Hawaii Request for Extension of the 9-Month Deadline

Description

How to fill out Hawaii Request For Extension Of The 9-Month Deadline?

Creating legal documents can be quite a hassle if you lack pre-prepared fillable templates. With the US Legal Forms online database of official paperwork, you can be assured of the blanks you acquire, as they all align with federal and state laws and have been reviewed by our experts.

Acquiring your Hawaii Request for Extension of the 9-Month Deadline from our collection is as straightforward as one-two-three. Previously registered users with a valid subscription just need to Log In and click the Download button after locating the appropriate template. Later, if necessary, users can retrieve the same document from the My documents section of their account. However, even if you’re a newcomer to our service, signing up for a valid subscription will only take a few minutes. Here’s a brief guide for you.

Haven't you utilized US Legal Forms yet? Subscribe to our service now to obtain any official document rapidly and effortlessly whenever you need to, and maintain your paperwork organized!

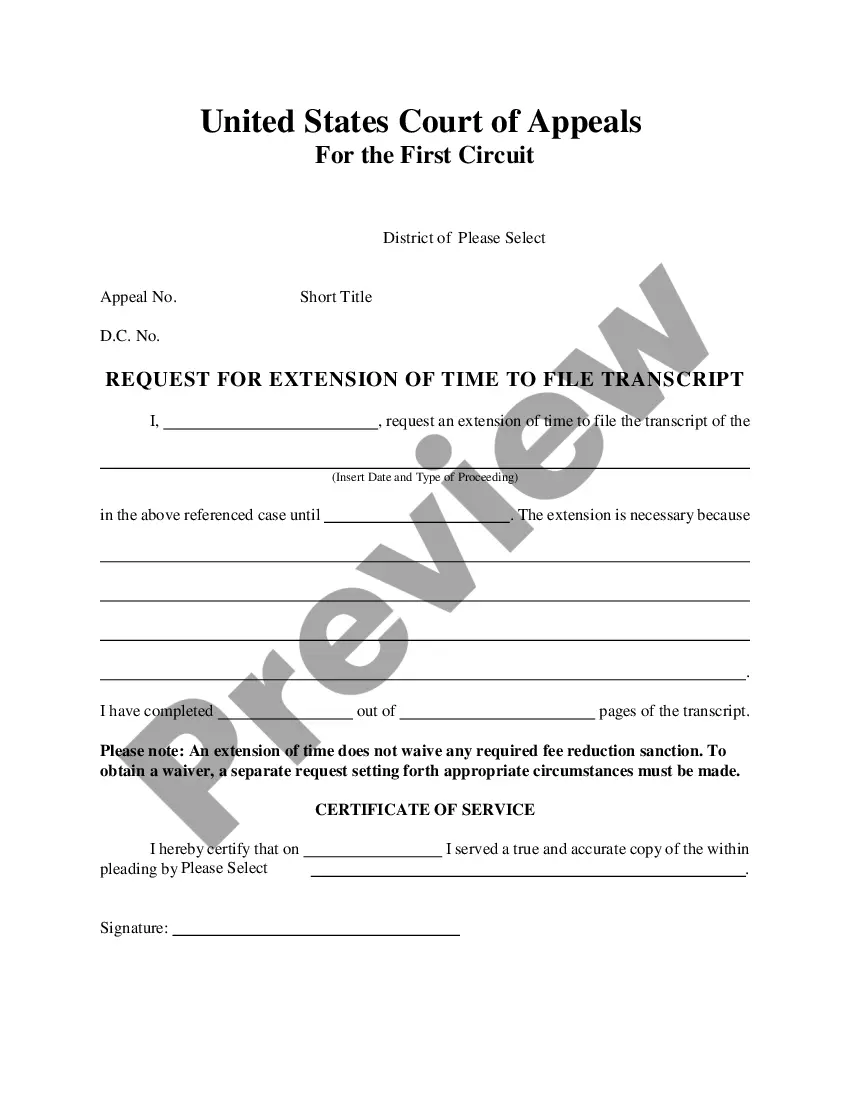

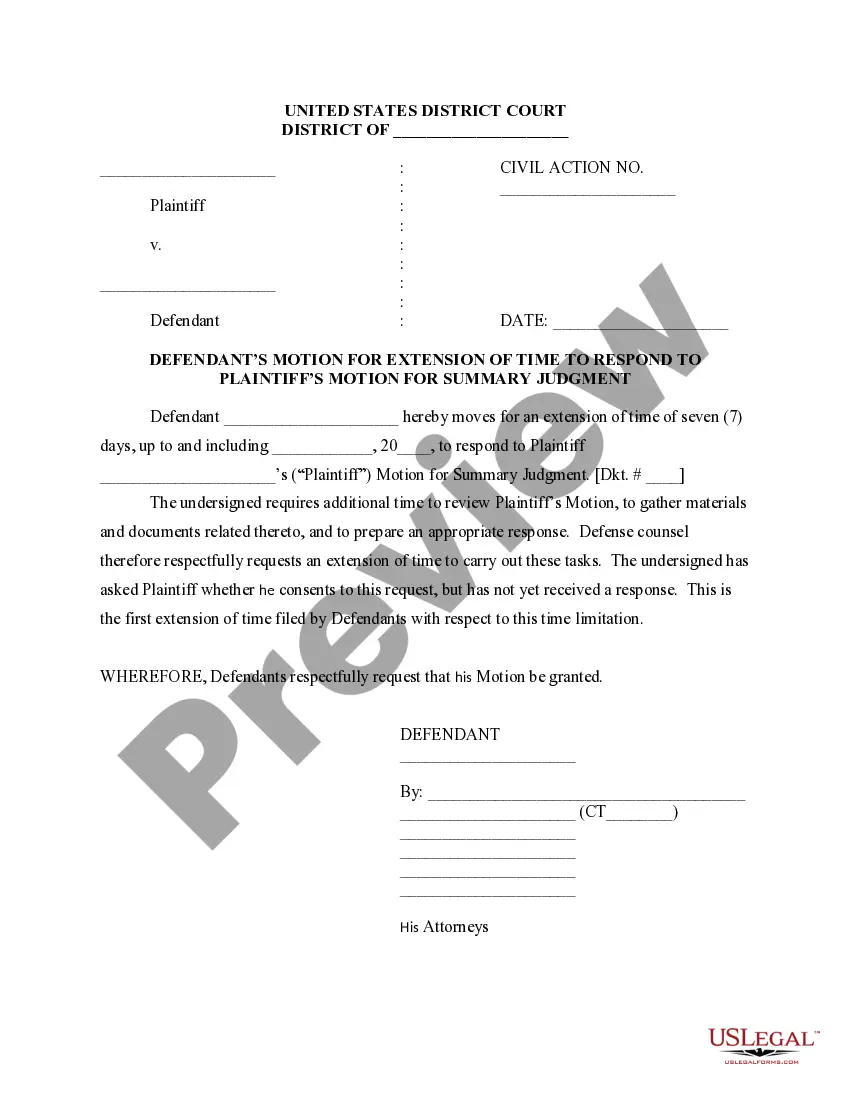

- Document compliance verification. You should carefully review the content of the form you wish to ensure that it meets your requirements and fulfills your state law stipulations. Previewing your document and examining its general description will assist you in doing just that.

- Alternative search (optional). If you find any discrepancies, explore the library using the Search tab at the top of the page until you discover an appropriate blank, and click Buy Now once you identify the one you require.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After your account is verified, Log In and select your desired subscription plan. Make a payment to proceed (PayPal and credit card options are provided).

- Template download and further usage. Choose the file format for your Hawaii Request for Extension of the 9-Month Deadline and click Download to save it on your device. Print it to complete your documents by hand or use a feature-rich online editor to create an electronic version more quickly and efficiently.

Form popularity

FAQ

The extension form is a request that allows taxpayers to extend their filing deadline. In Hawaii, this form is essential for those who require more time to submit accurate tax returns. By completing the Hawaii Request for Extension of the 9-Month Deadline, you can ensure compliance while avoiding the stress of rushing to file. This process simplifies tax management and provides peace of mind.

The Hawaii tax G-49 form is specifically designed for certain tax filings within the state. It is often associated with partnerships and LLCs needing to report income and expenses. When dealing with time-sensitive tax filings, the Hawaii Request for Extension of the 9-Month Deadline can be beneficial to gain additional time before submission. This helps in accurately reflecting financial details, which can lead to better outcomes.

