hawaii Property Division Chart Instructions that outline procedural steps.