Yes, Hawaii provides an extension form for taxpayers. This form grants an extended period to file your tax returns without incurring penalties. It's known as the Hawaii Request for Extension of the 9-Month Deadline, and it's an essential tool for managing your tax obligations. Utilizing this form helps ensure you comply with state tax laws while affording you the required time.

Tax filing deadlines in Hawaii can be extended but are not always changed every year. To optimize your filing schedule, it is wise to stay updated on announcements related to the Hawaii Request for Extension of the 9-Month Deadline. If you are unsure about the deadlines, checking with the Hawaii Department of Taxation or using reliable service platforms can provide clarity and peace of mind.

Yes, there have been instances when Hawaii extended tax deadlines, particularly during significant events like natural disasters. However, each year's situation may vary, so it's crucial to check for announcements regarding the Hawaii Request for Extension of the 9-Month Deadline. Keep yourself informed through the state's Department of Taxation website for any changes that may affect you.

To file a Hawaii state extension, you need to complete Form N-101A, also known as the Hawaii Request for Extension of the 9-Month Deadline. Ensure you include all necessary information and submit the form by the original due date of your return. You can file online or send a paper form by mail, depending on your preference. Using platforms like USLegalForms can help simplify the process and ensure accuracy.

A nonresident must file a Hawaii tax return if they earned income within the state. This includes individuals who may not reside in Hawaii but have earned income there during the tax year. Filing these returns correctly ensures compliance and is crucial if you are considering the Hawaii Request for Extension of the 9-Month Deadline.

The G45 form is a tax return used for general excise tax filings, while the G49 form is a reconciliation form that summary reports annual income. Both serve different purposes and are essential for proper compliance. If you are uncertain about these forms, consider utilizing uslegalforms as a resource when navigating your Hawaii Request for Extension of the 9-Month Deadline.

The Hawaii extension form, officially known as the Request for Extension of the 9-Month Deadline, allows individuals to extend the time for certain legal matters in Hawaii. This form is essential for those who need additional time to complete their filing requirements related to various legal processes. By using this form, you ensure compliance and avoid potential penalties for late submissions. You can find this form on the US Legal Forms platform, which simplifies the process and guides you through the necessary steps.

Hawaii N-11 refers to the income tax return form specifically for individual taxpayers residing in Hawaii. It is used to detail income and compute taxes due. If you're unable to meet the filing deadline for your N-11, you can file a Hawaii Request for Extension of the 9-Month Deadline to relieve some pressure and ensure your return is accurate.